Ukrainian President Volodymyr Zelensky will visit the Philippines for the first time. Zelensky will arrive in Manila late in the evening on Sunday, June 2, news website Rappler reported, citing diplomatic sources.

According to the report, this is Volodymyr Zelensky’s first visit to Manila since he was elected president in 2019, the Ukrainian president will arrive in the Philippines immediately after his visit to Singapore.

As previously reported, in Singapore Zelensky took part in the Shangri-La Dialogue conference and held meetings with Singaporean government officials, investors, as well as US Secretary of Defense Lloyd Austin.

Ukrainians who had a permit for temporary collective protection from war in Norway, but whose permit was revoked or not renewed, cannot subsequently obtain it again.

The corresponding tightening to the protection rules was adopted by the Norwegian Ministry of Justice and Public Safety on May 31, according to a press release from the agency.

“Norway spends a lot of money on accelerated processing and resettlement of Ukrainian asylum seekers under a special scheme. The Center Party and the Labor Party in the government think it is wrong that asylum seekers who have voluntarily returned or have broken the rules should receive special treatment again,” Norwegian Justice and Public Safety Minister Emilie Enger Mehl said.

According to the Directorate of Immigration, about 2,000 Ukrainians with temporary collective protection have not received an extension of their one-year residence permit in Norway. In many cases, these are people who have moved back to Ukraine or other European countries. These people will no longer be able to receive collective protection in Norway if they apply for it again; instead, they will be referred to the normal individual asylum procedure.

The Minister also does not rule out the possibility of further tightening the rules for temporary collective protection in Norway.

“Immigration must be sustainable. We are therefore considering further tightening of the temporary collective protection scheme,” Mel indicated.

As reported, on March 11, 2022, the Norwegian government introduced a temporary collective protection scheme for displaced persons from Ukraine. This scheme means that those covered by it are granted a residence permit under a simplified procedure and without individual assessment.

According to Eurostat, at the end of March this year, Norway had 70.69 thousand citizens with temporary protection status from the war in Ukraine, compared to 52.61 thousand at the end of August 2023 and 66.94 thousand at the end of 2023.

A total of 4 million 211.5 thousand citizens of non-EU countries who left Ukraine as a result of the Russian invasion on February 24, 2022 had temporary protection status in the EU countries as of March 31, 2024. Ukrainian citizens accounted for more than 98% of temporary protection beneficiaries.

According to Eurostat data, at the end of March 2024, the main EU countries that received temporary protection beneficiaries from Ukraine were Germany (1 million 301.79 thousand people; 30.9% of the total), Poland (955.52 thousand people; 22.7%) and the Czech Republic (364.38 thousand people; 8.7%). The combined share of these three countries is 62.3%.

Three candidates are vying for the position of head of state in presidential elections being held in Mexico on Sunday, the Associated Press reported.

The incumbent president Andres Manuel Lopez Obrador is not taking part in the election, while Claudia Sheinbaum, who is favored by many observers to win, is running on behalf of his National Revival Movement party.

Sheinbaum’s rivals are Sochitl Galvez of the opposition center-right bloc “Strength and Heart for Mexico” and former member of the lower house of the Mexican parliament Jorge Alvarez of the “Citizens’ Movement” party.

Observers, paying attention to the trio of candidates, note the high probability that the new president of Mexico for the first time could be a woman.

Mexico’s president is elected for a six-year term.

In addition to the presidential elections on Sunday, Mexico is holding parliamentary elections, as well as local elections, including the mayor of the capital Mexico City and governors of eight states.

Earlier Experts Club analytical center presented analytical material about the most important elections in the countries of the world in 2024, elections in Mexico were among the top 5 most important elections in the world in 2024, more video analysis is available here – https://youtu.be/73DB0GbJy4M?si=eGb95W02MgF6KzXU.

