Among all Middle Eastern countries, Iraq ranks among those toward which Ukrainians have the least positive attitudes. These data were obtained from a sociological survey conducted by Active Group in April 2025 in cooperation with the information and analytical center Experts Club.

According to the results, 40.0% of Ukrainians have a negative attitude toward Iraq (30.1% — mostly negative, 9.9% — completely negative). Only 5.8% of respondents expressed a positive attitude (3.7% — mostly positive, 2.1% — completely positive). Another 46.2% of respondents chose a neutral position, and 8.0% were unable to answer.

“Ukrainians associate Iraq primarily with military conflicts, terrorism, instability, and geopolitical threats, rather than diplomatic or economic contacts. This shapes a persistent image of the country as a ‘risk zone,’” commented Maxim Urakin, founder of Experts Club.

The results indicate deep informational associations that need to be changed if countries plan to expand contacts in the peaceful, trade, or cultural spheres.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Shareholders of Arsenal Insurance (Kyiv) decided at a meeting on May 7 to allocate UAH 34.705 million of undistributed profits for 2021 and UAH 15.395 million for 2022 to dividend payments, the company reported in the information disclosure system (NSSMC).

As stated in the report, the dividend per ordinary share will be UAH 167. Dividends will be paid directly to shareholders in proportion to the number of shares held by each of them from May 29 to June 27, 2025.

Insurance Company Arsenal Insurance is the successor to Insurance Company Arsenal-Dnipro, which has been operating in Ukraine since 2005. It is represented in all regional centers and some major cities of the country.

According to the NBU, the company is one of the top ten insurers in Ukraine in terms of premiums collected for the first nine months of 2024.

