The average daily spending of foreign tourists in Ukraine in 2021 is fixed at $929, the average visit time is 7-9 days, the State Agency of Ukraine for Tourism Development told Interfax-Ukraine.

According to the agency study, among travelers, citizens of the United Arab Emirates had the highest average daily expenses, spending $2,220 daily. Citizens of Saudi Arabia and Oman spent $1,500 daily, Canada – $1,250 daily, the United States – $1,125.

“Last year, despite the pandemic, much more tourists came to Ukraine than in pre-COVID times. In terms of such indicators as the tourist tax for the nine months of 2021, we saw an increase of 20% compared to 2019. This became possible due to the fact that new tourism markets have opened up for us – the UAE and Saudi Arabia. The forecast for 2022 is even more positive. We expect repeated and first visits of tourists from countries that showed interest in 2021. New countries will join them,” head of the agency Maryana Oleskiv said.

According to her, in general, over 4 million foreigners visited Ukraine in 2021, which is almost 26% higher than in 2020.

The main purpose of visits by foreigners last year was vacation, leisure and recreation (29.5%). Some 25.9% of respondents came on a business trip, 22.4% of respondents visited relatives and friends, 11.7% of foreigners came for treatment and rehabilitation, only 4% for shopping. Another 1.2% of travelers visited Ukraine in search of their own roots.

At the same time, 36.5% of foreigners traveled in Ukraine with their families, 35.4% – alone, 21.8% of travelers – with friends. Some 5.1% and 1.2% of foreign tourists traveled with colleagues or as part of tourist groups, respectively.

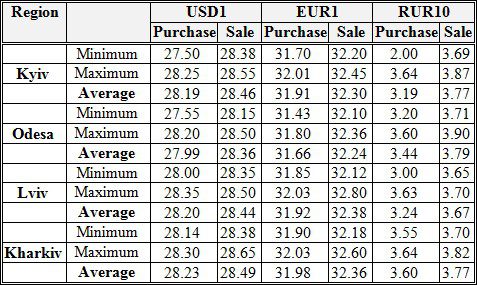

Ukrainian banks’ cash exchange rates on 20/01/22.

Source: Interfax-Ukraine

IT company IdeaSoft, part of Swedish-Ukrainian Sigma Software Group, has announced the acquisition of Kharkiv-based software and gaming technology company PULS Software.

According to the Sigma Software Group’s website post, PULS Software has already changed its name to Eventyr, while retaining its structure and leadership team after the merger.

The transaction took place on January 20, 2022. It is expected to accelerate both companies’ growth, business and management capabilities, and strengthen entire Sigma Software Group by adding new domains to business offerings for existing and new customers.

The amount of the transaction is not disclosed.

One of the main business vectors will focus on the Web 3.0, NFT games and Metaverse vectors, as well as expansion into the large corporate IT sector.

IdeaSoft CEO Andriy Lazorenko emphasizes that the main reason for this collaboration is the strong management team at Eventyr.

“We will assist them to grow and launch new business verticals. The merger allows us to explore deeper to the NFT gametech domains utilizing Ideasoft and Eventyr [ex. PULS Software] key expertise. That perfectly lines up with the current market growth,” Lazorenko said.

Eventyr is a fast growing company with extensive experience in mobile app development, AR/VR and games. It was founded in 2017 by Danylo Slupsky and Oleh Voitenko joined in 2020 as COO. Currently, Eventyr brings together 70 professionals and has more than 200 projects.

Earlier, in December 2021, Sigma Software, Ideasoft and Datrics created a new venture fund in Ukraine called SID Venture Partners with a $15 million trust fund.

The fund will focus on financing at early stages (pre-seed, seed, Series A) of projects with Ukrainian founders in deeptech, b2b, blockchain, fintech and automotive industries. Entrepreneurs from Clean.io (cybersecurity solutions) and NEAR (a $6 billion blockchain project), as well as other representatives of the IT market, will also be involved in scaling portfolio companies.

The Moldovan parliament has declared a 60-day state of emergency over the gas crisis.

The decision has been made at the government’s proposal, an Interfax correspondent said in a report. It was supported by 58 deputies from the ruling Party of Action and Solidarity (out of 101 parliament members).

The opposition denied support to the government proposal.

Budhouse Group’s shopping centers were visited by 28.6 million people in 2021, which is 50% more than in 2020, the developer’s press service reported.

Such a significant increase is explained, first of all, by the opening of Kharkiv shopping center Nikolsky in May 2021. If we compare the attendance of other operating shopping centers, then there is also a gradual recovery of traffic after a fall in 2020 – a 13.1% increase. But none of the company’s shopping centers has yet reached the level of 2019, which is explained by quarantine restrictions, which also took place in 2021.

On average, as reported by the press service, there were 552 visitors per 1,000 square meters of the mall area. According to the company’s research, on average, visitors visit Budhouse Group’s shopping centers seven times a month and spend 73 minutes in them per visit. This is about the same as in 2020, and 16% less than in 2019, due to the restriction of the entertainment and catering sector.

The total turnover of Budhouse Group’s shopping centers in 2021, taking into account the new Nikolsky shopping and entertainment center, amounted to about UAH 10.4 billion. The turnover of Budhouse Group’s shopping centers in hryvnia equivalent in 2021 increased by 22% compared to 2020 and by 13% compared to 2019. In euros/dollars, the turnover of the company’s facilities reached the level of 2019 and even slightly exceeded it. The largest growth in turnover was observed in the Forum Lviv shopping center (27%).

The average vacancy in Budhouse Group’s shopping centers in 2021 was about 0.8% (0.6% in 2020). The minimum vacancy was recorded in the Forum Lviv shopping center and the Lubava shopping center (0.4-0.5%).

The rotation of tenants has decreased compared to 2020. In just a year, 19 new lease agreements with a total area of 3,600 square meters were signed in the existing shopping centers. For comparison: in 2020, some 30 new contracts were signed for a total area of more than 6,500 square meters.

Budhouse Group is a full cycle company engaged in investment, development and management of sustainable real estate assets. Since 2009, the company has opened four shopping centers: Fabrika shopping center (Kherson), Lubava shopping center (Cherkasy), Forum shopping center (Lviv), Nikolsky shopping center (Kharkiv) and Khortitsa Palace hotel (Zaporizhia). There are two projects at the implementation stage – Yessa shopping center (Odesa) and Khortitsa Mall shopping center (Zaporizhia).

State-owned Ukrgasbank (Kyiv) issued mortgage loans totaling UAH 1.25 billion, which is 3.1 times more than in 2020 (UAH 401.8 million), the bank’s press service reported on Tuesday, January 18.

According to the report, the bank issued more than 1,500 mortgage loans, including 327 loans worth UAH 325 million for the purchase of housing in the primary market and 1,220 loans worth UAH 925 million for the purchase of housing in the secondary market.

It is indicated that under the Affordable Mortgage 7% program, since the beginning of its operation, the bank has issued 257 loans in the amount of UAH 250 million.

JSB Ukrgasbank was founded in 1993. The state, represented by the Ministry of Finance, owns 94.94% of the shares of the financial institution.

According to the National Bank of Ukraine (NBU), as of October 1, 2021, Ukrgasbank ranked fifth (UAH 121.19 billion) in terms of total assets among 71 banks operating in the country.