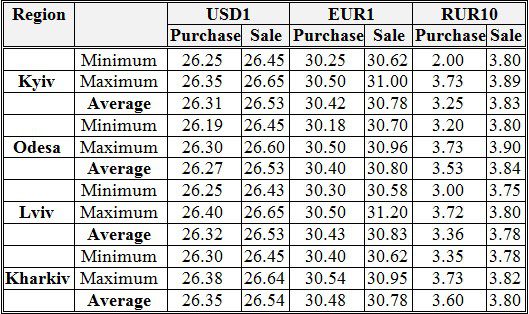

Ukrainian banks’ cash exchange rates on 27/10/21

Source: Interfax-Ukraine

The State Property Fund (SPF) during an auction held on Wednesday sold the First Kyiv Machine-Building Plant JSC (previously the Bilshovyk plant) for UAH 1.429 billion. The auction, which lasted about 10 minutes, was held in one round, during which participant 3 offered a price of UAH 1.409 billion, and participant 1, which was General Commerce LLC, offered UAH 1.429 billion.

The price grew by UAH 40 million. Participant 2 was Invest Novatsiia LLC, participant 3 was Developing Company Kaskad LLC.

General Commerce LLC was registered in Kyiv in 2018, the charter capital is UAH 4,100. Its head is Ihor Khyzhniak.

The ultimate beneficiary of the company, Volodymyr Dovhopolov, is also the founder with a share of 9.99% via UDP Asset Management.

As Head of the State Property Fund Dmytro Sennychenko said, after the auction, the procedure provides for 10 days to sign the contract, 30 days to pay the specified amount, as well as the approval of the Antimonopoly Committee.

As reported, the starting price of the plant was set at UAH 1.39 billion. According to the privatization conditions, the new owner shall pay off the debts of the plant to employees, the state budget and other creditors (now the debts are more than UAH 500 million), implement the current collective agreement and prevent dismissal within a certain period.

In addition, the buyer needs to invest at least UAH 57 million in the modernization of the enterprise over three years, to retain a part of the production that has potential at the site in Kyiv or Zhashkiv, or other production facilities in Ukraine.

U.S. President Joe Biden did not change his opinion that the Russian Nord Stream 2 gas pipeline is a factor of instability for Ukraine and Europe, but, being unable to prevent its completion, the U.S. administration turned its attention to mitigating the negative consequences of its completion, the Voice of America said with reference to a representative of the U.S. State Department.

“The idea of reaching the joint statement with Germany was recognizing the reality of the complete – the near completion of the pipeline itself, understanding that aggressive action by the United States would likely not have changed the outcome and perhaps only would have delayed it. So looking at reality, understanding it, and fashioning something with an arrangement with Germany that would allow us to continue to defend the significant interests that Europe has, that the United States have to defend the security of Ukraine while addressing and mitigating the bad effects and the threats that Nord Stream 2 could pose,” the U.S. Department of State quoted Amos Hochstein, senior advisor for global energy security, as saying.

The senior U.S. official also stressed that Washington is in contact with European countries and Ukraine regarding the search for mechanisms that would alleviate the risks that may arise in the winter.

Hochstein also noted that the world is on the verge of transition to cleaner energy and expressed hope that in the future Ukraine would retain its historical role in the supply of energy resources to Europe.

In his opinion, the factor of this will be investments in Ukraine, indicated by the joint statement of the United States and Germany, and the integration of Ukraine into the European power grid.

Based on the results of the work of metallurgical enterprises in September 2021, Ukraine increased steel production by 3.2% compared to the same period in 2020, but decreased it by 8.3% compared to the previous month, to 1.704 million tonnes, keeping the 13th place in the ranking of 64 countries – the main world producers of these products, compiled by the World Steel Association (Worldsteel).

In September, an increase in steel production compared with September 2020 was recorded in most countries of the top ten, except for China, the Russian Federation, and South Korea.

The top ten steel-producing countries in September 2021 were as follows: China (73.750 million tonnes, a drop of 21.2% compared to September 2020), India (9.547 million tonnes, an increase of 7.2%), Japan (8.144 million tonnes, an increase of 25.6%), the United States (7.293 million tonnes, an increase of 22%), the Russian Federation (5.860 million tonnes, a decrease of 2.2%), South Korea (5.460 million tonnes, a decrease of 5%), Germany (3.340 million tonnes, an increase of 10.7%), Turkey (3.303 million tonnes, an increase of 2.4%), Brazil (3.051 million tonnes, an increase of 15.3%) and Italy (2.304 million tonnes, an increase of 28%).

They were followed by Taiwan (PRC, 1.890 million tonnes, an increase of 19.9%), Vietnam (1.762 million tonnes, a decrease of 2.3%), Ukraine (1.704 million tonnes, an increase of 3.2%), Mexico (1.455 million tonnes, 2.2% more) and Iran (1.250 million tonnes, 51.4% down).

In general, in September this year, steel production fell by 8.9% compared to the same period last year, to 144.417 million tonnes.

In the first nine months of 2021, 64 countries produced 1.461 billion tonnes of steel, which is 7.8% more than in the same period last year.

About 130 Ukrainian citizens want to return home from Afghanistan at the present time, Ukrainian Foreign Minister Dmytro Kuleba has said.

“Now about 130 citizens want to return. We are developing safe exit routes. We do not abandon our people in trouble abroad and have already proved this many times. They also leave on their own. In a month, more than 30 citizens and their family members left Afghanistan on their own,” Kuleba wrote on his page on Twitter on Tuesday.

The Lviv Clinical Emergency Hospital has performed the first lung transplant in Ukraine.

According to the press center of the Lviv Clinical Emergency Hospital, the transplantation to 56-year-old Viktor was carried out on September 21, 2021. The donor was a 54-year-old man who died of a hemorrhagic stroke. The family of the deceased gave permission for organ harvesting.

Transplantation became possible thanks to the recent opening of the first transplant center in Ukraine, which was opened on the basis of the Lviv Emergency Clinical Hospital Center.

“It is very important that our Center is located in isolation. It has its own separate ventilation, separate wards only for transplanted patients. After all, such patients, as a rule, have low immune function,” head of the center Maksym Ovechko said.