On September 26, 2024, a meeting was held at the Kyiv City Employment Center where veteran Danylo Honcharenko was presented with a voucher for studying at the National University of Physical Education and Sports of Ukraine. Thanks to this voucher, he will be able to study in the specialty 017 “Physical Culture and Sports”, educational and professional program “Physical Culture and Sports Rehabilitation” to become a physical and sports rehabilitation specialist.

Danylo Goncharenko, who served his country faithfully, chose this specialty to help and rehabilitate his fellow soldiers in the future. “While undergoing rehabilitation at the Training and Rehabilitation Center of the National University of Physical Education and Sports of Ukraine, I realized how important it is to help my comrades and convey the importance of lifelong health maintenance. My goal is to use the knowledge I have gained to support those who have gone through the hardships of war. I want to help my comrades return to a full life,” he said during the presentation.

An educationvoucher is a standardized document that allows you to pay for education in a certain specialty in higher or vocational education institutions. The voucher is used for retraining in blue-collar professions, training in specialties for a master’s degree, as well as training at the next level of education, specialization and advanced training in professions and specialties in accordance with priority economic activities. A person independently chooses a profession or specialty from the approved list, as well as the form and place of study.

Representatives of the Kyiv City Employment Center emphasized the importance of supporting veterans in their adaptation to civilian life. Tuition vouchers enable former military personnel to acquire in-demand professional skills and successfully integrate into society.

The National University of Physical Education and Sports of Ukraine offers modern educational programs that meet international standards. Specialty 017 “Physical Culture and Sports”, educational and professional program “Physical Culture and Sports Rehabilitation ” trains specialists capable of working effectively in the field of rehabilitation and physical health.

HONCHARENKO, rehabilitation specialist, TRAINING, voucher, ветеран

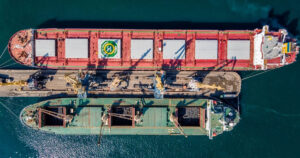

In January-September 2024, Ukrainian ports increased cargo transshipment by 1.8 times to 74 million tons, the state-owned Ukrainian Sea Ports Authority (USPA) reported.

“According to the operational data of USPA, from January to September 2024, Ukrainian seaports handled 74 million tons of cargo. This is a significant increase compared to the same period last year, when the volume amounted to 41.1 million tons,” the USPA said in a Facebook post on Thursday.

It is indicated that a significant part of the cargo turnover – 46.3 million tons – is agricultural products. This emphasizes its importance for the national economy and exports, the USPA said. In September, the volume of cargo handled in ports increased to 7 million tons, which is twice as much as in September 2023, when 3.4 million tons were handled, the USPA said. Of this volume, 4.1 million tons were agricultural products supplied to international markets.

Earlier it was reported that the cargo turnover of Ukrainian ports in August this year also amounted to 7 million tons. The leaders of cargo turnover are grain and ore cargo – 4 million tons and 1.2 million tons, respectively. At the same time, cargo turnover through the Ukrainian sea corridor in August amounted to 5.9 million tons, of which 3.6 million tons were products of Ukrainian farmers.

In total, in January-August 2024, Ukrainian ports handled almost 67 million tons of cargo, compared to 37.7 million tons in the same period a year earlier.

The new French government wants to reduce the budget gap by 60 billion euros in 2025 and is preparing a temporary tax increase.

The new French government has announced a decision to raise taxes starting in 2025. The Minister of Finance Antoine Armand said this on RTL radio.

The draft budget for 2025 with specific proposals is to be released on October 10.

The goal of the French authorities is to reduce the budget deficit by 60 billion euros. This is partly planned to be done by cutting spending (by €40 billion) and partly by increasing budget revenues.

“As soon as we manage to cut spending significantly, we will need exceptional and temporary help from those with very high incomes,” Arman said. He assured that people with low and middle incomes will be exempt from the additional fiscal burden: “The income tax rates for those who go to work every day will not change.”

His government colleague, Laurent Saint-Martin, Minister of Budget and Financial Accounts, said on France 2 on Thursday that only 0.3% of the population will feel the tax increase – the richest households in France, those without children and earning an annual income of 500,000 euros.

The tax increase will also affect the largest companies.

Earlier this week, French Prime Minister Michel Barnier warned that the current financial situation in the country is a sword of Damocles hanging over every French citizen. “We need to act now to ensure a stable financial future for our country. Our debts exceed €3.2 trillion, and this is a situation we cannot ignore,” he said.

In September 2024, for the first time since the global financial crisis, the yield on French government bonds exceeded that of Spanish securities. The reason is that the budget deficit in France is too high.

Last year, it was 5.5% against the planned 4.9%, and this year it may reach 6%, which is much higher than the European Union’s limit of 3%. At best, France will be able to return to the target no earlier than the end of this decade.

