The Credit Institution for Recovery (KfW) transferred EUR 150 million to the state budget of Ukraine on Friday for a 15-year loan with a five-year grace period, the Finance Ministry said.

“Today, another loan from the Credit Institution for Recovery (KfW) in the amount of EUR 150 million was transferred to the state budget of Ukraine. These loan funds were provided as co-financing of the Additional Financing of the Development Policy Loan in the Conditions of Emergency Economic Situation of the International Bank for Reconstruction and Development,” — The Finance Ministry announced on its website on Friday.

The funds raised will be directed to social spending and spending in education and health, the ministry said.

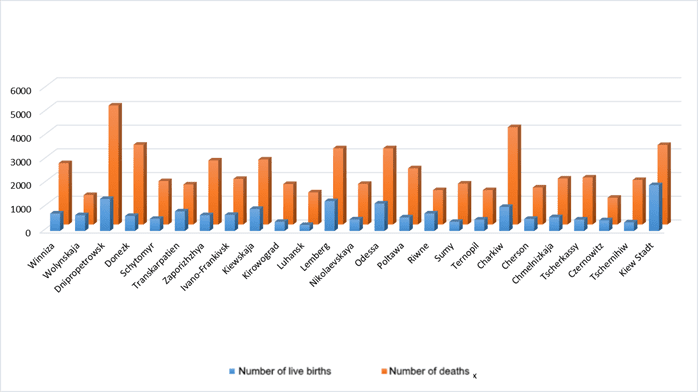

Ratio of fertility and mortality by region in Jan 2022

SSC of Ukraine

Chairman of the Servant of the People faction David Arakhamia announced the preparation of a program to reduce government spending on the bureaucracy.

“We are now preparing an extensive program to reduce government spending on apparatuses, on bureaucracy. Everyone has been talking about this for 30 years. Now the war will eventually force everyone to do this. And this, it seems to me, is a unique chance for the country to increase the efficiency of the state during martial law. And then go out with the same mood after the victory. So that it is no longer a burden, but, in fact, a driver for the growth of the state and the economy,” the Verkhovna Rada telegram channel quotes Arakhamia as saying on Saturday.

Regulation of the European Parliament and Council No. 2022/870 on temporary trade liberalization measures, exempting Ukrainian exports from duties for a year, came into force on Saturday, the Ministry of Economy reported.

“This decision complements the opportunities that our exporters have in accordance with the Association Agreement between Ukraine and the EU. Now the tariffs prescribed in the Agreement will be temporarily suspended,” the agency said.

It clarified that these were duties for industrial products; suspension of the application of the entry price system for fruits and vegetables and all tariff quotas for agricultural products; and the suspension of anti-dumping duties on imports of goods originating from Ukraine and the application of global safeguard measures in relation to Ukrainian goods.

In turn, the liberalization of trade relations implies that Ukraine will comply with European rules: the origin of goods and related procedures under the Association Agreement; refraining from any new restrictions on imports from the EU; Ukraine’s respect for democratic principles, human rights and fundamental freedoms, the rule of law, and the fight against corruption.

“These new rules will be in effect for a year and will help Ukrainian producers and exporters withstand the pressure of the war and strengthen their positions in the European market,” the Ministry of Economy stressed.

It indicated that the EU is now Ukraine’s largest trading partner. In 2021, the European Union accounted for 39% of the total trade volume of our state. The volume of trade increased by 35% and amounted to $62.5 billion.

Ukraine exports to the European Union, primarily ferrous metals, ores, electrical machines, oil and grain. “We expect that trade liberalization will help our exporters strengthen their positions in these and other commodity niches,” the Ministry of Economy added.

The number of refugees from Ukraine registered for temporary protection or similar national protection schemes in Europe stood at 2.93 million as of the end of May 2022, the Office of the United Nations High Commissioner for Refugees (UNHCR) said in its site.

According to his data collected from national governments, Poland has the most refugees with this status – 1 million 142.96 thousand, while 3.792 million people arrived in the country from Ukraine, according to the Polish border service, from the beginning of the war to June 2 , and in the opposite direction departed to Ukraine 1.795 million.

Following are the Czech Republic and Germany, where the number of refugees registered for temporary protection from Ukraine amounted to 361.42 thousand and 329.34 thousand, respectively.

