More than 300 domestic manufacturers have already registered on the first marketplace of Ukrainian clothing and footwear brands shopping.ua, co-founder of the shopping.ua platform Serhiy Azarenka told Interfax-Ukraine.

“The war had a great impact on representatives of the clothing industry in Ukraine. We constantly analyze the market, we see how difficult it is for Ukrainian manufacturers today. Our platform was created for true connoisseurs of made in Ukraine,” Azarenka said.

According to him, the portal was launched during the war, in April 2022. It was the war that prompted people to give people the opportunity to buy Ukrainian in different regions, the expert explains.

He clarified that in total before the war, 1,600 sewing enterprises operated in Ukraine, a significant part of which is located in the north-eastern region of the country: in Sumy, Chernihiv and Kharkiv regions. These regions were the first to be hit by the enemy.

“The producers of Kharkiv, the most affected by constant shelling and power outages, are already gradually recovering,” Azarenka said.

Overall, he estimates that approximately 60% of companies in the industry have either closed or are operating with interruptions. The reason is not only in the destruction, but also in the absence of orders, the expert notes.

“The marketplace will allow Ukrainians to support a Ukrainian manufacturer, which will have a positive impact on the economy of Ukraine as a whole,” Azarenka is convinced.

Currently, the marketplace offers author’s collections of famous designers, promotional offers from brands such as CAT ORANGE, Jadone Fashion, Tuto Vzuto, Egostyle, MAN’s SET, Amulet, Sofia Shelest, Aura Shoes, etc.

Any domestic clothing and footwear manufacturer can join the platform. To connect, it is enough to provide an extract from the unified state register of taxpayers. Registration and placement of goods on the marketplace are free.

A large Ukrainian manufacturer of corrugated cardboard – Poninkovskaya Cardboard and Paper Factory-Ukraine (“PKBF-Ukraine”, Khmelnytsky region) produced products worth UAH 1 billion 526 million in January-August, which is 12.2% more than in the same period of 2021 of the year.

According to the statistics of the UkrPapir association provided to the Interfax-Ukraine agency, in physical terms, the factory reduced the production of containerboard (including corrugating paper) by 19.2% – to 48.3 thousand tons, and by 17.6% corrugated boxes from it – up to 43.1 million square meters. m.

At the same time, paper production increased by 72% – up to 381 tons.

At the same time, in August, the production of corrugated packaging by the factory decreased by 9% compared to August 2021, to 6.9 million square meters. m, paper and cardboard – by 2%, up to 8.1 thousand tons.

The Ponikovskaya Factory (formerly the Ponikovsky Cardboard and Paper Mill), once the largest manufacturer of school notebooks, currently has one main production – paper and cardboard, mainly produces corrugated packaging, as well as wrapping, waste paper.

The factory is part of the United Cardboard Company-Ukraine (UCC, Lutsk), whose production assets include, in particular, Lutsk KBF-Ukraine (Volyn region), which reduced the production of cardboard by 22% in January-August – to 33, 4 thousand tons.

As reported with reference to data collected by the association from industry companies, in January-August, taking into account the fact that a number of enterprises in the industry were either destroyed or damaged or located in the occupied territory, the production of paper and cardboard in Ukraine decreased by 43.2% compared to with the same period last year – up to 336.7 thousand tons, corrugated packaging – by 42.2%, up to 282.3 million square meters. m.

More wealthy people live in New York than in any other city in the world, according to a report by the consulting company Henley & Partners.

There are 345.6 thousand millionaires and 15.47 thousand multimillionaires in New York, that is, residents with a fortune of more than $10 million. There are also 737 people whose wealth exceeds $100 million and 59 billionaires.

About 4% of New Yorkers’ 8.38 million own investment assets (property, cash or stock) worth more than $1 million, according to the study, according to CNBC. The total personal wealth of New Yorkers exceeds $3 trillion.

Tokyo ranked second in the ranking of cities with the largest number of wealthy residents (304.9 thousand, including 12 billionaires), in third place is the San Francisco Bay Area, which includes Silicon Valley (276.4 thousand, 62 billionaires).

London is on the fourth line (272.4 thousand), Singapore is on the fifth (249.8 thousand) and China’s Beijing (131.5 thousand) and Shanghai (130.1 thousand) close the top 10.

In addition, the leaders of the ranking include Los Angeles, Chicago and Houston, occupying positions from six to eight. Thus, half of the ten richest cities in the world are located in the United States.

Meanwhile, the fastest growing cities in terms of the number of millionaires are outside this country. The leader is Riyadh (Saudi Arabia), Sharjah and Dubai (UAE), Lusaka (Zambia) and Luanda (Angola). In the first half of 2022, their wealthy population increased by 20%. Henley & Partners attribute this to the active development of the oil and gas industry and the growth of stock markets in these countries.

At the same time, the number of rich residents in seven of the ten cities with the largest number of them has decreased. The increase was noted only in Singapore, San Francisco and Houston. At the same time, in New York in 2022, their number decreased by 12%, in Los Angeles – by 6%, in Chicago – by 4%, in London – by 9%. One of the reasons for this is the general decrease in wealth in the world, the report says.

Truskavets is a balneological resort, in the past a resort of all-Union significance. Located in the foothills of the Ukrainian Carpathians. This is an amazing land of pristine nature, picturesque mountain landscapes, lush forests, crystal clear air, rapid mountain streams, and mineral springs. This is a land of original culture and hospitable residents. Due to the absence of harmful industrial enterprises, this region is considered ecologically clean in Ukraine. It is here, on the shore of a picturesque lake, that the Hotel-resort complex “Karpaty” is located (previously, the Sanatorium “Karpaty”).

