The Law “On the State Budget of Ukraine for 2026,” which the Verkhovna Rada adopted on December 3, provided for an increase in expenditures to support the agricultural sector by almost 47% compared to the previous year, or by UAH 4.5 billion, to UAH 14.1 billion, according to the Ministry of Finance.

According to the report, the 2026 state budget provides for UAH 9.5 billion to finance subsidies per hectare for frontline territories, insurance of agricultural products, and UAH 0.2 billion of this amount for irrigation/land reclamation.

The 2026 state budget provides for support for farmers (loans, subsidies per 1 hectare, subsidies for cows, goats, and sheep) in the amount of UAH 2.6 billion. The government has allocated UAH 2 billion for the humanitarian demining of agricultural land.

In addition, the state budget provides for the replenishment of the “Affordable Loans 5-7-9%” entrepreneurship development fund with UAH 18 billion, the innovation fund with UAH 7.4 billion, and business support programs with UAH 4.9 billion to support business. UAH 1.9 billion and UAH 0.6 billion will be allocated to the decarbonization and energy efficiency fund, respectively.

The National Association of Lobbyists of Ukraine (NALU) is initiating an official appeal to the European Parliament regarding the rules for registering Ukrainian organizations in the EU Transparency Register.

“The National Association of Lobbyists of Ukraine will soon send an official appeal to the European Parliament requesting clear and unambiguous clarification on which Ukrainian organizations are required to register in the European Union Transparency Register in order to interact with European institutions,” she told the Interfax-Ukraine news agency.

The association will also raise the question of whether Ukrainian entities—public organizations, professional associations, business associations, consulting companies, charitable foundations, and other structures—should undergo additional registration and obtain lobbyist status when working with EU bodies in accordance with the requirements of European legislation.

The association notes that with the entry into force of Ukraine’s Law on Lobbying and the state’s active course towards European integration, the issue of harmonizing Ukrainian lobbying practices with European Union approaches is becoming critically important. The lack of clear instructions and a unified position may create legal uncertainty for Ukrainian organizations seeking to operate within the EU legal framework and represent Ukraine’s interests at the international level.

“We seek to obtain an official explanation so that Ukrainian organizations can act in accordance with European rules, avoid risks, and ensure maximum transparency in their activities. This is also important for protecting Ukraine’s image as a state that is moving towards civilized interaction and open advocacy,” notes the NALU.

The explanations received from the European Parliament are planned to be published and forwarded to Ukrainian institutions, businesses, and public organizations as an official guideline for further work with EU bodies.

The pharmaceutical company Galichpharm JSC (Lviv) plans to increase sales by 15% by the end of 2025, according to a report posted on its website.

According to the report, in the first nine months of 2025, Galichpharm produced 4.753 million packages of finished medicines worth UAH 904.94 million.

The average cost of one package of manufactured medicines in the form of injections was UAH 132.24, infusions – UAH 32.35, liquids and syrups – UAH 67.9, and tablets – UAH 22.24.

The company’s revenue for January-September reached UAH 252.449 million.

In addition, the company reports that exports accounted for 9.13% of total sales, and its products were supplied abroad for more than UAH 23 million. The company exports to the markets of Kazakhstan, Georgia, Uzbekistan, Latvia, and other countries.

According to the company’s estimates, Galichpharm ranks fifth in terms of retail sales in monetary terms for the first nine months of 2025, with a market share of 1.3%.

As reported, at the end of 2024, Galichpharm reduced its net profit by 39% compared to 2023, to UAH 13.705 million, while in 2023 this figure was UAH 22.52 million.

As reported, the investment company Sky Development won an open auction organized by the Deposit Guarantee Fund and acquired the rights to claim the insolvent JSC Bank Finance and Credit under ten loan agreements with leading Ukrainian pharmaceutical companies: JSC Galichpharm and JSC Kyivmedpreparat. According to Sky Development, the total amount of its claims exceeds UAH 3.5 billion.

For their part, Kyivmedpreparat and Galichpharm stated that the information disseminated by Sky Development is “unreliable, manipulative, and shows signs of deliberate discrediting of the companies’ activities.” In particular, both companies denied the existence of “multibillion-dollar debts” to Sky Development. The pharmaceutical companies regarded the statements of Sky Development LLC as “an attempt to illegally create non-existent creditor debt for the purpose of a possible raider takeover of the companies.”

Over UAH 13.7 billion has been borrowed by Ukrainians from microfinance organizations over the past three months, which is more than 2 million microloans. In total, 6.5 million microloans worth UAH 40 billion have been issued since the beginning of the year. The average amount of a microloan in Ukraine is UAH 6,417. In total, citizens currently owe more than UAH 25 billion to microcredit organizations. The amount of debt has increased by 26% since the beginning of the year.

Ukrainians took out 2,138,569 microloans in the third quarter. The quarter-on-quarter loan growth rate is slightly lower – about 2%. Over the past three months, more than UAH 13.7 billion has been borrowed from microcredit organizations.

In total, since the beginning of the year, microloans have been applied for more than 6 million times, with the total amount of loans amounting to more than UAH 40 billion.

Despite the fact that the number of microloans is decreasing, the average loan amount per quarter has increased. Currently, the average amount borrowed from MFIs is UAH 6,417. For comparison, at the beginning of the year, payday lenders borrowed UAH 5,773.

