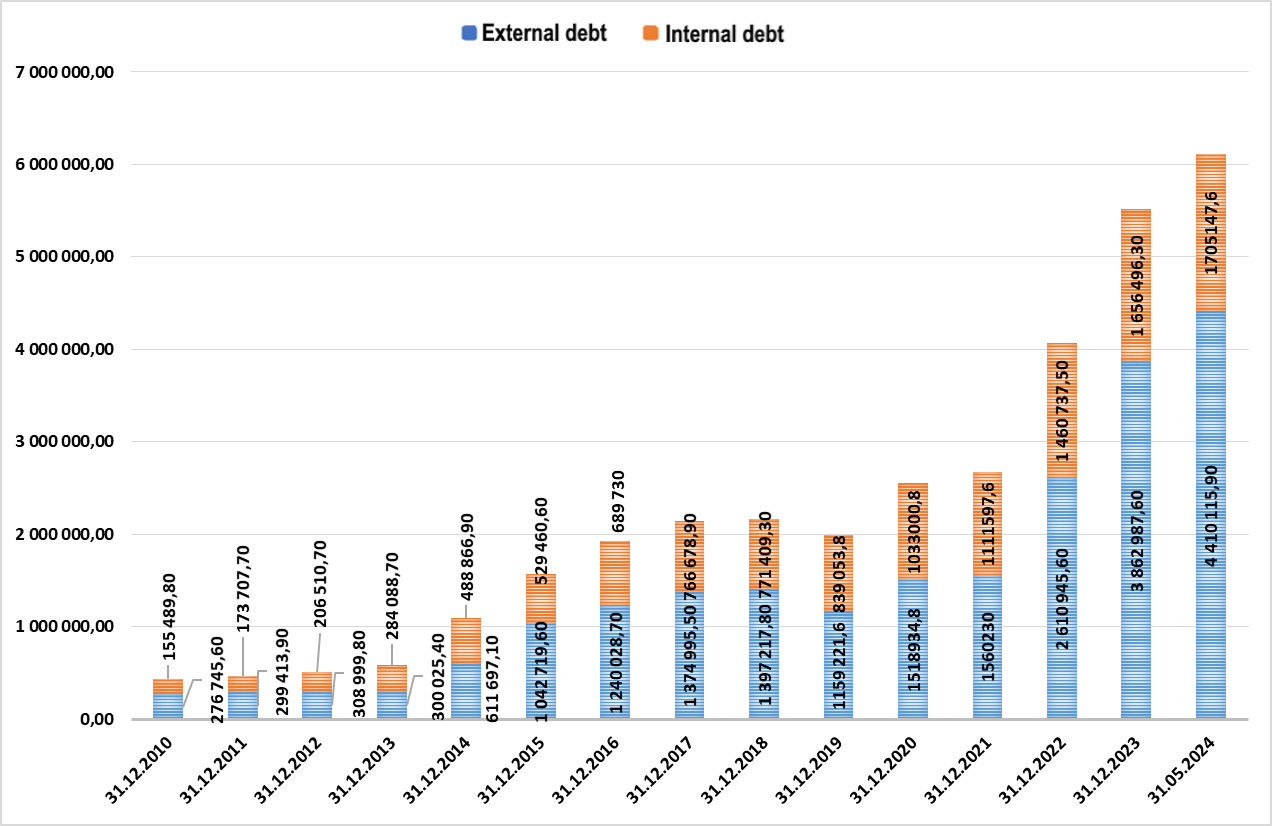

Internal and external debt of Ukraine in 2010-May 2024

Source: Open4Business.com.ua

In the first half of 2024, distribution system operators of DTEK Grids repaired about 9.2 thousand kilometers of power lines of various voltage classes and 3.3 thousand substations and distribution points of various voltage levels.

“The works were carried out as part of the repair and investment program. The DSOs also invested more than UAH 2.2 billion in the renovation of power facilities in the first half of the year,” the energy holding said in a press release on Friday.

According to the document, despite the full-scale hostile aggression, the planned works are carried out every year to ensure the stability of the power grids during peak loads in the autumn and winter.