In the complex, you can choose one of the comfortable and modern rooms, which are equipped with everything necessary for a comfortable rest. From each room you can enjoy a picturesque view of the mountains or the lake.

One of the advantages of the complex is a powerful medical base. After all, most clients come precisely for the purpose of treatment. Modern medical technologies, innovative diagnostic equipment, specialists who manage to combine many years of experience in sanatorium-resort treatment and new methods in the world of medicine. You can undergo an examination, as well as procedures prescribed by a doctor, without leaving the “Karpaty” complex.

Now “Karpaty Hotel and Resort Complex” invites you to health and rehabilitation under the following programs:

– 20% for rehabilitation at the GKK “Karpaty”. “Psychological rehabilitation” program

Special price – UAH 1200/day.

The course of the program is 14 days

In the program:

● Diagnostic procedures (analyses, ECG)

● Consultation of specialized specialists (Therapist, ENT, neurologist, cardiologist, psychologist)

● Therapeutic and preventive procedures (massage, mineral baths, etc.)

● Treatment and preventive procedures “Yusla”

● Reception of mineral waters

– 30% for rehabilitation at the GKK “Karpaty”. “Post-traumatic rehabilitation” program

Special price – UAH 1200/day.

The course of the program is 14 days

In the program:

● Diagnostic procedures (analyses, ECG, radiography)

● Consultation of specialized specialists (Therapist, ENT, neurologist, cardiologist, orthopedic traumatologist)

● Therapeutic and preventive procedures (massage, mineral baths, etc.)

● Treatment and preventive procedures “Yusla”

● Reception of mineral waters

The main component of the treatment complex is sports and physical therapy. A swimming pool with a spa area, a gym, and an outdoor training ground are at the guests’ disposal. If necessary, the specialist will draw up a program of classes taking into account the specifics of the disease and your state of health. For children, classes in the pool with a trainer are provided.

Families with children come to “Karpaty Hotel and Resort Complex” Truskavets. In order for parents and children to rest and have interesting leisure time, the resort complex has developed a special program for young Ukrainians.

“Safe Carpathians for Children” program

Children’s age: 10-16 years.

Group – up to 20 people.

Arrivals – August 1; August 15

Special price – UAH 750/day.

Accommodation in double rooms.

A balanced diet and regimen will benefit any child. Favorite big games, themed parties, quests and master classes will be held in a safe place together with a friendly team of professionals from the Karpaty complex in Truskavets.

For the entire period of the shift (14 days), children are grouped into teams according to the floors of the residence. Quests and other activities involve uniting children in teams of different ages under the guidance of experienced teachers.

Children, accompanied by their parents, have the opportunity to visit the camp and live with their parents at a special price – 750 hryvnias.

The program includes:

● safe and comfortable accommodation;

● 4 meals a day;

● medical support and professional curators;

● master classes, entertainment events, contests, karateoke;

● classes in the pool (aqua aerobics);

● thematic games, sports competitions, classes in the pool;

● interesting excursion programs;

● free internet.

Modern man leads a very active and eventful lifestyle. Every day we are faced with stress, important matters and a lot of work. And, as always, everything must be done qualitatively and quickly. A wellness vacation will provide you with good health and a positive mood. And taking into account the state of war in Ukraine, which significantly affected the incomes of citizens, sanatorium “Karpaty” reduces prices by up to – 20% under the condition of booking a full package of services (accommodation, food and treatment) from 16 days. The promotion is valid from 09.06.2022.

Hotel and resort complex “Karpaty” Truskavets is an ideal choice for rest for adults and children in an atmosphere of fabulous nature and comfort.

You can get detailed information on the website of the “Karpaty Hotel and Resort Complex” or by calling: +38 (03247) 62 000, +38 (095) 27 62 000, +38 (067) 82 62 000

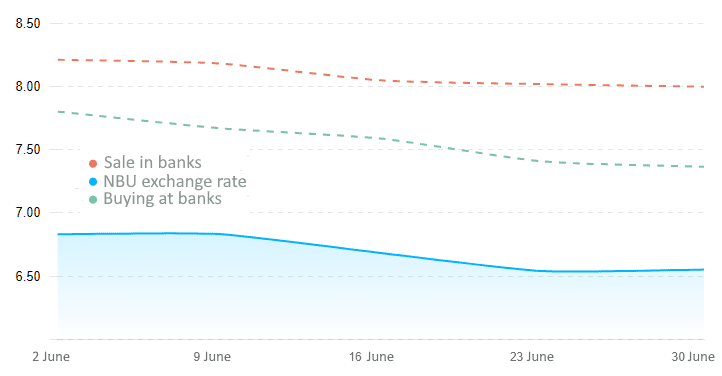

Quotes of interbank currency market of Ukraine (UAH for 1 PLN, in 01.06.2022-30.06.2022)

Ukraine allowed vaccination against COVID-19 for children from five years old.

As the chief sanitary doctor of Ukraine Igor Kuzin said at a briefing in Kyiv on Monday, vaccination of children from 12 years of age was allowed in Ukraine earlier.

Children aged 5 to 11 will be vaccinated with Pfizer’s Comirnaty vaccine. Now Ukraine is waiting for the appropriate vaccine in a special dosage for children.

Kuzin did not specify when this vaccine could be delivered to Ukraine.