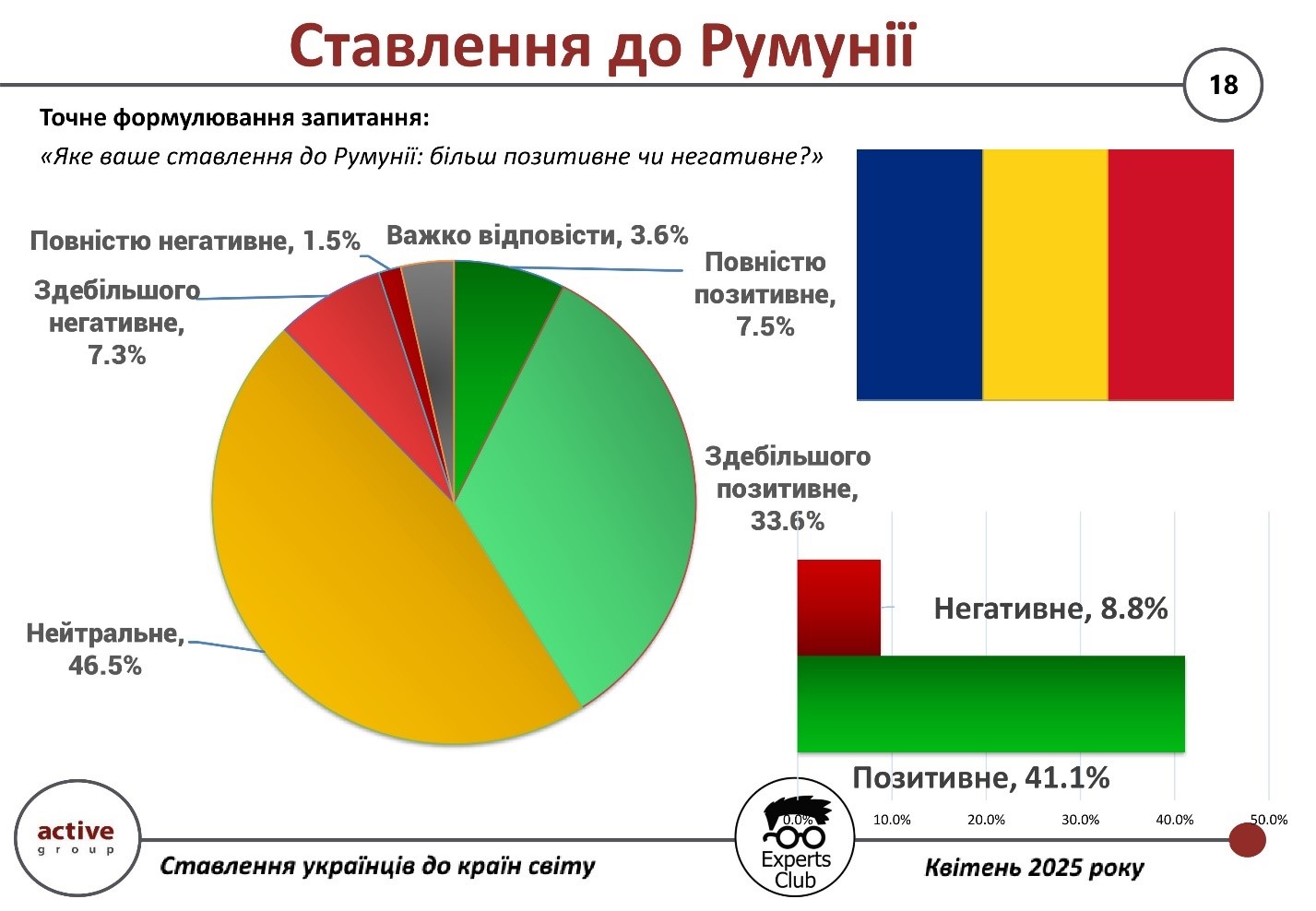

Romania, which is Ukraine’s neighbor and a member of the EU and NATO, is perceived by Ukrainian society as mostly neutral or moderately positive. This is evidenced by the results of a sociological survey conducted by Active Group in April 2025 in collaboration with the Experts Club think tank.

According to the survey, 41.1% of Ukrainians have a positive attitude toward Romania (33.6% mostly positive, 7.5% completely positive). On the other hand, 8.8% of respondents expressed a negative opinion (7.3% mostly negative, 1.5% completely negative). The largest share was held by those with a neutral position — 46.5%, while 3.6% of respondents were undecided.

“Neutrality towards Romania can be explained by both limited information about its support and the lack of high-profile initiatives that shape the image in the public consciousness. Nevertheless, there is almost no negativity,” commented Maksim Urakin, founder of Experts Club.

Thus, Romania has significant potential to deepen cooperation and improve its image in the eyes of Ukrainian society.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Under the coordination of the Ministry of Energy of Ukraine, as part of a project to ensure uninterrupted power supply to critical railway infrastructure, JSC Ukrzaliznytsia (UZ) has received 23 backup power stations from donors in the Netherlands and Switzerland.

“Since the start of Russia’s full-scale aggression, Ukraine has received 211 humanitarian shipments from the Netherlands weighing a total of 2,905 tons, and 59 shipments from Switzerland weighing a total of 651 tons,” the ministry said on Thursday.

The Ministry of Energy did not specify the capacity of the power generators provided.

The equipment was provided to Ukraine by the Dutch Ministry of Economy and Climate and an unnamed donor from Switzerland.

As reported, in December 2024, the European Bank for Reconstruction and Development (EBRD) opened two credit lines for Ukrzaliznytsia: EUR 180 million for the purchase of gas piston units and EUR 300 million for the purchase of electric locomotives.

According to the plans, EUR 180 million will be allocated for the purchase and installation of equipment for decentralized small-scale gas generation with a total capacity of up to 270 MW. The facilities were planned to be located at Ukrzaliznytsia sites throughout Ukraine. The total cost of the project is EUR 248 million.