The UN, referring to government data, indicates that in total in Germany, where Ukrainians are allowed to stay without registration until the end of August, 780,000 refugees from Ukraine were recorded. So, based on the data presented, less than half of them applied for temporary protection status in this country.

In the Czech Republic, the situation, according to UN information, is different: almost all arrivals applied for protection status – 361.42 thousand out of 361.56 thousand.

In the vast majority of other countries, the picture is similar to the Czech Republic: the statistics of registered refugees is completely or almost equal to the statistics of those who applied for protection status, which is probably due to the peculiarity of their registration. An exception, similar to Germany, is only Romania – 33.22 thousand with the status of 84.47 thousand refugees registered in the country, Estonia – 25.69 thousand out of 39.8 thousand and Italy – 97.31 thousand out of 125 .91 thousand

In addition to Poland, the Czech Republic, Germany and Italy, more than 50 thousand refugees from Ukraine have also registered for temporary protection status in Spain – 109.47 thousand, Slovakia – 78.57 thousand (out of 270 thousand net inflows across the border since the beginning of the war) , Austria – 68.75 thousand, the Netherlands – 60.02 thousand, Lithuania – 53.89 thousand and Switzerland – 50.1 thousand.

Following are Belgium – 44.65 thousand, France – 43.3 thousand, Portugal – 39.79 thousand, Sweden – 38 thousand, Great Britain – 37.4 thousand, Ireland – 32.42 thousand and Denmark – 27.21 thousand, as well as the above-mentioned Romania and Estonia.

From 10 to 25 thousand refugees from Ukraine with the status of temporary protection in Finland – 24.46 thousand, Latvia – 23.38 thousand, Hungary – 23.35 thousand, Norway – 16.71 thousand, Greece – 13, 4 thousand, Croatia – 13.37 thousand and Cyprus – 11.98 thousand.

In addition, in the UN statistics on those who received the status of temporary protection, Ukrainian refugees are represented in Slovenia – 6.94 thousand, Luxembourg – 5.4 thousand, Montenegro – 2.53 thousand, Iceland – 1 thousand, in Malta – 0.92 thousand, in Serbia and Kosovo – 0.62 thousand and Liechtenstein – 0.19 thousand.

In addition, the table contains data from Bulgaria, possibly entered with an error: according to them, 78.71 thousand refugees from Ukraine were recorded there, but 110.62 thousand received protection status.

The UN also indicated the countries in which refugees from Ukraine were recorded, but there is no data on their obtaining status: Moldova – 87.72 thousand, Turkey – 85 thousand, Georgia – 19.69 thousand, Azerbaijan – 5.06 thousand. , Albania – 1.34 thousand, North Macedonia – 1.13 thousand, Bosnia and Herzegovina – 0.36 thousand and Armenia – 0.3 thousand.

Separately, it is worth mentioning Russia and Belarus, the Ukrainian border with which was crossed by 1 million 41.1 thousand and 16.65 thousand people, respectively. The UN information indicates that in the Russian Federation all those who crossed the border were recorded, while in Belarus – less than half. There is no data on any status of these people, as well as data on crossing the border of Ukraine in the opposite direction.

In total, according to the UN, 6.98 million people have left Ukraine since the beginning of the war, while, according to the State Border Service of Ukraine, about 2.5 million have returned. According to this information, the net outflow since the beginning of the war can be estimated at about 4.5 million people, including to Russia – more than 1 million people.

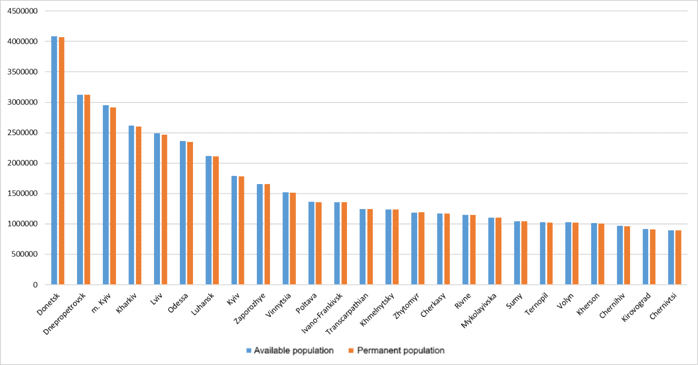

Ukrainian population by regions as of Feb 1, 2022 (graphically)

SSC of Ukraine