The total revenue of the top 10 companies in the agricultural sector in 2023 increased by 35% compared to 2022, to UAH 86.57 billion, and almost 1.5 times compared to pre-war 2021, according to the Opendatabot website.

According to the Opendatabot index, the largest profits among all the businesses in the top ten were made by the enterprises of the MHP, Kernel, and Ukrprominvest agricultural holdings.

At the same time, four poultry companies accounted for 46% of the total income of the leaders.

Thus, the leader of the most profitable companies, Myronivska Poultry Farm, which is part of the MHP agricultural holding, earned UAH 21.23 billion, which accounted for 24.8% of the total income of the agricultural sector leaders. The result was 1.5 times higher than in 2022.

The Starynska Poultry Farm of the same agricultural group earned UAH 7.13 billion and took 8.2% of the total revenues of the top 10.

Dniprovsky Poultry Complex, owned by the same agricultural group (a new company in the index), increased its figure by one third to UAH 5.37 billion and became a newcomer to the Opendatabot index with a 6.2% share in the top ten. The holding is owned by Alexander and Yulia Ryazanov.

Zorya Podillya poultry complex of Ukrprominvest agricultural holding, whose beneficiary is the son of former President of Ukraine Oleksiy Poroshenko, accounted for UAH 5.3 billion (6.1%). The company returned to the ranking after a year-long break with a 1.5-fold increase in revenues.

At the same time, the total revenue of the three companies of the MHP agricultural holding, whose beneficiary is Yuriy Kosyuk, amounted to UAH 34.32 billion, which is 40% of the total revenue of the leaders in the agricultural sector.

After the top ten leader Myronivska Poultry Farm, Lebedynskyi Seed Plant, owned by Dmytro Kravchenko’s LNZ Group, ranks second. In 2023, the company increased its revenue by 17% to UAH 15.67 billion (18%).

Two companies of Kernel Agro Holding – Druzhba Nova LLC and Enselco Agro LLC – earned UAH 14.71 billion in 2023, up 27% year-on-year. Their share in the total income of the top 10 is 17%.

Ukrprominvest is also represented in the ranking by two companies – in addition to Zorya Podillya, it includes PK Podillya. In total, they earned UAH 11.35 billion, accounting for 13% of the total revenue of the top 10 agricultural companies.

Another newcomer to the Opendatabot 2024 index, having increased its earnings by a quarter, is Zakhidnyi Buh, whose beneficiaries are Oksana Drul, Valerii Ovcharuk, and Yurii Hladun.

The Czech Republic will contribute tens of millions of euros to an initiative it is leading to purchase artillery ammunition for Ukraine, Czech Prime Minister Petr Fiala has said.

According to Reuters, Fiala told CNN’s Prima News on Wednesday evening that the Czech contribution would be over a hundred million kroons, which equates to tens of millions of euros.

“This is roughly the share that a country of our size and prosperity should contribute,” Fiala said.

The Czechs, through a team of government officials and private companies, have requested at least 800,000 pieces of large-caliber ammunition from countries around the world, with the first deliveries to Ukraine expected by June.

But Czech officials have said that this figure is not final and that more ammunition will be delivered if more funding is secured.

The Czech-led initiative has attracted about 18 countries, with Germany pledging the largest contribution so far – €576 million for 180,000 artillery rounds.

One of Ukraine’s largest tour operators, Join UP! has opened its first franchise agency in Poland, the office will operate in Katowice and become the hundredth in the company’s franchise network, its press service told Interfax-Ukraine.

The Join UP! brand entered the Polish market in 2022 as a tour operator and began cooperating with local travel agents. The opening of a franchise agency was the next step in strengthening the travel brand in the market.

“The interest in cooperating with us on a franchise basis in Poland demonstrates the high trust of our partners, which we have gained over more than a year of work in the new market. We try to support entrepreneurs in all the countries where we operate and give them the opportunity to build a profitable business together with Join UP!”, comments Marina Daineko, Head of Sales Development.

In addition, she noted that the development of the franchise network abroad expands access for Ukrainians to the already familiar travel service created by compatriots.

The development of the franchise network is one of the strategic vectors of the brand. Join UP! started this direction more than 10 years ago, and as of March 2024, the network includes 100 travel agencies, 33 of which opened after the start of the full-scale invasion. The office in Katowice became the second foreign office under the franchise program (since 2017, it has been operating in Moldova).

According to Daineko, the average cost of a lump sum (one-time start-up) fee in Ukraine is UAH 60 thousand (depending on the city and region), the highest is in Kyiv, in small towns – about 40 thousand. Royalties (monthly payment) range from $50 to $125 per month, also depending on the region.

