The stock markets of the largest countries in the Asia-Pacific region are falling at the auction on Thursday on the continuing fears about the rise in interest rates by the central banks of the world.

Global equity markets have come under pressure this week following the annual economic symposium at Jackson Hole, during which Fed Chairman Jerome Powell and a number of European Central Bank officials called for – despite the risks of a recession – to raise rates to a level that will control inflation.

“At some point, central banks will realize that inflation remains high despite the increase in interest rates, and they will stop,” said Clifford Bennett, chief economist at ACY Securities.

The Hong Kong Hang Seng index fell by 1.7% by 08:20 Moscow time, the Chinese Shanghai Composite index by 0.1%.

Among the leaders of the decline in quotations on the Hong Kong Stock Exchange are shares of the Internet company Meituan (-5.2%), casino operator Sands China Ltd. (-5%), automaker BYD Co. Ltd. (-4.9%) and restaurant chain owner Haidilao International Holding Ltd. (-3.9%).

China’s manufacturing purchasing managers’ index (PMI) fell to 49.5 in August from 50.4 in the previous month, according to data from Caixin Media Co. and S&P Global, which calculate the value of the indicator.

A PMI value above 50 points indicates an increase in activity in the sector, below – its weakening. Analysts had expected a less significant fall, on average, to 50.2 points, according to a Trading Economics poll.

Meanwhile, Caixin and S&P Global’s reading came close to the official manufacturing PMI estimate of 49.4 released by China’s National Bureau of Statistics a day earlier.

The value of the Japanese Nikkei 225 index decreased by 1.6% by 8:30 Moscow time.

Among the components of the index, shares of the chemical Unitika Ltd. are the most actively depreciating. (-4.6%), trading Marubeni Corp. (-4%) and engineering Denso Corp. (-3.9%).

Papers of the media company Kadokawa Corp. rise by 5% on the news that its IT division – FromSoftware Inc. – invested in Sony Group Corp. and Tencent Holdings Ltd.

The South Korean index Kospi by 8:35 Moscow time fell by 1.8%.

Shares of one of the world’s largest manufacturers of chips and consumer electronics Samsung Electronics Co. cheaper by 2%, automaker Kia Corp. – by 0.3%.

The South Korean economy in the second quarter of 2022 grew by 2.9% compared to the same period last year, showed the final data of the Bank of Korea. Compared to the first quarter of 2022, the country’s GDP increased by 0.7%.

Both estimates coincided with preliminary data.

The Australian S&P/ASX 200 fell 1.7%.

The market value of the world’s largest mining companies BHP and Rio Tinto falls by 1% and 1.3% respectively.

Insurance companies of Ukraine in January-June 2022 collected net premiums in the amount of UAH 17.721 billion (which is 24.6% less than in the same period in 2021 (UAH 23.480 billion), according to the main performance indicators of insurance companies companies (by institutions) for the first half of 2022, published on the website of the National Bank of Ukraine (NBU).

According to the regulator, the volume of written insurance premiums collected by insurers for the specified period amounted to UAH 17.608 billion, which is 28.9% less compared to the first half of 2021 (UAH 24.780 billion).

In six months, insurers paid UAH 5.934 billion of insurance claims (which is 30.6% less than in the first half of a year earlier (UAH 8.552 billion).

As of June 30, 2022, the assets of Ukrainian insurers on the balance sheet amounted to UAH 65.474 billion, while as of the same date a year earlier – UAH 65.186 billion

The regulator also reports that in the first half of the year the volume of formed insurance reserves increased by 4% – up to UAH 36.438 billion.

According to the NBU, the total number of insurance companies in Ukraine as of June 30, 2022 is 137, while as of the same date a year earlier it was 181.

