In January-August 2022, Ukraine exported 265.5 thousand tons of poultry meat and offal, which is only 9.9% less than the figure for the same period in 2021, the Union of Poultry Breeders of Ukraine Association reported on the website.

At the same time, it is noted that in monetary terms, the export of these products for the specified period increased by 32.8% – up to $589.2 million. Such an increase in export earnings became possible due to an increase in prices in the traditional export markets of Ukrainian products, in particular the EU countries and the Middle East.

The largest importers of meat and edible poultry offal from Ukraine in August 2022 were Saudi Arabia (24%), the Netherlands (16%) and Slovakia (10%). According to the results of January-July, these countries became the largest consumers of Ukrainian poultry meat.

At the same time, the import of poultry meat to Ukraine for the same period amounted to 49.7 thousand tons, which is 36% less than for the same period in 2021. The entire volume came from EU countries, mainly from Poland.

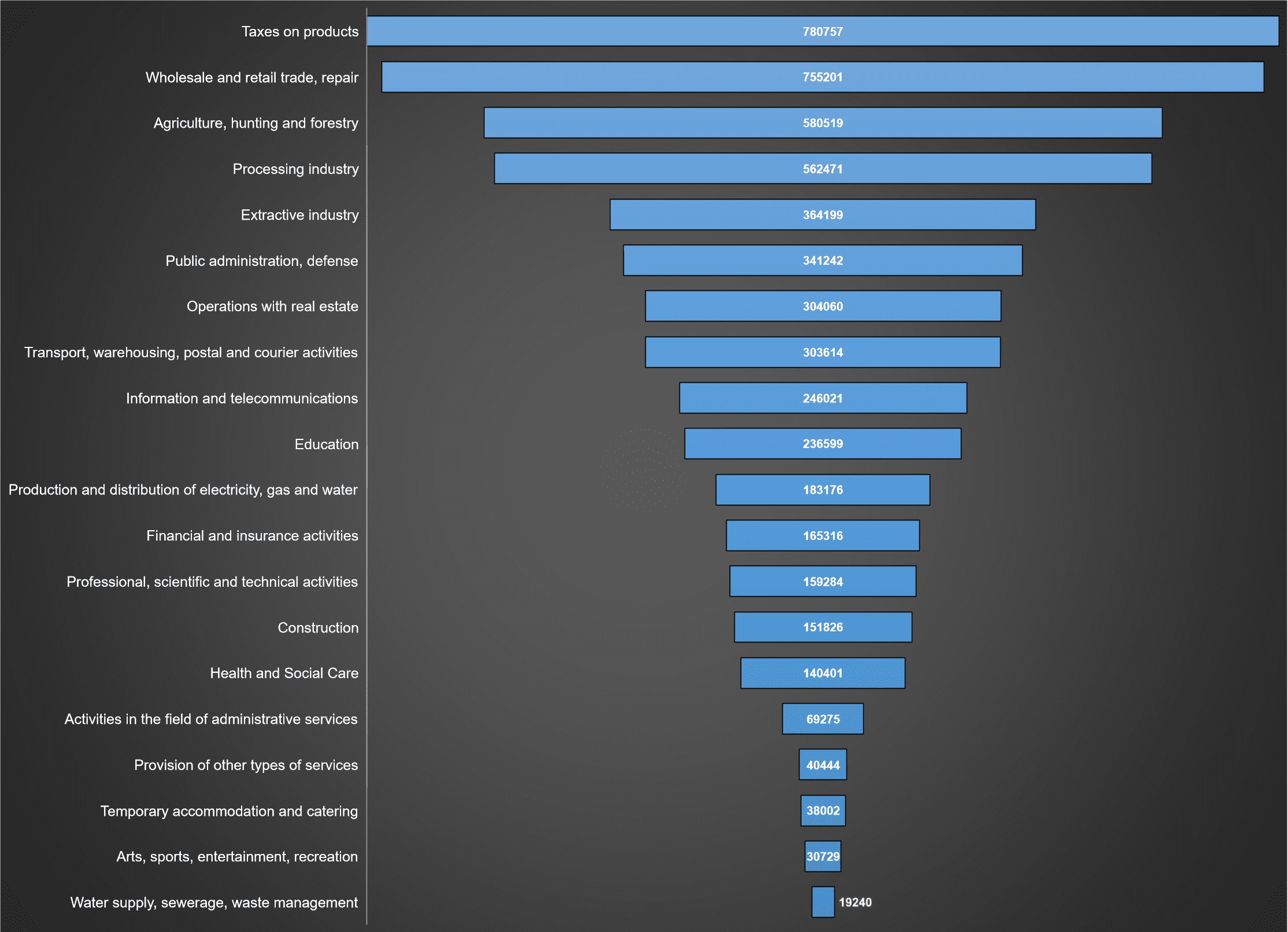

Structure of Ukraine’s GDP in 2021 (production method, graphically)

SSC of Ukraine

About 7,000 restaurants and cafes have closed in Ukraine since the start of the war, and more than 2,000 new establishments have opened, Olha Nasonova, co-founder of the National Restaurant Association of Ukraine, told Interfax-Ukraine.

