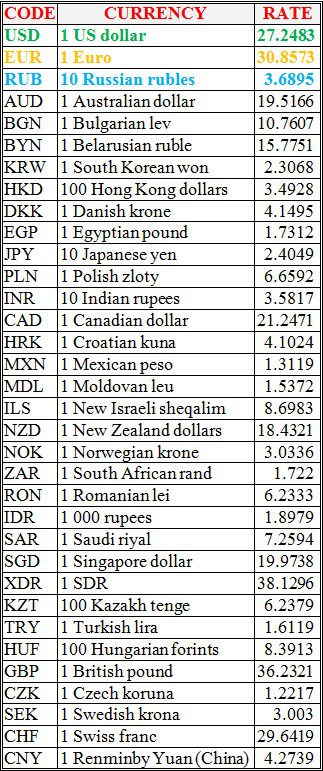

National bank of Ukraine’s official rates as of 20/12/21

Source: National Bank of Ukraine

The Adonis medical group at the Podil branch in Kyiv has implemented a knopka system to control the safety of patients.

According to a press release from Adonis, the knopka system is a Ukrainian technology startup that has proven its effectiveness in a number of state-owned clinics, including in the COVID-19 wards for critically ill patients, where there is a high workload on staff.

At the Adonis clinic in Podil, the first stage of the system has been launched, which allows tracking the work of nurses. The launch of the second phase will make it possible to make not only hospital beds and toilets safe for patients, but also any point in the hospital.

“The system will check the arrival of a medical team where the patient may feel bad – from wards to doctors’ offices in the clinic. Thus, the clinic plans to comply with the international safety standard under the Code Blue,” the medical group said.

As explained, the knopka system receives signals from buttons that are accessible to patients in the clinic and generates messages to the phone, which are received by nurses and doctors. Thus, doctors identify the patient and where he is. In addition, the system checks if the medical staff was at the patient’s bed in no more than 2-3 minutes.

If a MAWI sensor is connected to the patient, which monitors the pulse, pressure, body position in space, saturation and other indicators in real time and if the indicators become critical, the system notifies the medical staff and generates messages of the highest priority. The medical team will be in the ward in no more than 1-2 minutes.

Adonis is a network of private medical centers for adults and children.

The private clinic Adonis was founded over 20 years ago. Its network includes 12 branches in Kyiv city and the region, including two of its own maternity hospitals and a stem cell laboratory.

In the branches of the clinic, doctors from 66 medical areas receive patients.

President of Ukraine Volodymyr Zelensky and British Prime Minister Boris Johnson have discussed energy security issues and steps to de-escalate the situation around Ukraine and a peaceful settlement in Donbas.

“I had a good talk with Boris Johnson. Energy security issues were discussed. We coordinated next steps to de-escalate the situation around Ukraine and peaceful settlement in Donbas. I appreciate the firm and unwavering Britain’s support for sovereignty and territorial integrity of Ukraine,” Zelensky said on his Twitter page.

Later, the President’s Office of Ukraine said on its website that Johnson and Zelensky expressed a common position on the inadmissibility of using the Nord Stream 2 project as a weapon.

Moreover, amid discussing Ukraine’s interaction with NATO, the head of the Ukrainian state and the prime minister of Great Britain stated a common approach to the fact that no third country can block Ukraine’s Euro-Atlantic integration.

“The interlocutors positively assessed the bilateral cooperation on the development of the defense capabilities of our state and the strengthening of the Ukrainian fleet,” the office said.

An exchange of views took place on further measures of political dialogue at the highest level. Zelensky renewed an invitation to Johnson to visit Ukraine in 2022.

The international vertically integrated pipe and wheel company Interpipe and the world leader in the production of premium pipe products Vallourec (France) have terminated the implementation of a partnership project for the joint production of steel pipes for the European market due to restrictions on this market.

The company’s presentation on the results of work for January-September 2021 states: the project with Vallourec has been completed.

The Interpipe press service confirmed the termination of the joint venture’s activities to Interfax-Ukraine.

“Indeed, there is such a phrase in the presentation… Interpipe has terminated cooperation with Vallourec within the framework of a joint venture established in April 2018 for the production of line pipes with their subsequent sale in the EU market,” the press service told Interfax-Ukraine.

As explained, Interpipe was forced to make the decision due to the impossibility of fully utilizing the capacities of this joint venture due to the preservation of quotas and duties on Ukrainian pipe products in the European market.

“At the moment, Interpipe and Vallourec no longer produce and sell pipe products in the EU market under the JV. Since October, line pipes in the European market have been sold under the Interpipe brand, as it was before the joint venture was established,” the company said.