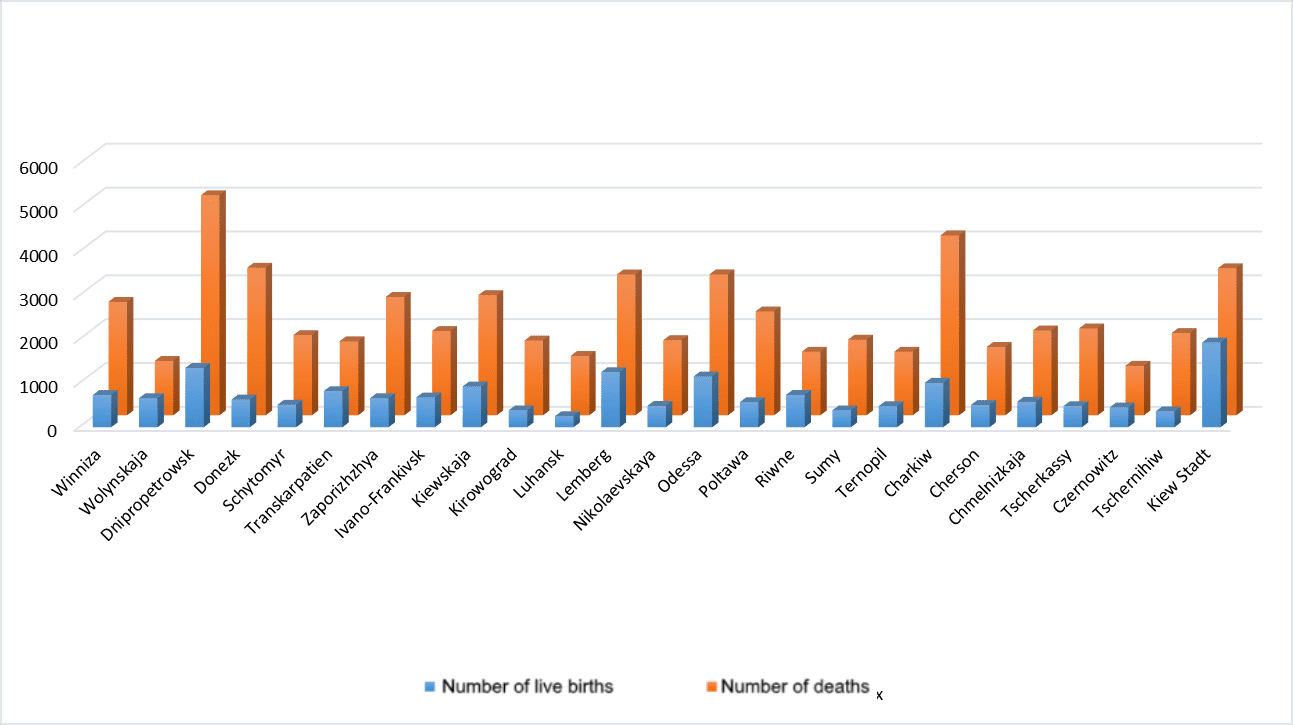

Ratio of fertility and mortality by region in Jan 2022

SSC of Ukraine

Oil prices ended August with a decline and continued to fall on the first day of September.

At the end of last month, Brent fell by 12.3%, WTI – by 9.2%, and negative dynamics were noted for the third month in a row, which is the longest such period since the first half of 2020.

The price of November Brent futures on the London exchange ICE Futures at 8:10 Moscow time on Thursday is $95.18 per barrel, which is $0.46 (0.48) below the closing price of the previous session. According to the results of trading on Wednesday, these contracts fell in price by $2.2 (2.3%), to $95.64 per barrel.

The price of WTI oil futures for October on the electronic trading of the New York Mercantile Exchange (NYMEX) is currently $89.08 per barrel, which is $0.47 (0.52%) lower than the final value of the previous session. By the close of the market the day before, the value of these contracts decreased by $2.09 (2.3%), to $89.55 per barrel.

Pressure on the market is caused by fears of a downturn in the world economy against the background of tightening of monetary policy by the world’s largest central banks, as well as coronavirus restrictions in effect in China, according to the Bloomberg agency.

“Concerns about the state of the economy are a key reason for the decline in the oil market,” said WTRG Economics energy markets analyst James Williams, quoted by Market Watch.

“OPEC expresses concerns about demand prospects, and sometimes representatives of the cartel raise the question of reducing quotas. The possibility of a recession now occupies an important place in OPEC’s thinking,” the expert notes.

Ukraine will need disposable and mobile granaries with a total capacity of up to 20 million tons for the storage of crops this season, thanks to public-private partnerships, the necessary equipment has already been contracted.

However, Ukraine’s purchases of alternative granaries have depleted their stocks on the world market, Mykola Solsky, Minister of Agrarian Policy and Food, said on Wednesday.

“Ukraine may have taken away all disposable crop storage systems that are now available on the world market, they mainly go to Ukraine. Therefore, the Ukrainian market and the state have secured themselves, and I hope that there will be no particular problems with crop storage,” he said. Solsky during the All-Ukrainian telethon.

At the same time, most of the funds for storing the harvest were purchased by Ukrainian agribusiness privately.

“Judging by our monitoring of the market and communication with its participants, 15-19 million tons of one-time storage was contracted by the business, and with the help of international funds and through the UN FAO, a tender was purchased and held this month at the initiative of the Ministry of Agro-Industrial Complex for about 6 million tons of one-time storage,” the minister said.

According to him, the day before, a separate tender was held from the United States Agency for International Development (USAID) for the purchase of mobile silos for Ukraine to store more than 1 million tons of crops, as well as equipment for loading and unloading them.

As reported, on August 15, 2022, President of Ukraine Volodymyr Zelensky signed bill No. 7548-1 on exemption from taxation of import duties on goods used for the storage of grains and oilseeds.

The import of mobile granaries will make it possible to save the harvest of this season, since in the conditions of the military invasion of the Russian Federation, by the end of 2022, a deficit of 10-15 million tons of elevator capacities is expected in Ukraine.

In mid-June, the Ministry of Agrarian Policy announced that Ukraine would soon receive the first batch of sleeves for temporary storage of crops – mobile granaries, the need for which arose due to a shortage of elevator capacities.

To address this issue, the agency turned to the governments of the United States, Canada, the UK and the EU.

As of the end of August 2022, Ukraine has accumulated 13 billion cubic meters of gas in its underground storage facilities (UGS). m of natural gas, said the head of the GTS Operator of Ukraine Serhiy Makogon in an interview with Interfax-Ukraine.

“Now there are 13 billion cubic meters of gas in underground storage facilities. By October 15, according to forecast calculations, there will be about 14.4 billion cubic meters of gas. With such reserves, it is realistic to get through a mild winter, since today gas consumption has significantly decreased,” he said.

At the same time, the head of the operator noted, the military threat factor increases the risks of a stable heating season, so additional imports would be appropriate.

“As a GTS operator, we can assure that the transport routes for receiving gas from Poland, Slovakia and Hungary are ready to import in the amount of 54 million cubic meters per day. We hope that colleagues from Naftogaz will be able to take advantage of these opportunities to purchase gas,” Makogon said. .

As reported, as of the end of July, gas reserves in Ukraine’s UGS facilities reached 12 billion cubic meters. m.