“There are no exact statistics, because. it is simply not being carried out now, among these 7 thousand there are closed establishments and those about which there is no data (in the occupied territories, in shelling zones). The market shrank by about 25% compared to February 2022. In some regions, the market decline was more than 50% (Kharkiv, Mykolaiv, Zaporozhye, Lugansk regions), in Kyiv, Odessa, Dnepropetrovsk regions – a drop of up to 30%,” Nasonova said.

At the same time, according to her, positive dynamics is observed in the western regions. In Lviv and the region, the number of restaurants and cafes increased by approximately 30%, in the Transcarpathian, Chernivtsi, Ivano-Frankivsk regions, an increase of approximately 20% was noted.

“Bythe beginning of summer, the market decline was more significant. But since June, restaurants began to open in Kyiv, as well as in the western regions, in general, more than 2 thousand establishments. The restaurant market developed most intensively in Lviv – more than 500 new establishments in the region since the beginning of the war. Of all the cities in western Ukraine, Lviv is the most cosmopolitan and the busiest,” Nasonova said.

According to her, among the summer openings of Lviv were establishments of “promoted” chains: Bao Casual (owner Taras Seredyuk), “Ostannya Barrikada” (Dmitry Borisov), a number of franchising establishments.

At the same time, the expert noted that it is incorrect to talk about the “relocation” of restaurants. “In fact, truly displaced, i.e. those who transported equipment, furniture, etc., are few. More often the restaurant turned out to be simply destroyed, or in the occupied territory, and there was simply nothing to take out. Therefore, new restaurants were opened,” Nasonova said.

In her opinion, restaurant investors began to consider cities in Western Ukraine as more profitable for starting a new business. As for expansion abroad, there are still few such examples. “It is planned to open Chernomorka, institutions of Borisov, Sukhomlin. Countries – Poland and Germany, but more Poland. There are more Ukrainians there, and the mentality of the Poles is closer to ours,” the expert said.

Established in 2021, the National Restaurant Association of Ukraine (NRAU) for May 2022 unites more than 50 members, 450 restaurants and cafes.

Ukraine, in the context of a full-scale Russian military invasion in January-August 2022, exported 59.4 thousand tons of dairy products, which is comparable to last year.

As reported on the Facebook page of the association “Ukrainian Agrarian Business Club” (UCAB) on Monday, the supply of dairy products to foreign markets grew especially rapidly in August – up to 12.7 thousand tons, which is twice as high as in August 2021.

According to the UCAB, in August 2022, Ukraine exported 3.58 thousand tons of non-condensed milk and cream (a threefold increase compared to June), 3.26 thousand tons of condensed milk and cream (twice as much), 273 tons of butter dish (50% less), 2.53 thousand tons of whey (72% more), 2.14 thousand tons of butter (3.5 times more), 1 thousand tons of cheeses of all types (62% more more).

In addition, in the summer of 2022 (June-August), Ukraine exported 31.5 thousand tons of dairy products, which is 52% of actual exports for the eight months of this year, as well as 40% more than in the same period of 2021.

The largest importers of Ukrainian products for eight months of 2022 were Moldova – 4.4 thousand tons, Poland – 2.4 thousand tons, China – 900 tons.

As noted by UCAB, imports of dairy products to Ukraine are gradually declining. Thus, according to its data, 42.3 thousand tons were imported in eight months, which is 37% less than last year. In August, 5 thousand tons of dairy products were imported, of which the majority were cheeses of all kinds (3.1 thousand tons).

“In January-August, the foreign trade balance is passive and amounts to $2.3 million. If in September the export rates remain the same as in August, then the foreign trade balance may already be active and overall trade will be more positive for the industry,” – the association quotes the expert Maxim Gopka.

As reported, in May 2022, the Union of Dairy Enterprises of Ukraine association predicted that this year milk production would decrease by 13-16% – to 7.33-7.56 million tons from 8.73 million in 2021, the depth crisis in the industry will be determined by the development of hostilities.