In particular, DTEK’s specialists have already reconstructed four distribution points and modernized 17 substations.

The company noted that due to the use of stabilization outage schedules, power equipment wears out and breaks down faster, so the amount of investment required increases.

“In the first half of 2024, the total investment since the beginning of the year under the investment program amounted to more than UAH 2.2 billion. By the end of the year, we plan to invest an additional UAH 2.6 billion in the development and renewal of the energy infrastructure,” said Oleksandr Fomenko, CEO of DTEK Grids, quoted in the press release.

According to DTEK Grids, the energy company continues to replace outdated meters with expiring service life by installing smart meters instead. In particular, in January-June, the company replaced 89.5 thousand meters, and plans to replace another 91.9 thousand meters by the end of the year.

In order to prepare for the heating season 2024/25 as efficiently as possible, the company also called on companies servicing apartment buildings – housing offices, condominiums and management companies – to inspect their equipment, carry out the necessary maintenance and eliminate possible malfunctions. “According to statistics, people were left without electricity in their homes in 25% of cases on average due to accidents in the adjacent networks,” DTEK explained.

“DTEK Grids develops the electricity distribution and power grid operation business in Kyiv, Kyiv, Dnipro, Donetsk and Odesa regions. The energy holding’s DSOs serve 5.5 million households and 158 thousand enterprises.

Agrarians in all regions of Ukraine have already harvested 31.821 million tons of new crops from 7.946 million hectares, the press service of the Ministry of Agrarian Policy and Food reported on Friday.

According to the report, more than 28.5 million tons of grains and 3.4 million tons of oilseeds have already been harvested.

It is specified that 21.7 million tons of wheat have been harvested from 4.846 million hectares at a yield of 44.7 c/ha, barley – 5.5 million tons from 1397.4 thousand hectares at a yield of 39.2 c/ha, peas – 458.5 thousand tons from 207.6 thousand hectares at a yield of 22.1 c/ha, buckwheat – 2.4 thousand tons from 1.4 thousand hectares. tons from 1.6 thousand hectares at a yield of 14.4 c/ha. tons from 207.6 thousand hectares at a yield of 22.1 c/ha, buckwheat – 2.4 thousand tons from 1.6 thousand hectares at a yield of 14.4 c/ha, millet – 9.5 thousand tons from 5.32 c/ha at a yield of 17.9 c/ha.

Ukraine continues to harvest oilseeds. In particular, more than 3.4 mln tons of rapeseed have been harvested from 1227.6 thou hectares with a yield of 27.2 c/ha and 1 mln tons of soybeans from 0.7 thou hectares with a yield of 27.4 c/ha. In Mykolaiv region, the harvesting of sunflower has started, with 3.8 thou tons harvested from 4.2 thou hectares at a yield of 9 c/ha.

In terms of grain harvesting, agrarians in Odesa region are leading the way with 1075.7 thou hectares harvested. Khmelnytsky region is the leader in terms of yield, with 65.5 c/ha. Dnipropetrovs’k region started harvesting soybeans on 0.65 thou hectares with a yield of 15.2 c/ha. Farmers in Mykolaiv region have started harvesting sunflower.

A new dealership center of the Nissan automotive brand, Avtosvit Mykolaiv, opened in August in Mykolaiv, according to a press release from Nissan Motor Ukraine.

The dealership complex with an area of more than 1,000 square meters, built according to Nissan standards, has a service center with nine stations, and the showroom presents the entire model range officially available on the Ukrainian market.

The car center also offers a trade-in program, as well as services for special credit, leasing and insurance programs.

The press service of the distribution company told Interfax-Ukraine that Avtomir Mykolaiv became Nissan’s new partner in Mykolaiv instead of the previous partner, which ceased operations.

“Prior to that, Avtomir Mykolaiv cooperated with another brand in this center, so the center was not built from scratch,” the press service said.

Nissan’s dealer network in Ukraine currently includes 29 centers.

According to the website of Nissan Motor Ukraine, the Juke (including the updated one), Qashqai, X-Trail, and Nissan Leaf electric car are officially presented in Ukraine.

