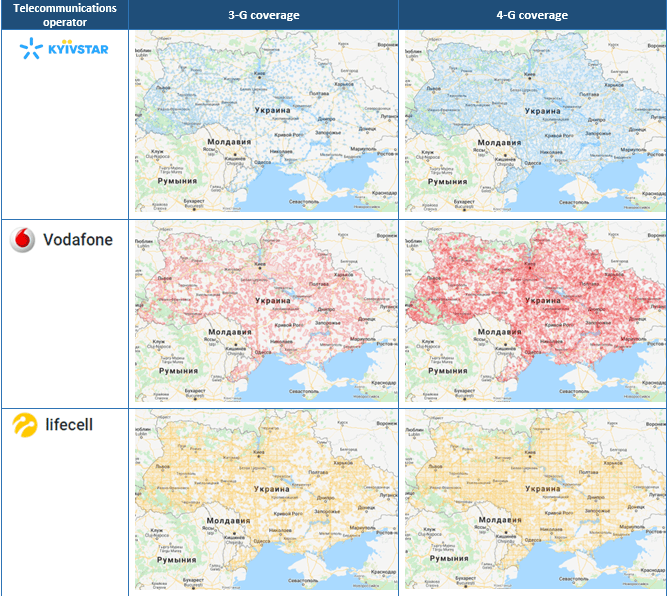

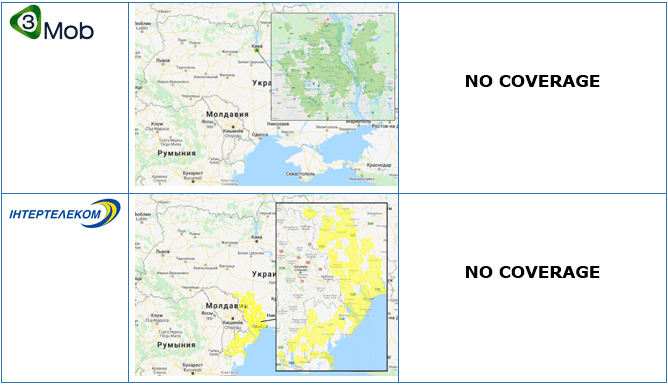

Map of internet coverings of ukrainian basic mobile operators in January 2022

The Ukrainian national team won 11 gold, 18 silver and 19 bronze medals at the 2022 World Gymnasium in France, according to the Ministry of Education and Science.

According to the press service of the ministry, the Ukrainian team was represented by 93 students aged 16 to 18.

“During the competition, the Ukrainian team won 11 gold, 18 silver and 19 bronze medals, thanks to which our athletes are among the top ten among 63 countries. For the state to participate in such priority international competitions is a great honor, pride and responsibility,” said. Ministry of Education.

It is noted that the national team of Ukraine competed in the following sports: badminton, 3×3 basketball, boxing, wrestling, Greco-Roman wrestling, beach volleyball, gymnastics, judo, athletics, swimming, orienteering, breaking, table tennis, taekwondo, taekwondo 7, archery and fencing.

Polish President Andrzej Duda will address the Verkhovna Rada of Ukraine on Sunday, the press service of the Polish head of state reports.

“President Andrzej Duda is in Ukraine. On Sunday, in the Verkhovna Rada in Kyiv, the President of the Republic of Poland will deliver a message as the first foreign head of state since the beginning of the war,” the Polish president’s website said in a statement.

Deputy Prime Minister and Minister of Finance of Canada Christia Freeland at a meeting of G7 finance ministers and central bankers in Germany on May 20 announced an additional loan of CAD250 million ($ 195 million) to Ukraine through an account managed by the International Monetary Fund (IMF) Of Ukraine.

“We will continue to work to hold Putin and his henchmen accountable for their illicit war and to ensure that Ukraine has the resources it needs to win. This new loan is an important contribution to these important efforts,” the statement said. website of the Government of Canada word Freeland.

According to him, together with previous financial support, this loan brings Canada’s financial obligations to Ukraine to CAD1.87 billion this year. This funding is provided separately and in addition to substantial military assistance, humanitarian assistance and immigration efforts, the release said.

Canada has previously pledged up to CAD1 billion for an IMF-managed account for Ukraine in the 2022 budget in addition to CAD 620 million in bilateral loans earlier this year.

Since February 2022, Canada has also provided military assistance to Ukraine in the amount of more than CAD620 million.

Portugal will provide Ukraine with up to 250 million euros in financial support. The corresponding memorandum was signed on Saturday in Kyiv by the Prime Minister of Ukraine Denis Shmygal and the Prime Minister of Portugal Antonio Costa.

“Ukraine should receive the first tranche of up to 100 million euros this year. This will help Ukraine maintain macroeconomic stability during the war and allow it to recover soon after our victory. Thank you Portugal for this support!” Shmygal wrote in a telegram channel.

22 million tons of food have been blocked in Ukrainian ports, Ukrainian President Volodymyr Zelensky said in Kyiv on Saturday after meeting with Portuguese Prime Minister Antonio Costa.

“Russia has blocked all maritime opportunities to export food products – our grain, barley, sunflower. 22 million tons have been blocked by the Russian Federation, “he said.

“And, to be honest, they are stealing slowly. Grain is taken out of ports and somewhere. We know what “somewhere” is, “Zelensky said.

According to him, Ukraine “works at the level of the Ministry of Foreign Affairs. At the level of conscience, it is impossible to work with these countries, so we work differently. ”

Zelensky noted that “it can be unblocked in different ways. One of them is military. That is why we are asking our partners for such requests for appropriate weapons, and Portugal is no exception. “