It is expected that the average milk consumption in Ukraine per capita in 2022 will increase by 8% – from 212 kg in 2021 to 229 kg this year due to internal and external migration of the population.

The stock indices of the largest countries of the Asia-Pacific region (APR) are mostly down on trading on Wednesday, with the exception of the Chinese Shanghai Composite, which is growing slightly.

The Japanese Nikkei 225 fell by 0.76% by 8:24 Moscow time.

The leaders of the fall among the components of the index are the shares of the transport company Nippon Yusen K.K. (-7.3%), electronics manufacturer Sharp Corp. (-6.5%) and transport Mitsui O.S.K. Lines Ltd. (-6.1%).

Quotations of shares of the largest clothing retailer in Asia, Fast Retailing, grow by 0.5%, Nissan Motor Co. – by 2.3%.

China’s Shanghai Composite added 0.04% by 8:31 Moscow time, while Hong Kong’s Hang Seng fell by 1.74%.

China’s foreign trade surplus unexpectedly fell to $79.39 billion in August, a three-month low, according to data from the General Administration of Customs of the People’s Republic of China. A month earlier, the indicator reached a record $101.26 billion.

At the same time, analysts expected an average reduction in August to $92.7 billion, reports Trading Economics.

Exports reached $314.92 billion, which is 7.1% higher than in August last year. For the first time since April, growth rates are expressed in a single-digit number in percentage terms. Imports in August increased by 0.3% in annual terms – up to $235.53 billion.

Experts on average assumed an increase of exports by 12.8% per hour, imports – by 1.1%.

The leaders of the decline in Hong Kong are the shares of the Internet giant Baidu Inc. (SPB: BIDU) (-4.15%), Budweiser Brewing Co. APAC Ltd. (-3.7%) and Alibaba Health Information Technology Ltd. , which provides services for the collection and use of medical data, (-3.5%).

Shares of Tencent Holdings Ltd. fall by 2% on the news that the company acquired a minority stake in the holding company that controls the publisher of the popular video game “Assassin’s Creed” Ubisoft Entertainment SA.

The South Korean Kospi index fell by 1.5% by 8:29 Moscow time.

Shares of one of the world’s largest manufacturers of chips and consumer electronics, Samsung Electronics Co. fell in price by 1.9%, while Hyundai Motor – by 0.5%.

The Australian indicator S&P/ASX 200 has decreased by 1.4% since the opening of the market.

Australia’s GDP in the second quarter of 2022 increased by 0.9% compared to the previous quarter, according to official statistics. Growth was recorded for the third quarter in a row. Australia’s economy grew by 0.7% in the first quarter. Analysts on average expected GDP growth in the second quarter by 1%, according to Trading Economics.

The market value of the world’s largest mining companies BHP and Rio Tinto decreased by 2.1% and 1.5%, respectively.

The stock indices of most of the leading economies in Western Europe ended with moderate growth trading on Tuesday.

The composite index of the largest companies in the region Stoxx Europe 600 increased by 0.24% and amounted to 414.38 points.

The German DAX indicator increased by 0.87%, the French CAC 40 – by 0.19%, the British FTSE 100 – by 0.18%. The Italian FTSE MIB added less than 0.01%, while the Spanish IBEX 35 lost 0.26%.

This week, the most important event for traders will be the meeting of the European Central Bank (ECB), which will be held on Thursday. At a meeting in July, the European Central Bank raised rates for the first time in 11 years, by 50 bp at once. The market as a whole expects that at the forthcoming meeting the rise could be 75 bp at once.

Meanwhile, on Tuesday it became known that the volume of orders of industrial enterprises in Germany in July fell by 1.1% compared with the previous month. Analysts on average expected a decline of 0.5%, according to data from Trading Economics. In June, according to revised data, the indicator fell by 0.3%, and not by 0.4%, as previously reported.

Shares of Volkswagen AG rose 3.7%. The German carmaker has confirmed its intention to list the shares of luxury sports car manufacturer Porsche AG. The IPO could be the largest in German history and the largest in Europe since 1999, according to Refinitiv data.

Deutsche Lufthansa AG added 1.5%. The German airline will continue negotiations with the pilots’ union to avoid a strike that would lead to the cancellation of numerous flights.

Finnair Oyj’s share price rose 1.1%, although the Finnish carrier reduced the number of passengers carried in August by 12% compared to the previous month.

Among the gainers among the components of the Stoxx Europe 600 index were shares of the German food delivery service Delivery Hero SE, which added 7.7%.

Energy companies led the decline, including Equinor (-6.7%), Orron Energy (-6.3%) and Uniper SE (-5.7%).