The UK will provide Ukraine with another £300m ($375m) in military aid to support Ukraine’s ongoing defense against Russia’s illegal incursion.

Prime Minister Boris Johnson will present this new aid package during his speech to the Verkhovna Rada by video link, the office of the head of the British government announced.

The new batch of aid will include electronic warfare equipment, a counter-battery radar system, night vision devices and satellite navigation jamming equipment. London will also supply heavy drones to support isolated forces and more than a dozen new specialized Toyota Land Cruisers to protect civilians in eastern Ukraine and evacuate civilians from frontline areas.

The prime minister is expected to say that this is Ukraine’s “finest hour” and the UK is “proud to be among its friends.”

“This is Ukraine’s finest hour, an epic chapter in your national history that future generations will remember and tell. Your children and grandchildren will say that Ukrainians have taught the world that the brute force of an aggressor means nothing against the moral strength of a people who have decided to be free,” quotes the premier’s office as saying his planned speech.

Johnson is expected to note that when the UK faced the threat of invasion during the Second World War, its Parliament, like the Verkhovna Rada, continued to meet throughout the conflict, and the British people showed such unity and determination that the country is remembering the time of the greatest danger as her finest hour.

It is indicated that this will be the first speech of a world leader in the Supreme Rage since the beginning of the war.

Britain has previously delivered more than 5,000 anti-tank missiles and five air defense systems to Ukraine worth £200m.

Darnitsa pharmaceutical company (Kyiv), within the framework of cooperation with the Ministry of Health of Ukraine and the National Security and Defense Council, has registered and produced the drug Potassium Iodide-125-Darnitsa, designed to protect people from radiation, Dmytro Shymkiv, the chairman of the board of directors of Darnitsa Group, wrote about this on Facebook.

He said that the drug was created in accordance with the regulations for iodine prophylaxis in the event of a radiation accident.

In addition, Shymkiv said that last week Darnitsa donated 525,000 packages (5.25 million tablets) from the first batch of Potassium Iodide-125-Darnitsa to the public health center of the Ministry of Health for free. This will make it possible to carry out iodine prophylaxis if necessary for more than 5 million people.

Potassium iodide is used to protect the thyroid from radiation buildup. The risk of radiation damage to the thyroid gland can be reduced or even leveled with the timely appointment of iodine prophylaxis. The optimal effect of iodine prophylaxis is achieved with preventive intake of potassium iodide for 6 hours or less, as well as simultaneously with the intake of radioactive isotopes of iodine or entering the contaminated zone.

British Prime Minister Boris Johnson in an address to the Verkhovna Rada announced the provision of assistance to Kyiv for GBP 300 million, MPs say.

“Boris Johnson appealed to the Verkhovna Rada. Volodymyr Zelensky answered him and spoke to the Verkhovna Rada for the first time since the beginning of the war,” Oleksiy Honcharenko, a deputy of the European Solidarity faction, wrote in his Telegram channel, noting that Johnson announced a new military aid package, including missiles and counter-battery radars.

In turn, a member of the Holos faction, Yaroslav Zhelezniak, specified that Johnson announced the provision of new weapons and protective equipment for GBP300 million, including “radar for anti-artillery.”

Earlier, the office of the British prime minister reported that London intends to provide Ukraine with military assistance for another GBP300 million ($375 million).

About 70% of patients with orphan diseases remain at home, despite Russia’s war against Ukraine, the press service of the State Enterprise “Medical Procurement of Ukraine” reports on Tuesday.

State Enterprise “Medical Procurement of Ukraine” coordinates with organizations representing patients with orphan diseases to ensure their access to medicines.

As reported, Airbnb provides patients with rare (orphan) diseases leaving Ukraine with free housing for a period of a month. The project is part of a partnership with Airbnb, which runs a larger Airbnb.org program to provide housing for 100,000 refugees leaving Ukraine.

According to unofficial data and feedback from patient organizations, the majority of people with rare diseases remained in Ukraine, as they need additional support to leave the country.

In Ukraine, there are about 2 million people living with rare diseases (such as spinal muscular atrophy).

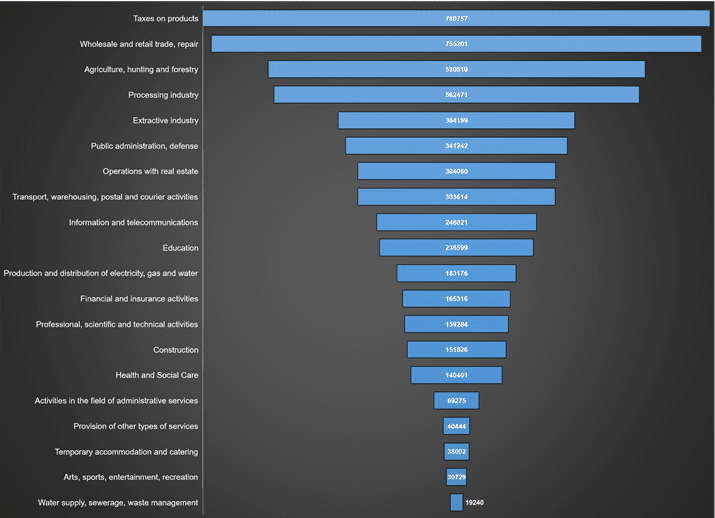

Structure of ukraine’s gdp in 2021 (production method, graphically)

SSC of Ukraine

German Chancellor Olaf Scholz says that Germany supports Ukraine and “acts decisively.”

“Our goal must be that Ukraine can defend its sovereignty, its freedom and its democracy. We support them in this. We are acting prudently and adapting to the current situation. And we are acting decisively,” he tweeted.

As reported, Finance Minister Serhiy Marchenko said last week that preparations had recently begun for the next EUR150 million loan from Germany, which will help support Ukraine’s macro-financial stability.

According to him, only in the second half of April, Germany received a EUR150 million loan to support small and medium-sized businesses, an agreement on which was reached back in March 2020.

“Minister Christian Lindner also noted that they are considering providing us with military support in the amount of EUR1 billion, but we expected from Germany no less financial support than that provided by the UK, Canada or the United States,” Marchenko said.