Microloans are not as well repaid: since the beginning of the year, the total amount of debt has increased by a quarter and reached UAH 25.15 billion.

Opendatabot analyzed the financial reporting data of microfinance organizations – among those that have already published this information – and compiled a rating of the country’s top 10 MFIs by income. The top ten in the first three quarters of 2025 was headed by UKR CREDIT FINANCE, which operates under the CreditKasa brand with a revenue of UAH 2.4 billion. For comparison, for the whole of last year, the company’s revenue amounted to UAH 4.2 billion. Credit plus (AVENTUS UKRAINE) is in second place with revenue of UAH 1.67 billion. The top three payday lenders are rounded out by ShvydkoGroshi (CONSUMER CENTER) with UAH 1.63 billion in revenue for the three quarters of this year.

https://opendatabot.ua/analytics/mfo-2025-9

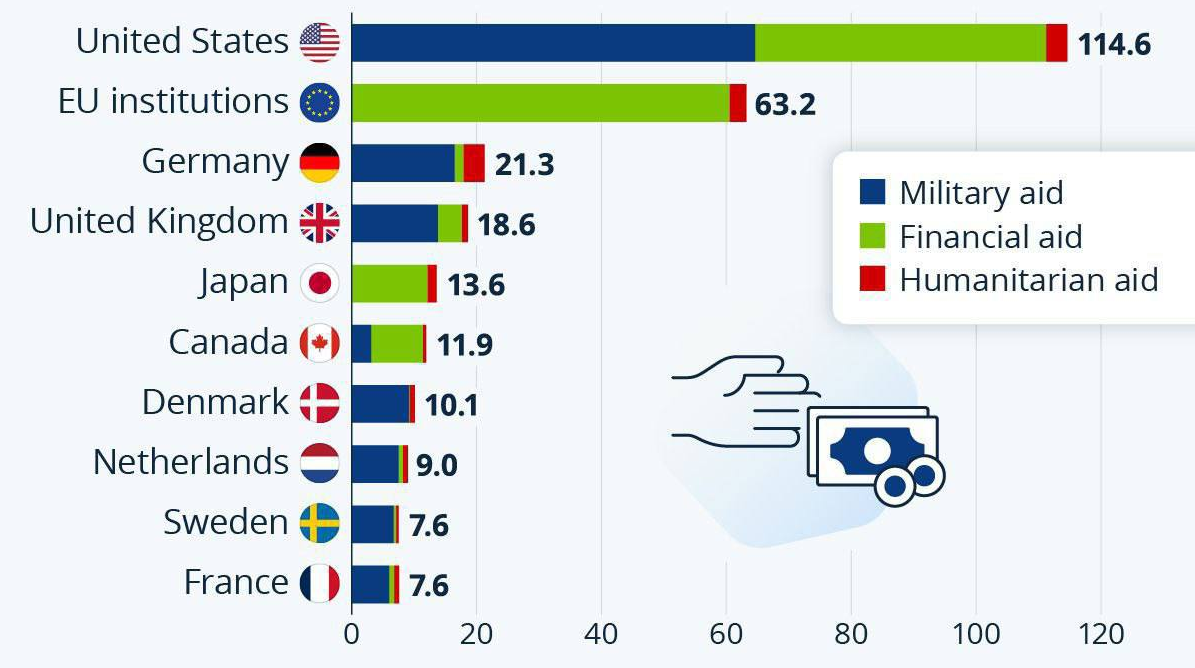

External financing of the state budget as 2022-2025, billion euros

Source: Open4Business.com.ua

Ukrainian banks will pay income tax at a doubled rate of 50% in 2026.

The corresponding law (No. 14097) on amendments to the Tax Code of Ukraine regarding the specifics of income tax for banks in 2026 was adopted by the Verkhovna Rada on Wednesday with 272 votes in favor, with a minimum of 226 votes required, according to a correspondent from the Interfax-Ukraine news agency.

According to Yaroslav Zheleznyak, first deputy chairman of the relevant parliamentary finance committee, banks will pay tax at this rate on a quarterly basis next year and in the first quarter of 2027, which should bring an additional UAH 15-23 billion to the budget in 2026 and about UAH 5 billion in 2027.

This is the third tax increase for banks to 50% since the start of Russia’s full-scale invasion, but the first two times — in 2023 and 2024 — the Rada made this decision retroactively in the fall.

At its meeting on October 30, the Financial Stability Council (FSC) noted the systemic risks that could be created by the introduction of a 50% tax rate on bank profits from 2026.

“Raising the tax rate for banks to 50% creates risks of limiting lending to the economy and weakening financial stability in wartime,” the FSC emphasized.

Council members also noted that the expected fiscal effect of raising the rate to 50% may turn out to be significantly lower than publicly communicated estimates.

Among other risks, the FRS cited possible complications in the privatization of banks with state ownership, failure by some institutions to implement capitalization programs within the specified time frame, difficulties in timely compliance with capital adequacy requirements in accordance with EU standards, the risk of violating the obligations under the Memorandum with the IMF, as well as a reduction in incentives to de-shadow the economy.

The National Bank also noted that banks and financial companies already have a higher level of income taxation compared to other sectors of the economy – 25% versus 18%.

According to the NBU, Ukrainian banks earned UAH 131.7 billion in net profit in the first 10 months of 2025, which is 4.9% more than in the same period of 2024, and paid 2.1% more income tax – UAH 34.7 billion.