According to Auto-Consulting, in July of this year, the Nissan car brand took the fifth place in the ranking of the best-selling cars in Ukraine, with sales of 335 cars against 238 units in June of this year and a market share of 5.54%.

In 2023, 2071 cars of this brand were sold in Ukraine, up 73.6% year-on-year, with the passenger car market growing by 62.4% to 65.086 thousand units.

“Nissan Motor Ukraine started operations in April 2005 and acts as an importer and distributor of Nissan and Infiniti in Ukraine.

Tower Group LLC, the beneficiary of which is businessman and politician Vadym Stolar, has purchased the only property complex of the state motor transport enterprise Avtomekhbaza in Kyiv at a privatization auction.

According to information on the Prozorro website, Tower Group offered UAH 80.5 million for the asset at a starting price of UAH 31.9 million (excluding VAT).

The lot includes administrative premises and garages with a total area of about 1.7 thousand square meters, as well as a fleet of cars.

The company’s debt to the budget for the first quarter of 2024 is UAH 528.1 thousand, according to the State Property Fund.

According to Opendatabot, the owners of Tower Group are Genesis (89%) and Phoenix (11%), with Stolar listed as the ultimate beneficiary.

The charity fund “Okhmatdet – Healthy Childhood”, which collected money for the restoration of the National Children’s Specialized Hospital (NCHS) after its destruction by a missile attack on July 8, is not going to transfer it to the accounts of “Okhmatdet”, said the director of NCHS Volodymyr Zhovnir.

“Since morning we have learned that BO “Charitable Foundation ‘Okhmatdet – Healthy Childhood’, does not plan to transfer funds to the account of VATB ‘Okhmatdet’. That is, as of August 16, 2024 UAH 378 million remain in the account of the BO “Charitable Foundation ‘Okhmatdet – healthy childhood’,” he wrote on Facebook on Friday.

According to Zhovnir, to raise funds, the details of the fund were made public on the pages in social networks of the hospital and its employees, in the media, as well as on the websites and pages of public authorities, public organizations and just concerned citizens.

“The fact that the fund contains in its name the name of Okhmatdet NDSB became for the benefactors an additional confirmation that the collected money will be used for the intended purpose and in no case will go for purposes unrelated to the recovery process”, – emphasized Zhovnir.

He also noted that no one had any doubts about the honesty of the fund, as they had always interacted normally with the hospital in the past. However, he argued, starting with the first public scandals and requests to transfer money, communication with the organization began to deteriorate.

“We are deeply shocked by the foundation’s decision. The hospital’s name is synonymous with responsibility, professionalism and hope. In my opinion, neither VATB nor the foundation, which bears the name “Okhmatdet”, has the right to let down Ukrainian society. However, the participants of the foundation (among whom there is not a single NDSB employee!) decided otherwise,” he said.

Zhovnir demands from the charity organization to transfer the money collected for the restoration of “Okhmatdet” to the hospital’s accounts and says that they are currently considering the possibility of breaking legal relations with the foundation because of the fact that their actions are “dishonest, as well as probably fraudulent”.

Meanwhile, an official statement from the BF says all funds raised for the hospital’s rehabilitation will remain in its accounts.

“The key thing is that all funds collected for the restoration of Okhmatdet after July 8th remain on the account of the Okhmatdet – Healthy Childhood Foundation. The fund is ready to pay for any urgent need of the hospital: medical equipment or restoration of buildings damaged as a result of the Russian attack. But we have not received a single letter from the Okhmatdet hospital about any such targeted need,” the website reported on Friday.

Representatives of the fund are also asking for legal grounds for transferring funds to treasury accounts without assignment.

“The Ministry of Health in its demands refers to Article 5 of the law “On Charity and Charitable Organizations.” However, this article of the law does not provide a legal mechanism for transferring funds collected by a benefactor to any state or other accounts without grounds. If we fulfill the requirement of the Ministry of Health to transfer the funds, we will grossly violate the law,” the statement says.

To confirm its transparency, the foundation invites the First Lady of Ukraine, Olena Zelenska, to become a member of its nabsoviet board to oversee and control the implementation of the reconstruction of the Okhmatdet hospital after the Russian terrorist missile attack.