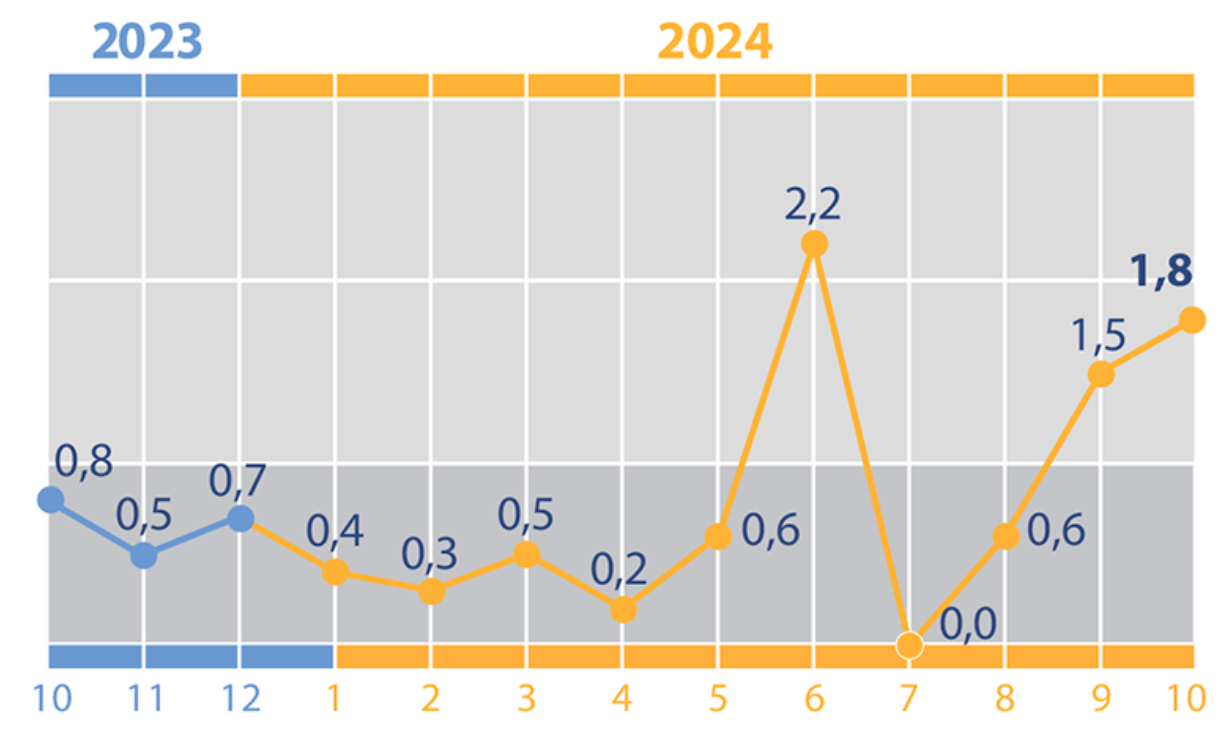

Change in consumer prices in 2023-2024, %

Source: Open4Business.com.ua

The Dark Storm group has claimed responsibility for the DDOS attack on Platform X, network crypto-futurist Ed Crassenstein said on Platform X.

According to him, the Dark Storm group, upon his request, admitted its involvement in the DDOS attack on Elon Musk’s network.

“Elon Musk seems to be pointing a finger at the people of Ukraine, blaming them for today’s DDOS attack on X. Dark Storm directly claimed responsibility for the attack. They literally told me they did it. They are not in Ukraine,” Krassenstein wrote on X.

As reported, Elon Musk said that Ukraine was allegedly involved in a cyberattack on his social network X on Monday.

Elon Musk has accused Ukraine of being involved in a cyberattack on his social network X on Monday.

“There was a massive cyberattack that tried to take down the platform from IP addresses originating in Ukraine,” he said in a commentary to FoxBusiness.

At the same time, he said he was not yet fully sure what happened.

Source: https://x.com/nicksortor/status/1899198049940832719?s=19

Ukraine may soon become the main supplier of biomethane to the European Union, with the share of Ukrainian biomethane in the European market reaching 20% in the future, said Georgiy Geletukha, Chairman of the Board of the Bioenergy Association of Ukraine (BAU).

“Ukraine has almost ideal conditions for biomethane production. We have medium and large agricultural enterprises with 3 thousand hectares of land (under cultivation – IF-U). We can get raw materials for the plant from a single source. We have a well-developed gas structure: distribution networks and a gas transmission network. We have the highest density of gas network coverage in the whole of Europe. We have the largest area of agricultural land and, accordingly, the largest resource. Therefore, this is a very promising topic for us,” he said at the Ukrainian Investment Congress in Kyiv.

Heletukha emphasized that Europe has ambitious plans for the production and consumption of biomethane and aims to consume about 35 billion cubic meters in 2030. At present, European production is estimated at around 3 billion cubic meters. Given the current trends in the alternative energy market, the EU will be able to increase its own production to 20 billion cubic meters of biomethane within five years.