Subscribe to Experts Club YouTube channel here – https://www.youtube.com/@ExpertsClub

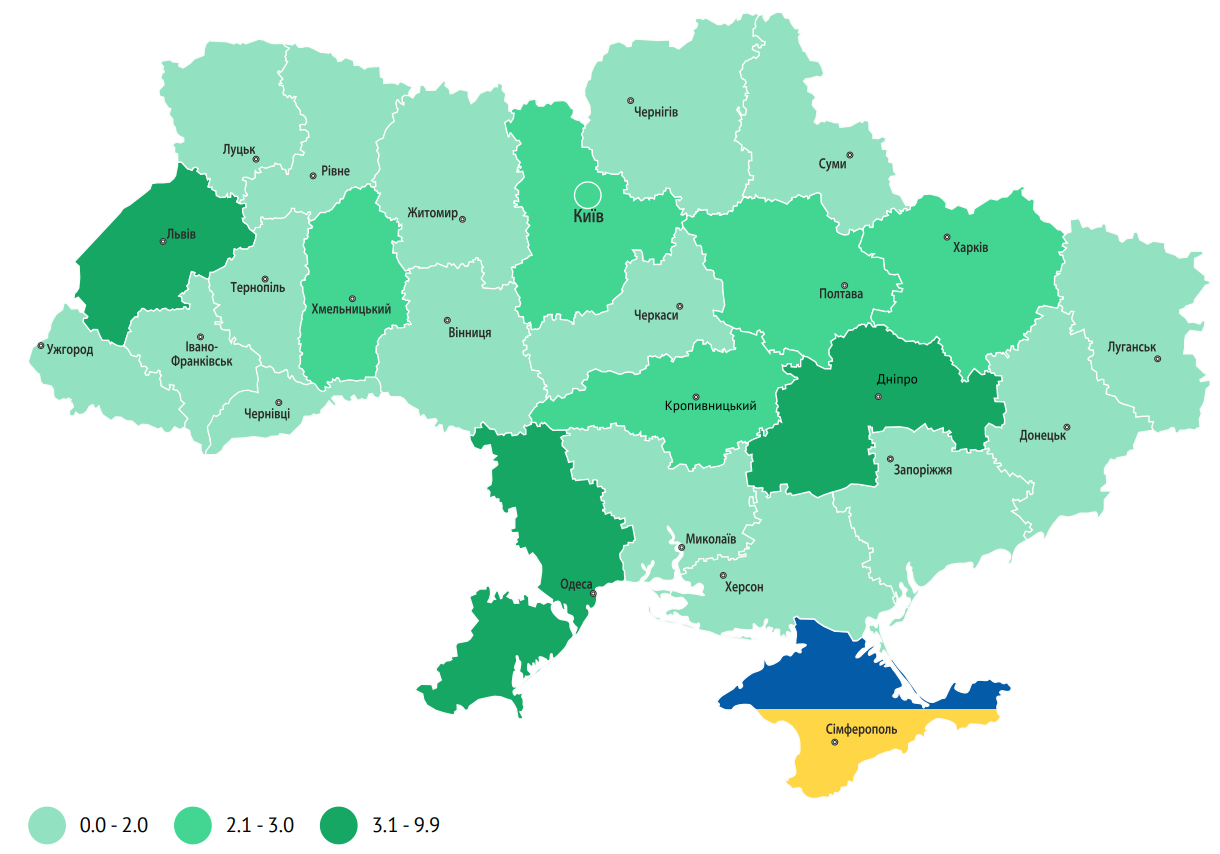

Number of vacancies as of 31.03.2024 (thousand units) according to data of state employment center

Source: Open4Business.com.ua and experts.news

On Monday, June 3, at night in most northern, central, Kharkiv regions, in the Carpathian region in the afternoon in some places short-term rains, thunderstorms; in the rest of Ukraine without precipitation, reports Ukrhydrometcenter.

The wind is south-western, 5-10 m/s.

The temperature at night 13-18°, in the west of the country 10-15°; during the day 27-32°, in the western, northern, Vinnitsa regions and on the seashore 23-28°.

In Kiev on Monday night in places short-term rain, thunderstorms, in the afternoon without precipitation. The wind is south-western, 5-10 m/s. The temperature at night is 16-18°, during the day 25-27°.

According to the Central Geophysical Observatory of Boris Sreznevsky in Kiev on June 3, the highest daytime temperature was 32.7° in 1901, the lowest nighttime temperature was 3.0° in 1918.

