The U.S. dollar is declining against major currencies in trading on Thursday morning after a speech the day before by Federal Reserve Chairman Jerome Powell.

The ICE-calculated index, which shows the U.S. dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona), is down 0.4%, while the broader WSJ Dollar Index is losing 0.6%.

During a speech at the Brookings Institution on Wednesday, Powell reiterated that the Fed could slow the rise in the prime rate as early as December. “The time to moderate the pace of rate hikes may come as early as the next meeting,” Powell said.

The Fed chairman, meanwhile, tried to balance those words with “hawkish” signals, Market Watch notes. He said that the U.S. Central Bank will have to raise the rate higher than could be expected a few months ago. In addition, Powell made it clear that the issue of rate cuts is irrelevant at the moment.

Another Fed official, Board of Governors member Lisa Cook is confident that the regulator needs to keep raising the rate because inflation is still too high. “We’ve started to get more favorable inflation data. But I would be cautious about drawing big conclusions on just one month’s worth of data,” Cook said during a speech at the Detroit Economic Club.

The euro/dollar pair as of 8:00 a.m. Ksk traded at $1.0445 versus $1.0410 at the close of Wednesday’s session.

The dollar/yen was down to 136.43 yen from 138.05 yen at the end of the previous session.

The pound is trading at $1.2103 versus $1.2058 the day before.

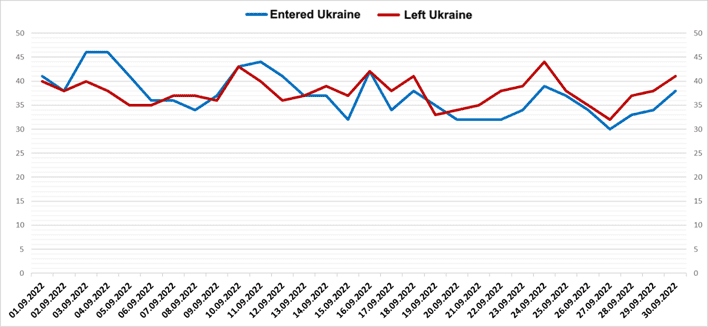

Passenger flow through western border of Ukraine in Sept 2022, thousand (graphically)

Data: State Border Service

Oil prices show weak negative dynamics on Thursday morning after a 3% jump a day earlier.

February futures for Brent crude oil on London’s ICE Futures Exchange fell by $0.28 (0.32%) – to $86.69 per barrel by 7:17 a.m. Kk. The previous day the price of these contracts grew by 3.2% up to $86.97 per barrel. The cost of January Brent futures, which expired on Wednesday, grew by 2.9%, reaching $85.43 per barrel.

WTI futures for January delivery on NYMEX fell by $0.22 (0.27%) to $80.33 per barrel by the same time. Those contracts rose 3% on Wednesday to $80.55 a barrel.

Meanwhile, Brent was down 9.9% in November, while WTI gained 6.9%, mostly on investors’ concerns about lower demand in China due to new lockdowns caused by coronavirus outbreak.

On Wednesday the oil market, however, was supported by the news that the authorities of the People’s Republic of China softened the anti-covids measures in a number of cities and provinces, including Beijing. Investors expect official Beijing to abandon its zero tolerance policy to the coronavirus after mass protests in the country earlier this week.

Moreover, the official data of the US Department of Energy showed a weekly drop of oil reserves by 12.58 mln barrels to 419.08 mln barrels. Meanwhile, experts expected reserves decline by only 3.12 mln barrels.

The market’s attention is gradually shifting to the OPEC+ meeting to be held on December 4. Some analysts expect that the alliance may decide on further reduction of production quotas.

The agreement was reached during the international exhibition Adipec 2022 in Abu Dhabi, where Centravis presented its products.

We are talking about Petroleum Development Oman (PDO), with which Centravis has been cooperating for a long time. However, after a series of shelling of the territory of Ukraine this autumn, the client from Oman suspended cooperation due to possible security risks.

During the meeting at the exhibition in Abu Dhabi, the representatives of Centravis managed to convince the partners from Petroleum Development Oman in the ability to fulfill the order qualitatively and on time.

“After successful negotiations, we received a new order for the production of almost 20 tons of GTP duplex steel grade pipes,” said Natalia Ryazantseva, Head of Marketing Department.

According to her, Centravis currently uses various forms of communication with customers to ensure a stable order book. In particular, weekly letters with information about production and security situation in the region and the country are published on the company’s website. Also, representatives of Centravis regularly travel to meet with customers, the company participates in international exhibitions. This autumn, Centravis had separate stands at the exhibitions in Maastricht World Stainless Steel and Adipec 2022 in Abu Dhabi.

“In times of war, each order is even more important than in peacetime. We managed to preserve the main backbone of customers and, accordingly, the production volume and team. This is the main achievement and we are doing everything to keep the economic front and help the country”, – said Natalia Ryazantseva.

Centravis is one of the ten largest manufacturers of seamless stainless pipes in the world. The company’s production volume at the end of 2021 amounted to 19.43 thousand tons.

From the first days of the full-scale war against Ukraine, the company joined the support of the rear and the front. 119 employees of the company joined the Armed Forces of Ukraine. Also, funds were allocated for the purchase of necessary materials and equipment for the forces of the security and defense sector – in accordance with the requests received by the company.

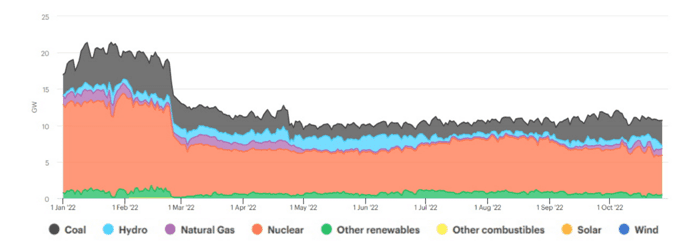

Generation distribution in power system of Ukraine in 2022

ENTSO-E

Yield of main crop crops in 2021-2022 (million tons)

NBU