KYIV. March 17 (Interfax-Ukraine) – The International Finance Corporation (IFC) from the World Bank Group could invest up to $20 million into the Emerging Europe Growth Fund III, L.P. (EEGF III, Delaware, the United States) launched by Horizon Capital Advisors, LLC mainly for investment in Ukraine.

The IFC said that the board will discuss the project at a meeting on April 28.

According to the document, an equity investment by IFC would not to exceed 20% of total commitments to the fund.

EEGF III will focus on small and mid-cap companies with growth capital needs.

The co-investor in the fund could be the European Bank for Reconstruction and Development (EBRD).

IFC is an investor in Horizon’s predecessor fund (EEGF II), and IFC’s repeat participation in EEGF III will a strong vote of confidence in Horizon’s ability to implement the growth PE strategy in the target region

In addition, given IFC is an investor in Horizon’s predecessor fund (EEGF II), Fund Manager is keen to secure IFC’s repeat participation in EEGF III, as it will be considered a strong vote of confidence in Horizon’s ability to implement the growth private equity strategy in the target region.

As reported, in June 2016, OPIC (Overseas Private Investment Corporation) said that the OPIC would provide up to $37.5 million to EEGF III launched by Horizon Capital for the period of up to 10 years.

The fund with a target size of $150 million will invest in export-oriented, fast-growing, mid-size companies in Ukraine and Moldova with the potential to grow from local to regional market leaders. The fund will primarily target minority stakes in high growth Ukrainian companies. It may also invest in early-stage, buyout and privatization opportunities as they arise.

Horizon Capital was established in 2006. It manages private equity funds Western NIS Enterprise Fund (WNISEF, established in 1994 with a capital of $150 million), Emerging Europe Growth Fund, L.P. (EEGF, established in 2006 with a capital of $132 million) and EEGF II (EEGF, established in 2008 with $370 million capital).

The money of these funds is invested in projects in Ukraine, Moldova, and Belarus.

The founding partners of Horizon Capital are Jeffrey C. Neal, Mark Andrew Iwashko, Natalie Jaresko and CEO Lenna Koszarny.

KYIV. March 17 (Interfax-Ukraine) – The most important for attracting investment to Ukraine are privatization, reformation of the corporate management of state-run enterprises and land reform, Managing Director of the European Bank for Reconstruction and Development (EBRD) for Eastern Europe and the Caucasus Francis Malige has said.

He said that the top priority for investment is privatization where was no progress: there was neither the right approach nor transparency of the process. A clear decision on the privatization of state-owned banks should be made, he said, speaking at the 13th Dragon Capital Annual Ukraine Investor Conference in Kyiv on Thursday.

Malige said that the reformation of the large and ineffective sector of state-run enterprises is also important.

Some state-run enterprises are a source of corruption, he said. They are used to finance election campaigns. It is important that these enterprises are reformed before 2019 and even before 2018, as when the election campaign starts no one would see reform in this segment, he said.

The third thing is the land reform. This is what will attract large investment in the agricultural sector, Malige said.

KYIV. March 16 (Interfax-Ukraine) – Net profit of MHP S.A., the holding company of Myronivsky Hliboproduct (MHP) agricultural holding was $69 million in 2016 compared to net loss of $113 million in 2015.

According to a company report posted on the London Stock Exchange (LSE) on Wednesday, revenue last year grew by 7%, to $1.135 billion.

Gross profit rose by 6%, to $362 million from $342 million in 2015. Operating profit fell by 9%, to $317 million from $347 million.

“The main reason of the decline in operating profit is our performance in the poultry segment. Global poultry prices in 2016 were lower than in 2015. Expenses on poultry production in Ukraine grew due to a rise in the prices of grain,” CFO Viktoria Kapeliushna told Interfax-Ukraine.

Earnings before taxes, depreciation and amortization (EBITDA) in 2016 fell by 5%, to $415 million and EBITDA margin – from 41% to 37%.

” Financial results are in line with management’s expectations, with EBITDA of US$ 415 million and EBITDA margin of 37%,” MHP CEO Yuriy Kosiuk said.

Exports revwnue grew by 21.2%, to $635 million (56% of total revenue). The foreign exchange loss in 2016 was $145 million.