Tuesday, June 4, in Ukraine, except for the southeast, short rains with thunderstorms, hail in some areas during the day, only at night on the left bank of the country without precipitation.

The wind is south-western with a transition to south-eastern, 7-12 m/s, gusty during thunderstorms.

The temperature in the western regions at night 10-15°, in the afternoon 20-25°; in the rest of the territory at night 14-19°, in the afternoon 27-32°, in the northern regions 23-28°.

In Kiev on Tuesday afternoon moderate, at night light short-term rain with thunderstorms, hail in some areas in the afternoon. The wind is southwesterly with transition to southeastern, 7-12 m/s, gusty during thunderstorms. The temperature at night is 16-18°; during the day 26-28°.

Europol has uncovered a corporate criminal enterprise based primarily in Ukraine that specialized in the theft of high-end rental cars. Thirteen people were arrested.

“In an operation codenamed ‘Matador’, law enforcement authorities from France, Germany, Latvia, Poland, Spain and Ukraine arrested 13 people responsible for large-scale thefts of luxury cars across Europe. Ongoing investigations have shown that the criminal group consists of more than 50 people from different countries and is responsible for the theft of at least 36 high-end cars,” Europol said on Friday.

The press release specifies that on May 21 this year, the authorities conducted more than 70 searches, which resulted in the seizure of six vehicles, forged documentation and license plates, as well as 132,165 euros in cash. “In Ukraine alone, police officers conducted more than 50 searches of the premises of persons involved in criminal activities, including those who recruited and helped with logistics,” the statement said.

Europol also informed that the international operation began with a Spanish investigation launched after car rental and leasing companies in the Malaga area reported the disappearance of luxury cars. “Investigators soon uncovered a criminal network that used the driving licenses and passports of vulnerable people to rent prestigious cars. Europol formed a task force with the participation of France, Spain, Poland and Ukraine to stop this criminal activity. As for the judicial side of the operation, Eurojust has set up a joint investigation team with the same countries,” Europol detailed.

According to the available information, for a year and a half, the authorities involved have been compiling an intelligence picture of the criminal network’s activities across Europe. In particular, the organization, based mostly in Ukraine, hired Ukrainian citizens to travel to the EU to rent luxury cars under their real names. In other cases, fake identity documents were used. As the criminals organized flights, hotel rooms, and other logistics, each person rented one or two cars, mostly in Spain or France.

After renting or leasing, the cars were handed over to contacts who organized the delivery of the vehicles by land or sea to various countries, including Lithuania, Germany, and Poland. At these processing plants, a separate branch of the organization, consisting of specialized car mechanics, prepared the vehicles for export. This included disabling the GPS transmitters installed in the vehicles, as well as forging and replacing license plates and other numbered parts of the vehicle. In some cases, the vehicles were completely dismantled for sale on the spare parts market.

After changing the identification numbers, members of the other branch used corrupt officials to legalize the cars and register them under their personal documents. This allowed them to sell the cars in the EU and abroad, to countries as far away as the United Arab Emirates or Asia. The whole process was financed by another branch of the organization, which is mainly based in Spain.

“Given the scale of the investigation into Operation Matador, as well as the high level of criminal expertise of its participants, Europol classified the main leader as a High Value Target (HVT). He maintained contacts with other organizations specializing in vehicle hijackings, which may be revealed in the coming weeks. On the day of the action, one Armenian citizen, one Lithuanian, two French, six Russians and three Ukrainians were arrested, including HVT,” Interpol reports.

In order to implement the operation, an operational center for coordination at the police level was established on May 21 in Malaga (Spain). The operation involved Ukraine (Department of Strategic Investigations of the National Police of Ukraine, Main Investigation Department of the National Police of Ukraine, Prosecutor General’s Office), France (National Gendarmerie), Latvia (Main Criminal Department of the State Police), Germany (Baden-Württemberg Police, North Rhine-Westphalia Police, Lower Saxony Police, Essen Prosecutor’s Office), Poland (Central Bureau of Police Investigations, Warsaw Prosecutor’s Office) and Spain (National Police, Investigative Court No. 1 of Málaga, Prosecutor’s Office).