The expert explained this delay in the development of the biomethane market in Europe by the lack of large free areas of agricultural land and, accordingly, the inability to produce the necessary amount of raw materials for processing.

“And according to all trends, it will not have time to produce 35 billion cubic meters. Well, according to the trends over the past five years, they will reach about 20 billion cubic meters. The market there (in the EU – IF-U) is completely different for agricultural products. It is deficit. And it will be deficient at least until 2050. And after 2030, Europe is setting new plans – production and consumption of 100 billion cubic meters of biomethane by 2050. It will be the same story. That is, they do not have time, they do not have enough raw materials,” Geletukha emphasized.

He suggested that if Ukraine were to produce up to 15 billion cubic meters of biomethane now, the EU would “buy everything with a bang.”

The UABIO CEO reminded that three powerful producers – MHP, Vitagro and Gals Agro – have already launched biomethane production in Ukraine, of which two have already started exporting, and the third is accumulating stocks in storage and will start exporting in the near future.

According to him, in Ukraine, the range of biomethane producers and potential exporters will expand in 2025. They will be joined by another MHP enterprise, Teofipol Energy Company and Józefów-Mykolaiv Biogas Company. In total, Ukrainian facilities will produce 111 million cubic meters of biomethane per year.

At a cost of EUR900 per 1 thousand cubic meters of biomethane produced from crop waste or from livestock waste, including manure or litter, at EUR1100-1200 per 1 thousand cubic meters, Ukraine will be able to receive up to EUR100 billion a year from exporting these products to the EU, Geletukha predicts.

As reported, the first batch of Ukrainian biomethane of 67 thousand cubic meters was exported on February 7, 2025 by Vitagro, an energy holding whose plant with a capacity of 3 million cubic meters of biomethane per year operates in Khmelnytsky region. The exports were made to Germany.

On February 11, MHP’s biomethane plant Oril-Leader (Dnipropetrovska oblast) exported 27.4 thousand cubic meters of biomethane, becoming the second Ukrainian company to do so. MHP exported biomethane via gas pipelines across the Ukrainian-Polish border to Germany. The buyer was Vitol. The capacity of Oril-Leader is 11 million cubic meters per year.

The Gals Agro agricultural holding has built a biomethane plant with a capacity of 3 million cubic meters in Chernihiv region. The company has already been connected to the grid and is preparing to make its first biomethane export transaction.

As part of the expansion of transport corridors and the development of international transportation, the first container train from India to Kazakhstan via Uzbekistan was launched.

According to the press service of JSC “Uztemiryulcontainer”, the train, which includes 12 twenty-foot containers, departed from the port of Mundra (India) to the station of Sorokov (Kazakhstan). The route passes through Iran, Turkmenistan, Uzbekistan and Kazakhstan, covering 1,585 km by sea and 4,300 km by rail.

Previously, container shipments from India to Uzbekistan (Mundra – Sergeli) have been successfully carried out along this route.

Payment of all taxes by the top ten filling stations by the number of filling stations by the results of 2024 increased by 40%, or by 3.1 billion UAH – up to 10.4 billion UAH, said the Director of the consulting group “A-95” Sergey Kuyun in Facebook.

“To begin with, let’s focus on the results of the top 10 networks by the number of filling stations, which account for 54% of fuel sales in the country. By taxes we mean VAT (without VAT on imports), income tax, personal income tax and unified social tax,” he wrote.

According to the expert, the payment of taxes increased despite a 2.9% decrease in sales. In particular, the payment of VAT amounted to UAH 4.2 billion, which is 55% more than in 2023.

“Among other things is explained by the effect of the preferential VAT rate of 7% during the first half of 2023,” – said Kuyun.

On payment of income tax last year was recorded growth by 32% – up to 2.2 billion UAH.

In turn, payroll taxes PIT+ESV also increased by 32% – up to UAH 3.4 billion. The average official salary for the top 50 increased over the year to 17482 UAH/month from 11853 UAH/month.

“Conclusion. The fuel market shows good dynamics of tax payment on all points, including such problematic ones as income tax and payroll taxes”, – claims the director of ‘A-95’.

According to the provided diagram, in terms of tax payment per liter of fuel the leading network is OKKO – 3.27 UAH (a year earlier 2.39 UAH), followed by Shell – 2.94 UAH (2.21 UAH) and UPG – 12.82 UAH (1.67 UAH).

Also in the top five are WOG – 2.15 UAH (1.25 UAH) and AMIC – 1.94 UAH (1.75 UAH).

The second five are KLO – 1.78 UAH (0.96 UAH), Avantazh 7 – 1.43 UAH (1.02 UAH), BRSM-Nafta – 1.36 UAH (1.09 UAH), VST – 1.2 UAH (0.88 UAH) and MOTTO – 1.09 UAH (0.53 UAH).

According to Kuyun, the increase in tax payments was mainly due to pressure from the tax service, MPs and experts. At the same time, there is still a large gap between the leaders and outsiders of taxpayers in the fuel market, which indicates, firstly, the budget losses in 2024 and, secondly, the potential to increase budget revenues in the current year.