According to the company’s report, net loss in Q4 2016 fell almost 67%, reaching $28 million. The foreign exchange loss in Q4 2016 was $55 million.

Revenue in Q4 2016 grew by 24%, to $313 million. Exports revenue rose by 52.5%, to $180 million (58% of total revenue).

EBITDA grew by 5.9% in Q4 2016, to $72 million and EBITDA margin fell by 4%.

Among MHP targets for 2017 is to start the construction of phase 2 of the Vinnytsia project with the ultimate aim of elevating production to around 730,000 tonnes per year by 2020.

Net debt as of late 2016 was $1.08 billion compared to $1.22 billion in 2015. The net debt/EBITDA ratio was 2.6 compared to 2.8 in 2015.

Kapeliushna said that since early 2017 the company has not received subsidies from the state.

“No one received subsidies. The mechanisms for receiving them are being drawn up. I am sure that in the first quarter the subsidies would not be provided,” she said.

MHP is the largest poultry producer in Ukraine. It also deals with production of grain, sunflower oil and meat.

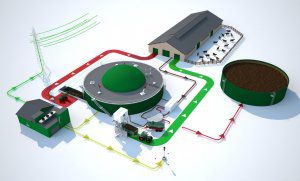

KYIV. March 16 (Interfax-Ukraine) – Danosha, a company with 100% Danish capital (Ivano-Frankivsk region), plans to begin the construction of a biogas plant with a capacity of 1.1 MW in 2017.

“We are starting the construction of the second biogas plant. One is already running at one of our largest pig complexes in the village of Kopanky, Ivano-Frankivsk region. The construction of the next biogas plant will be started this year. It should be more advanced than the previous one,” head of the department of external relations and company development Liubov Bohachevska told reporters at the sixth IFC International Forum on Food Safety in Kyiv.

According to her, the construction of the plant is designed for two years. Funds for the project implementation are to be attracted from NEFCO international financial organization and IFU investment fund.

Danosha intends to expand production. At present the total number of pigs is 180,000 animals.

“We are planning to expand, but we need new farms. We plan to build them and would like to increase livestock numbers by 11,900 animals,” she said.

She clarified now Danosha continues seeking a land plot for building a meat processing plant.

KYIV. March 16 (Interfax-Ukraine) – PJSC Vistec machine building plant (Bakhmut, Donetsk region), in 2016, according to preliminary data, saw a net profit of UAH 34.14 million, while a year earlier it was UAH 280,000.

According to information on the agenda of a general meeting of shareholders scheduled for April 13, the company’s retained earnings by the beginning of this year amounted to UAH 62.77 million.

Current liabilities last year slightly decreased, to UAH 124.3 million, long-term liabilities rose to UAH 1.08 million.

Its total debtor indebtedness by January 1, 2017 amounted to UAH 106.66 million, which is 10.4% more than a year earlier, while the value of assets increased by 18%, to UAH 205.04 million.

The number of the plant personnel reduced by 110 people, to 709 employees.

PJSC Vistec specializes in production of round-link chains for various purposes, welding electrodes, metal cutting tools and goods made of metal powder. The enterprise also has forge-press and wire-nail production.

KYIV. March 16 (Interfax-Ukraine) – Ukrainian authorities would consider the possibility of creating an industrial park on the model of the Istanbul park.

The press service of the Cabinet of Ministers of Ukraine reported that on Wednesday as part of his official visit to Turkey Ukrainian Prime Minister Volodymyr Groysman visited the Istanbul industrial park and met top managers of the SAHA Istanbul, the association of defense and aerospace complex.

Groysman said that Ukrainian science, especially in the aerospace sector, aircraft building and military area is very fruitful.

He said that Ukraine and Turkey are all-sufficient to make a joint product if the countries unite their opportunities.

After the meeting the Ukrainian prime minister instructed to study the possibilities of creating the industrial park in Ukraine on the model of the park in Istanbul, which would discover the entire potential of Ukrainian science and technologies.

Top managers of the Istanbul park expressed their readiness to provide a free-of-charge place in the Istanbul park for one university and one enterprise from Ukraine.