The Ukrainian government has introduced a quota for exports of poultry and poultry by-products to the EU in the amount of about 137,000 tons starting July 1.

According to Cabinet of Ministers Resolution No. 612 of May 30, published on the government portal, the quota for the supply of poultry meat and edible offal to the EU, including chickens, geese, ducks, guinea fowl (UKTZED code 0207), is set at 133.28 thousand tons, and turkey meat and edible offal (UKTZED code 0207 24-27) at 3.76 thousand tons.

The Ministry of Economy will consider applications for licenses to export these goods to the EU within 10 days. Permits will be issued on the basis of applications and approvals provided by the Ministry of Agrarian Policy.

For the period of martial law, applicants shall prepare and submit documents electronically through the relevant information and communication systems (the Ministry of Economy’s electronic services portal, the Unified State Web Portal of Electronic Services).

The licensing regime for the export of quota goods to the EU is also mandatory if the non-resident counterparty is registered in the EU under a foreign economic agreement (contract).

At the same time, the volume of quotas approved for the commodity item “Meat and edible offal of poultry: poultry chickens, ducks, geese, guinea fowl”, excluding the reserve quota of 1400 tons for new exporters, and for the commodity “Turkey meat and edible offal of turkeys” is distributed by the Ministry of Agrarian Policy among exporters in proportion to the actual volume of their exports to the EU in the first quarter of 2024. Information on the actual export volumes of these products for the first quarter of 2024 must be provided by exporters to the Ministry of Agrarian Policy with supporting documents by June 25, 2024.

The reserve quota of 1400 tons will be distributed among exporters who did not export these products in the first quarter of 2024.

If there is an unused balance of the quota as of November 1, 2024, it is distributed among exporters in proportion to the actual exports of these products to the Member States of the European Union for the three quarters of 2024.

As reported, on May 13, the EU Council finally approved the extension of the autonomous trade measures for another 12 months – until June 5, 2025. At the same time, restrictions have been imposed on the duty-free supply of a number of agricultural products – poultry, eggs, sugar, oats, cereals, corn and honey – in the amount of the average export volume for the period from the second half of 2021 to the end of 2023.

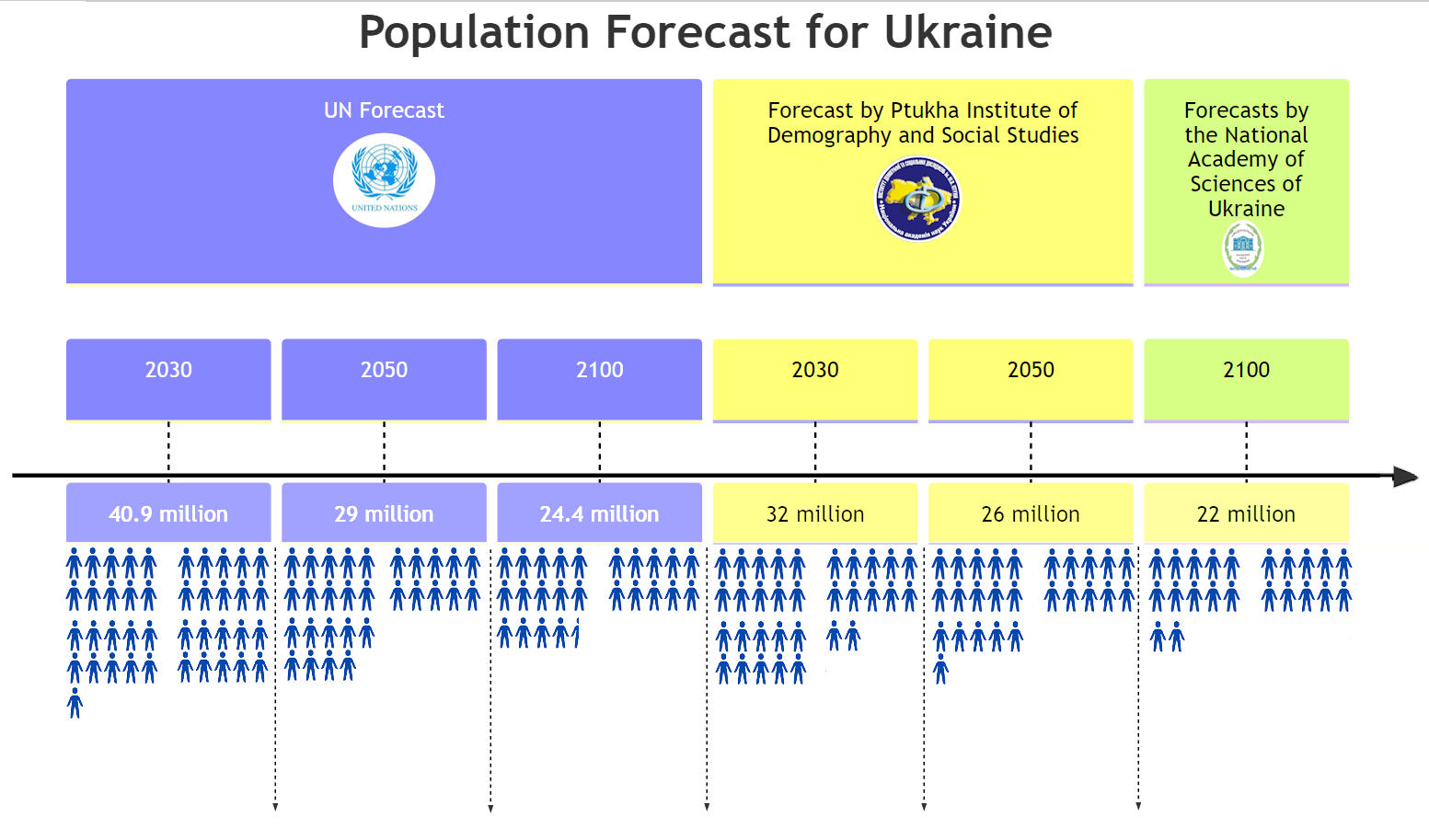

Population forecast for Ukraine in 2030-2100

Source: Open4Business.com.ua and experts.news

Germany will provide Ukraine with another US-made Patriot air defense missile system and a EUR500 million aid package, the German Foreign Ministry’s social media account X reported on Friday, citing the head of the ministry, Annalena Burbock.

