The European Bank for Reconstruction and Development (EBRD) plans to implement around 25-30 new financing projects in Ukraine, EBRD Director in Ukraine Sevki Acuner said at a press conference in Kyiv. The bank plans to step up its presence and it is always open for business, he said.

In turn, EBRD Director for Transport Sue Barrett said that three or four projects for EUR 100-200 million will be implemented in the transport and infrastructure spheres.

As reported, the EBRD in 2017 approved projects for EUR 800 million for Ukraine, which is 37% more than a year ago. In 2017, Ukraine became the third largest recipient of EBRD loans following Turkey, which received EUR 1.54 billion in loans, as well as Egypt with EUR 1.41 billion loans. To date, the bank has made a cumulative commitment of almost EUR 12.1 billion across some 400 projects since the start of its operations in the country in 1993.

The State Fiscal Service of Ukraine has imposed UAH 160.8 million of fine for over 600 facts of violation of declaration of transactions under control under transfer pricing by taxpayers, and 55% of the sum was paid to the national budget, the authority said on its website on Tuesday. “About 3,000 taxpayers report annually on the performance of controlled transactions, and 2,700 reports for 2016 for the amount of UAH 2.47 trillion were submitted,” the authority said.

According to its data, the main countries, with residents of which controlled transactions were held in 2013-2016, except for banking, were Cyprus (27%), Russia (18%), Switzerland (15%) and the United Arab Emirates (12%).

Most of the taxpayers who perform controlled transactions are registered in the Office of Large Taxpayers – 40%, while the amount of transactions performed by these companies is 92% of the total volume of transactions. Another 24% of taxpayers registered in Kyiv (the amount of transactions – 4%), and 4.6% of companies in Dnipropetrovsk region (the amount of transactions – 0.8%), according to the data of the fiscal service.

The largest subjects in terms of volumes of controlled transactions are banking – 57%, goods – 31% and financial services – 6%, the authority said.

As the fiscal service said, 34 out of 58 inspections started in 2014-2018 on taxpayers’ compliance with the arm’s length principle ended. According to their results, the supervising agencies added UAH 400 million of income tax, UAH 5.8 million of value-added tax (VAT) and reduced the amount of VAT refund by UAH 4.1 million. In addition, the supervising authorities also charged UAH 68 million penalty.

At the same time, 430 enterprises voluntarily increased their taxable income or reduced losses for operations in 2013-2016 by more than UAH 4.7 billion. “As a rule, this happened after receiving a request from the State Fiscal Service for the submission of documents on transfer pricing,” the authority said.

Ukraine on April 4 launches an online registration service for citizens of 46 states of electronic visas (e-visa) for entry with business or tourist purposes, the official website of the Ministry of Foreign Affairs of Ukraine has reported. “We are making Ukraine even closer to the world. Today we have launched an electronic visa. Citizens of 46 countries can now apply for a visa to Ukraine without leaving home,” Ukrainian Foreign Minister Pavlo Klimkin wrote on Twitter. The Foreign Ministry instructs that to fill out an e-Visa, one need to take a few simple steps without leaving home: fill out an online application form, download scanned copies of the required documents, pay by bank card (MasterCard Worldwide or Visa International) and print out electronic visa which was e-mailed to you.

Remote submission of documents at any convenient time and receipt of an e-Visa without the need to visit a consular office, the possibility of online tracking of the e-Visa application status, centralized registration of all e-visas in the Ministry of Foreign Affairs of Ukraine are benefits of e-Visa.

Processing time – up to nine business days; fee – $65; the term of validity – single entry for up to 30 days.

E-Visas are introduced for citizens of the following states: Australia, Antigua and Barbuda, the Commonwealth of the Bahamas, Barbados, Bahrain, Bolivia, Bhutan, Vanuatu, Haiti, Guatemala, Honduras, Greenland, Dominica, Dominican Republic, Indonesia, Cambodia, Qatar, Costa Rica, Kuwait, Laos, Mauritius, Malaysia, Maldives, Mexico, Micronesia, Myanmar, Nepal, Nicaragua, New Zealand, Oman, Palau, Peru, El Salvador, Samoa, Saudi Arabia, Seychelles, Saint Vincent and the Grenadines, Saint Lucia, Singapore, Suriname, Thailand, Timor-Leste, Trinidad and Tobago, Tuvalu, Fiji, Jamaica.

“The introduction of the e-Visa will facilitate a significant simplification of visa formalities for those who wish to visit Ukraine for the purpose of tourism or business and is a progressive step towards the development of the migration and visa sphere. The e-Visa project is implemented in cooperation with our long-time partners – State Border Guard Service of Ukraine, JSC Oschadbank and the Institute of Software Systems of the National Academy of Sciences of Ukraine,” the message reads.

Lending to small and medium-sized enterprises (SME) becomes a driver of the banking market, Deputy Board Chairperson of the bank Globus Olena Dmitriyeva said at a roundtable organized by the Financial Club in Kyiv on Tuesday. “SME becomes a driver of lending, as in this segment the quality of the portfolio is twice better than the quality of portfolios of corporate clients. 75% of banks started lending to SME, and this is a good trend,” she said. Dmitriyeva said that at present, banks are trying to relax the decision making processes for lending to SME.

Head of the SME department at Piraeus Bank Svitlana Bazhenova said that from October 2017 through February 2018, the SME loan portfolio in Ukraine grew by UAH 25 billion.

“The growth of SME share of total portfolio of loans issued to businesses by Ukrainian banks grew from 51% to 52% of the total loan portfolio. The growth was mainly generated by loans to SME,” she said. Deputy Director of the SME department at Ukrgasbank Semen Puskai pointed out the importance of programs to support development of SME.

“We are optimistic about the future of the SME segment, as there are now many assistants in this area. There is the state that implements programs to reduce the cost of loans for agrarians, and we also see the active participation of international financial institutions like the German-Ukrainian Fund, the EIB and IFC. When decentralization began municipalities started joining the project. They cheapen lending rates and support business in their region… To date, the programs signed and declared with the municipalities are quite numerous, but it is necessary that these programs start working as soon as possible and then, there will be cheaper rates,” he said.

LENDING, MEDIUM-SIZED ENTERPRISES, SMALL ENTERPRISES, UKRAINIAN MARKET

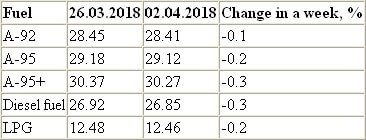

Average retail prices for petrol, diesel fuel and liquefied petroleum gas (LPG) in Ukraine in the period from March 26 to April 2, 2018 fell by 0.1-0.3%, according to data from the A-95 Consulting Group (Kyiv). As reported, average retail prices for petrol in Ukraine for 2017 increased by 19.2-20.1% (by UAH 4.61-4.76 per liter), for diesel fuel by 22.6% (by UAH 4.84 per liter). At the same time, average prices for liquefied petroleum gas (LPG), despite a sharp increase in August due to deficit, showed an increase of only 2.9% for the year (by UAH 0.36 per liter).

Changes in average retail fuel prices UAH per liter in Ukraine:

©Source: A-95 Consulting Company