In Poland, the cost of a lump sum payment is EUR2500, and royalties are 0.5% of the sales of Join UP! tours and 1% of the sales of tours of other tour operators.

In addition to full franchise support provided by the brand, new cooperation formats are also being introduced to attract new partners.

According to Deineko, with the outbreak of a full-scale war, several dozen franchise agencies in the country closed due to occupation and destruction. In addition, the logistics of traveling in Ukraine have changed dramatically.

“To preserve the Ukrainian tourism sector in such difficult conditions, it is extremely important to support and unite the market. To this end, we have launched the Join UP! program with simplified conditions for joining the Join UP! network for agents with experience,” she said.

Today, the Join UP! brand is represented in eight markets. In 2022, the brand’s companies appeared in Estonia, Latvia, Lithuania, Kazakhstan, Poland and Romania, and its position in the Moldovan market, where the tour operator has been represented for several years, was strengthened. This year, the company plans to enter the Czech Republic and Slovakia as a tour operator.

Join UP! LLC was established in 2013, with an authorized capital of UAH 72 million 671 thousand. In 2023, revenue increased to UAH 16 million 639 thousand, which is 2.3 times higher than in 2022. At the same time, the company incurred a 1.8-fold higher net loss of UAH 234 million 120 thousand, compared to UAH 129 million 486 thousand a year earlier.

The strategic partner of the tour operators operating under the Join UP! brand is SkyUp, and together they are part of the UPfamily group of businesses, the ultimate beneficiaries of which are Yuriy and Alexander Alba.

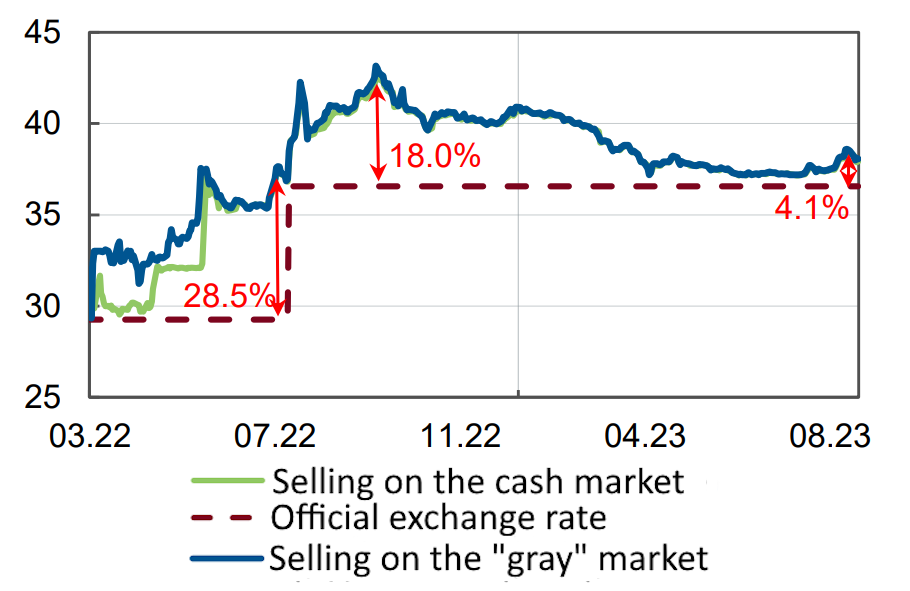

Dynamics of the exchange rate of hryvnia to U.S. Dollar in 2022-2023

Source: Open4Business.com.ua and experts.news

The Reserve Bank of Zimbabwe is putting into circulation a new currency – Zimbabwe Gold (Zimbabwe Gold, or ZiG), writes MarketWatch with reference to its message.

ZiG will replace the Zimbabwean dollar and will be backed by gold, other precious metals and foreign currencies.

The new currency will help simplify monetary and financial relations, bring certainty and predictability to them, said the head of the national central bank John Mushayaavanhu.

The central bank will set the interest rate for borrowing in Zimbabwean gold at 20 percent against a global maximum of 130 percent for the former currency.

Banks will start converting account balances into the new currency on Friday. It will be put into circulation on Monday at a rate of 13.56 gold pieces per U.S. dollar, CNBC Africa reported.

Zimbabwe’s annual inflation accelerated to 55 percent in March from more than 47 percent a month earlier amid the collapse of the former national currency and the country’s economy’s reliance on the U.S. dollar.

The Reserve Bank of Zimbabwe also cited problems with change in payments, including its issuance in the form of coupons or candy.