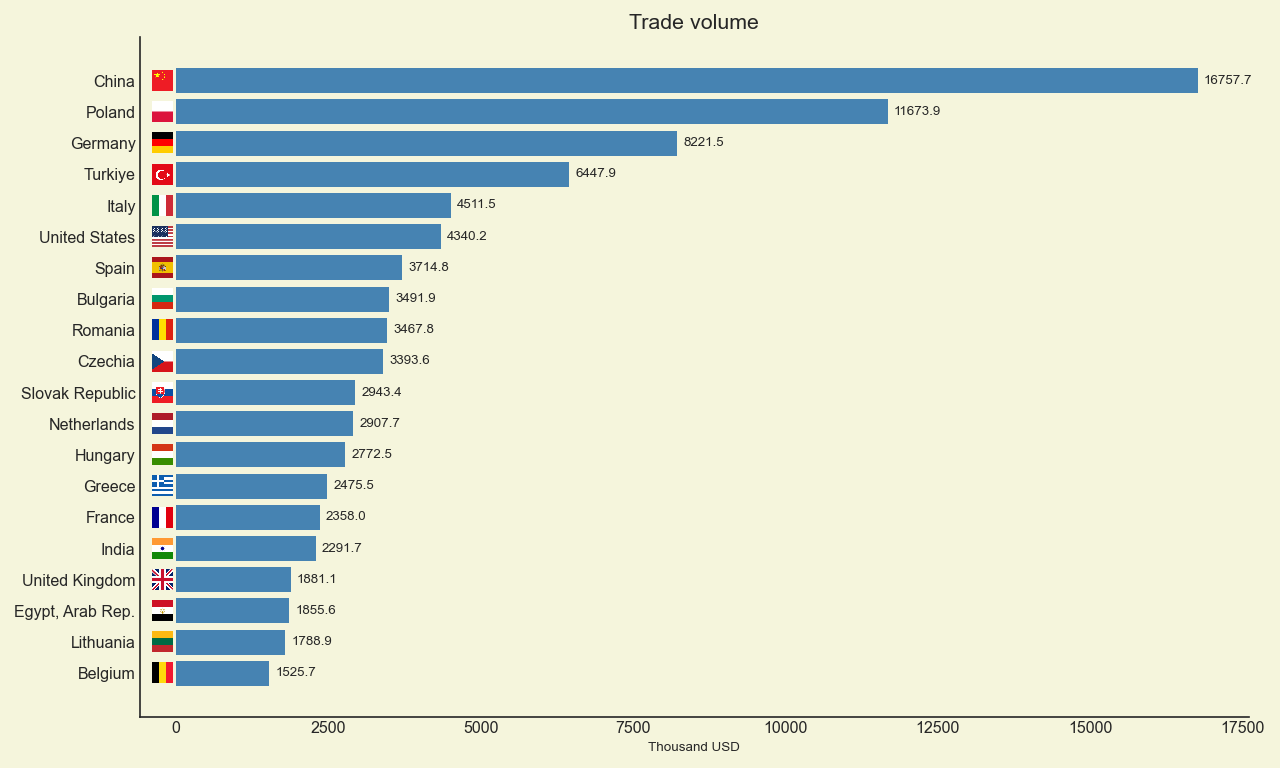

Geographic structure of Ukraine’s foreign trade (trade volume) in January-December 2024, mln. USD

Agrotrade will allocate more than 12,000 hectares for soybeans in the 2025 season. Sowing has already been completed in the Kharkiv region and is ongoing in the Sumy and Chernihiv regions, the company’s press service reported on Facebook.

“We plan to complete the main stage of soybean sowing by Monday. In some northern regions, work will continue throughout next week. Soybeans are one of the company’s staple crops, so we are working within a proven system: no changes in approaches, technologies, or crop structure,” said Oleksandr Ovsyanyk, director of the agro-industrial department at Agrotrade.

As reported, the production structure of the agricultural holding in 2025 will be as follows: winter wheat 25.2% of the sown area, corn 24.32%, soybeans 23.58%, sunflowers 17.84%, winter rapeseed 7.4%, mustard 1.02%, industrial hemp 0.56%, etc.

The Agrotrade Group is a vertically integrated holding company covering the entire agricultural cycle (production, processing, storage, and trade of agricultural products). It cultivates over 70,000 hectares of land in the Chernihiv, Sumy, Poltava, and Kharkiv regions. Its main crops are sunflower, corn, winter wheat, soybeans, and rapeseed. It has its own network of elevators with a total storage capacity of 570,000 tons.

The group also produces hybrid seeds of corn, sunflower, barley, and winter wheat. In 2014, a seed plant with a capacity of 20,000 tons of seeds per year was built on the basis of the Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand, Agroseeds.

The founder of Agrotrade is Vsevolod Kozhemyako.