The Serbian Economist reports that Prindon Sadrija, the husband of Kosovo President Vjosa Osmani, called on Trump’s son-in-law Jared Kushner to move the Trump Hotel project to Pristina, which his organization had previously rejected in Belgrade.

Sadrija wrote on social network X that the withdrawal from the Belgrade project confirms the thesis that “significant projects should unite, not divide,” and suggested “moving this idea to Pristina” with the transformation of the capital’s Grand Hotel into Trump Hotel.

The statement came amid reports that Affinity Global Development, linked to Kushner, has withdrawn from plans to build a hotel and residential complex on the site of the former General Staff building in downtown Belgrade, which was damaged during the 1999 NATO bombing and has been the subject of public controversy over memory preservation and cultural heritage status.

The company notified the decision to withdraw from the project after months of protests and amid a legal scandal surrounding the removal of the site’s protected status, for which the Serbian prosecutor’s office sought to prosecute a number of officials.

In Serbian statements, the losses are estimated at “at least 750 million euros” – a figure that Serbian President Aleksandar Vucic and representatives of the ruling party have voiced, linking the investor’s withdrawal to the pressure of protesters.

At the same time, earlier publications on the parameters of the project estimated the investment at about $500 million.

https://t.me/relocationrs/1999

The Cabinet of Ministers has extended the ban on imports of goods originating from Russia into the customs territory of Ukraine until December 31, 2026.

According to Resolution No. 1707 of December 24, the government amended Cabinet Resolution No. 1147 of December 30, 2015, which is updated annually.

In addition, by Resolution No. 1706, the government extended the term of Resolution No. 1146 of December 30, 2015, which establishes import duty rates on goods originating in the Russian Federation, for another year, until December 31, 2026. These instruments have been in effect since 2015 as countermeasures in response to economic pressure that has been going on for many years.

As reported, in 2015, the Cabinet of Ministers adopted two resolutions restricting trade with Russia in response to the actions of the aggressor state against Ukraine, in particular, the unilateral termination by the Russian Federation of the Agreement on the Free Trade Area within the CIS with regard to Ukraine and the introduction of bans on the import of a number of goods of Ukrainian origin from January 1, 2016. The validity of these acts is extended every year in December.

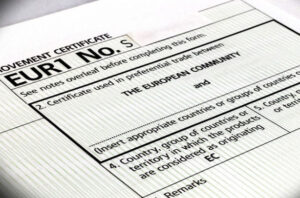

To support exports of Ukrainian goods, the State Customs Service issued 1.5 million EUR.1 certificates for transportation starting January 1, 2016, with exporters of agricultural products being the main recipients, according to the agency’s press service.

The State Customs Service reminded that the presence of a EUR.1 transport certificate exempts Ukrainian goods from import duties when imported into the EU, EFTA, Montenegro, the United Kingdom and Northern Ireland, Georgia, and Israel.

According to its data, during 2025, Ukrainian producers received EUR.1 certificates mainly for the export of goods of plant origin, sunflower oil, white sugar, chicken meat, and natural honey.

The largest number of such certificates was issued for the supply of products to Poland (24%), Germany (18%), Romania (8%), Italy (5%), and the Czech Republic (5%).

The US will impose tariffs on chip imports from China in connection with Beijing’s “unreasonable” attempts to secure dominance in the semiconductor industry, the administration of US President Donald Trump has announced. The size of the tariffs will be announced at least 30 days before their introduction, which has been postponed until June 2027.

“China’s focus on dominating the semiconductor industry is unreasonable and burdens or restricts US trade, and therefore warrants action,” said US Trade Representative Jamison Greer in a statement.

The US authorities have been investigating Chinese chip imports for unfair trade practices throughout the year and have concluded that China has been engaging in such practices.

Beijing could use its control over the global semiconductor industry to exert economic pressure on other countries, the trade representative’s release said.

In response, the Chinese Foreign Ministry criticized the US for abusing tariffs and suppressing sectors of the Chinese economy.

Ministry spokesman Lin Jian said that the American approach harms not only global supply chains, but also Americans themselves.

“If the US continues to do things its own way, China will resolutely take appropriate measures to protect its legitimate rights and interests,” the Financial Times quoted him as saying.

The Cabinet of Ministers has assigned the duties of the chairman of the State Service for Medicines and Drug Control to the deputy chairman of the service, Vladimir Korolenko.

The government adopted the relevant order on December 24 in connection with the removal of the head of the State Service, Roman Isaenko, from his duties.

Korolenko will perform the duties of the head of the service during Isaenko’s removal.

As reported, on December 24, the Cabinet of Ministers initiated disciplinary proceedings against Dmitry Isaenko. The Commission on Senior Civil Service Issues must carry out the relevant disciplinary proceedings by January 27, 2026.

In November, NABU conducted searches at the State Service’s main office, in particular, in Isaenko’s office. In February 2025, he became a subject of the Bihus.Info investigation. Journalists found out that people from Isaenko’s circle and the SBU’s curator of this area had created a private laboratory called Dobrobut-Likilab, which almost immediately after registration began receiving orders to test medicines from the State Service of Ukraine on Medicines and Drugs Control.

Isaenko has headed the State Service of Ukraine on Medicines and Drugs Control since 2018, first as acting chairman, and in early 2019, he won the competition for the position of head of the agency.