The state-owned enterprise Skhidny Mining and Processing Plant in 2021 reduced the production of uranium oxide concentrate (UOC) by 38.9% (by 289.07 tonnes) compared to 2020, to 454.63 tonnes.

According to the company’s data on the unified public portal of open data, 32.17 tonnes of UOC were produced in January, 31.37 tonnes in February, 49.8 tonnes in March, 37.8 tonnes in April, and 41.57 tonnes in May, 35.1 tonnes in in June, 52.3 tonnes in July, nothing in August, 60.14 tonnes in September, 33.28 tonnes in October, 18.1 tonnes in November, 63 tonnes in December.

In addition, in January 2022, the production of uranium concentrate by the enterprise amounted to 24.6 tonnes.

Skhidny Mining is the only enterprise in Ukraine and the largest enterprise in Europe for the extraction and processing of uranium ore. The annual demand of Ukrainian NPPs for uranium concentrate is about 22,400 tonnes.

Ukraine is already at the peak of the current wave of coronavirus (COVID-19) disease, Minister of Health of Ukraine Viktor Liashko has said at a briefing on air of the Rada TV channel.

“We already have the peak incidence, because we record 41,000 cases a day,” the minister said.

He also added that during this COVID-19 wave, the number of cases is growing, but not the number of hospitalizations, which in turn reduces a burden on hospital care.

At the same time, according to Liashko, there is a large burden on primary medical care, so the Ministry of Health has taken management decisions that should reduce a burden on family doctors. The latest of these solutions is the introduction of remote calling in sick.

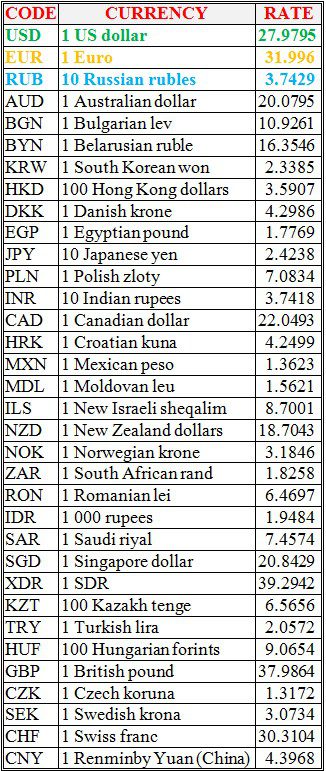

National bank of Ukraine’s official rates as of 10/02/22

Source: National Bank of Ukraine

The growth of consumer prices in Ukraine in January 2022 accelerated to 1.3% from 0.6% in December and 0.8% in November 2021, the State Statistics Service reported.

At the same time, in January last year, it also amounted to 1.3%, so in annual terms, inflation remained at 10%, the agency said.

Underlying inflation fell to 0.1% last month from 0.4% in December and 0.8% in November. Taking into account 0.3% in January 2021, in annual terms underlying inflation decreased to 7.6% from 7.9% in the last year.

According to the State Statistics Service, in the consumer market in January 2022 compared to December 2021, prices for food and non-alcoholic beverages increased by 2.5%. Vegetables went up in price by 20.5%, prices for eggs, fruits, bread, milk and dairy products, meat and meat products, rice, lard, butter increased by 3.9-1%. Sugar and sunflower oil fell in price by 0.8% and 0.5%, respectively.

Prices for clothes and footwear fell by 5.7%, including footwear – by 6.1%, clothing – by 5.4%.

The increase in tariffs for housing, water, electricity, gas and other fuels by 0.7% was mainly due to an increase in sewerage tariffs by 14.9%, water supply – by 12%.

Last month, transport prices increased by 1.3%, primarily due to a 2.9% increase in the cost of travel in railway passenger transport, and a 2.6% increase in fuel and lubricating oils.

In the telecommunications sector, prices increased by 1.1%, which is associated with an increase in tariffs for local telephone communications by 13.6%.

The increase in the cost of education services by 1.6% was mainly due to the increase in fees for the maintenance of children in preschool institutions by 23.3%.

As reported, in 2021 inflation in Ukraine rose to 10% from 5% in 2020 and 4.1% in 2019, while underlying inflation rose to 7.9% against 4.5% a year earlier.