Trends in the global and Ukrainian economies can be tracked via the Experts Club information and analytical channel – https://www.youtube.com/@ExpertsClub

Globus Bank has issued 55 loans totaling UAH 42 million in more than two months since the start of its preferential energy lending programs, said Dmitry Zamotayev, director of the retail business department at Globus Bank.

He specified that 26 loans were issued to private households for UAH 10 million, 13 loans for UAH 14 million were granted to small and medium-sized businesses, and 16 loans for UAH 18 million were financed by condominiums participating in the Energodom and Grindim programs from the Energy Efficiency Fund, including condominiums and housing cooperatives under the state program Affordable Loans 5-7-9. The bank has issued energy loans in 16 cities of Ukraine, and is currently processing a total of 27 more applications for energy loans.

According to him, this result can be considered quite acceptable, and the growing demand for energy loans may eventually be transformed into liberalization of credit conditions.

“So far, we have seen a rapid growth in demand for such loans from households – in October, the bank plans to triple its loan portfolio under energy loan programs,” Zamotayev emphasized.

The expert pointed out that the main reasons for loan denials are borrowers’ failure to comply with the terms of participation in the programs. For example, for individuals, it is a high total monthly family income for six months that exceeds the amount of UAH 189 thousand provided for in the program, or the total area of the house exceeds 250 square meters. For condominiums and housing cooperatives, loan denials are extremely rare, as only those organizations that have no debts or have insignificant debts to utility companies can apply.

Globus Bank was registered in 2007. According to the NBU, as of April 11, 2023, the bank’s shareholders were Elena Silnyagina (100%), Dmitry Polkovsky (16.198866%), Yevgeny Varyagin (9.899307%), Sergey Mamedov (9.899307%), Andrey Pinchuk (9.899307%) and Taras Lesovoy (3.599748%), who indirectly own the authorized capital.

According to the National Bank of Ukraine, as of May 1, 2024, Globus was ranked 26th (UAH 9.4 billion) among 60 banks operating in the country in terms of total assets. As of April 2024. The regional network includes 31 branches

Ukraine continues to hold the third place among the main exporters of agri-food products to the EU after Brazil and the UK, the press service of the Ukrainian Agribusiness Club (UCAB) reported, citing an analytical report by the European Commission.

According to the report, Ukraine’s share in imports of agricultural products to the EU in the first six months of 2024 increased by only 2% (EUR 124 million) compared to the same period in 2023.

In total, imports of agri-food products to the EU reached EUR13 billion. Imports from Côte d’Ivoire increased the most in value terms – by EUR951 mln (+46%), followed by Nigeria with EUR473 mln (+132%), due to the rise in cocoa prices.

At the same time, imports from Tunisia more than doubled (+107%), mainly due to the growth of volumes and prices of imported olive oil. Imports from Australia decreased significantly by EUR843 mln (-46%) due to lower volumes of rapeseed, and from Brazil – by EUR634 mln (-7%).

The total exports of agri-food products from the EU in January-June 2024 reportedly reached EUR116.4 billion, which is 1% (+EUR1.1 billion) more than in the same period of 2023.

In the first half of 2024, EU exports to the United States grew the most, increasing by EUR1 billion (+8%) primarily due to higher prices for olives and olive oil. This sector also contributed to an increase in exports to Brazil by EUR209 million (+18%).

The EU’s exports to China decreased by 9% (-EUR689 million) in the period from January to June 2024 compared to 2023.

This is mainly due to a decline in several major products exported from the EU to China, including pork, dairy products, and cereals.

Consumer prices in Turkey in September increased by 49.4% in annual terms, according to a report by the country’s statistical institute (Turkstat). The growth rate slowed from 52% in August and was the lowest since July 2023. The weakening of inflation was noted for the fourth consecutive month.

The consensus forecast of experts, cited by Trading Economics, assumed an even more significant slowdown in consumer price growth – to 48.3%.

The increase in the cost of food and non-alcoholic beverages in September slowed to 43.7% from 44.9% in August, transportation services to 26.6% from 29%, and utilities to 97.87% from 101.49%. Prices in hotels, cafes and restaurants increased by 65.41% (+67.7% a month earlier), alcohol and tobacco products went up by 52.35% (+60.94%), educational services by 93.59% (+120.81%), and medical services by 50.7% (+53.49%).

Consumer prices in Turkey in September increased by 2.5% compared to the previous month after rising by 3.2% in August.

Producer prices (PPI index) in the country last month increased by 33.09% in annual terms and by 1.37% in monthly terms, Turkstat reported. In August, they rose by 35.75% and 1.68%, respectively.

The Turkish Central Bank has kept its key interest rate at 50% since March this year, and tight monetary policy has helped to ease inflation. Back in June 2023, the rate was at 8.5%.

Trends in the global and Ukrainian economies can be tracked via the Experts Club information and analytical channel – https://www.youtube.com/@ExpertsClub