“In NATO, we adhere to the principle of ‘one for all, all for one’. Putin’s brutal aggression against Ukraine and his provocations on the external borders of the EU and NATO require our unwavering unity. International law is unequivocal: states under attack not only have the right to defend their territory, but also have an obligation to protect their citizens. Our military support to Ukraine is consistent with these principles,” Burbock said at the NATO meeting in Prague.

President of Ukraine Volodymyr Zelenskyy and Prime Minister of Iceland Bjarni Benediktsson signed an agreement on security cooperation and long-term support in Stockholm, the press service of the Ukrainian president reports.

“Iceland has committed itself to providing comprehensive and long-term economic, humanitarian and defense support to Ukraine, as well as to facilitate its future membership in the EU and NATO. During 2024-2028, Iceland will annually allocate at least 4 billion ISK (about $30 million). Support for Ukraine will continue throughout the term of the agreement. Iceland is ready to finance, purchase and supply defense materials and equipment. In addition, it is ready to cooperate with Ukraine in the development of its defense industry,” the statement said.

It is noted that the uniqueness of the agreement lies in the fact that Iceland undertakes to continue to transport military supplies and equipment from NATO allies to Ukraine by chartered cargo aircraft. In addition, Iceland will pay special attention to supporting and equipping Ukrainian women in the Armed Forces of Ukraine.

Separate sections of the agreement relate to support for the Ukrainian peace formula, sanctions against Russia, compensation for damages, and bringing the aggressor to justice. The agreement also provides for the strengthening of social and civilian infrastructure, particularly in the areas of education and energy security.

Iceland also pledges to strengthen its diplomatic mission in Kyiv to deepen cooperation with government agencies, parliament, civil society, and the private sector in Ukraine.

The text of the agreement is published on the website of the President of Ukraine.

Ukraine and Iceland signed an agreement to implement the G7 Vilnius Declaration, which was adopted on July 12, 2023.

In total, Ukraine has signed 14 bilateral security agreements: with the United Kingdom, Germany, France, Denmark, Canada, Italy, the Netherlands, Finland, Latvia, Spain, Belgium, Portugal, Sweden, and Iceland.

Dispatch center of NEC Ukrenergo introduces consumption limits to regions for industrial and household consumers from 18:00 to 23:00 on Saturday, June 1.

As noted by the system operator in the Telegram-channel on Friday evening, to the critical infrastructure that ensures the vital functions of the population, the restrictions do not apply.

“In case of exceeding the limits of consumption brought by Ukrenergo oblenergos can apply schedules of hourly shutdowns”, – explained the NEC.

As reported with reference to the IAEA on Thursday, the fourth reactor of Rivne NPP is being prepared for shutdown for scheduled repairs. Scheduled repairs are also underway at one of the units of the Pivdenno-Ukrainian NPP. A total of nine power units with a capacity of 7.8 GW are available to Ukraine after the occupation of Zaporizhzhya NPP.

There were no electricity restrictions from Tuesday through Friday after two units were taken out of repair on May 26 and 27.

Insurance company Vuso and international insurance broker WTW have developed and started to implement the program of insurance of ground cargo transportation on the territory of Ukraine with coverage against military risks, according to the press release of the insurer.

It is also noted that the established limit of market capacity will provide full protection and support to Ukrainian and foreign enterprises engaged in cargo transportation on the territory of Ukraine. This program is reinsured in the private reinsurance market of Great Britain and Lloyd’s, with participation of leading reinsurers and leadership of Markel syndicate.

The insurance program developed by Vuso and WTW will contribute to the sustainability of the Ukrainian economy, the safety of cargo transportation and guarantee the maximum level of financial support for the insurance company’s clients.

“During wartime, we faced many issues that required consistent solutions. We are glad that WTW Ukraine supported Vuso on this case. The main task for today is to guarantee stability and comfort to our corporate clients regardless of the current events in our country. (…) This capacity will allow us to expand the range of programs for Ukrainian business to protect cargo transportation from military risks”, – says the Chairman of the Board of IC Vuso Andrey Artyukhov.

The project is already realized. You can learn more about the program from representatives of Vuso or WTW Ukraine.

The global consulting, brokerage company Willis Towers Watson (WTW) provides analytical solutions in the field of people, risk and capital. Using the global perspective and local expertise of colleagues operating in 140 countries and markets, it helps organizations develop their strategy, improve organizational resilience, motivate their people and maximize productivity.

VUSO IC was founded in 2001. The company holds 50 licenses: 34 – for voluntary and 16 – for compulsory types of insurance, is represented in all regions of Ukraine. It is a member of ITSBU and UFS, a participant of the Agreement on direct settlement of losses and a member of the Nuclear Insurance Pool.