Fierce competition in all industries and the rampant development of information and communication technologies constantly require businesses to look for new means to expand markets.

In August 2021, the Ukrainian Exporters Club launched a new online “Digital expo – Ukrainian Products and Services” Project. The Scope of the Project is to draw the attention of foreign importers, distributors, representatives of trading networks to Ukrainian products, attract them to cooperation and, thus, increase Ukrainian exports.

Digital expo is a web resource where only Ukrainian companies are represented. Each of them has its own web site with a scope of activities description, photos and presentations of products and services and a feedback form to send requests for cooperation. For ease of search, all companies are grouped by main categories, namely:

PRODUCTS:

Metallurgy and Metalworking Production

Energy and Raw Materials Resources

Agriculture and Animal Husbandry

Food Industry

Mechanical Engineering

Vehicles and equipment

Chemicals and Pharmaceuticals Industry

Agriculture

Wood and Furniture

Construction Industry and Public Works

Glass and building materials

Precision equipment

Electrical and electronic equipment

Textiles and clothing

Luxuries

Products for sports and recreation

SERVICES:

Information Technology

Printing and publishing

Transport and related services

Marketing, Advertising and Mass Media

Banking

Finance and Insurance

Business services

Health Care

TOURISM

Digital expo is three sites, each in its own language: in Ukrainian, English and Chinese. This is done in order to improve market coverage and increase the confidence of foreign companies located in different regions of the world.

In fact, “Digital expo – Ukrainian Products and Services” is not a new project of the Ukrainian Exporters Club. It is a modernized, updated and adapted to modern market needs “Inspired By The Best In Ukraine” Project, which was created in 2015.

The previous project was supported by DHL and the EBRD at various stages of its life. It presented Ukrainian products and services at the international exposition IF CHINA in Beijing in 2016 and CIIE in China in 2019.

In the summer of 2021, the electronic catalogues of the Ukrainian Exporters Club became Digital expo.

In the last 3 months (June to August) of 2021, the exhibitors received more than 10,000 requests for cooperation from Malaysia, Poland, Turkey, China, Korea, Baltic States and other countries.

The modern project has become even better. It participates in international online expositions, including: worldexpo, expotobi, food1.com, echemi.com, infobel.com, foodfocus.co.za and others.

“Digital expo – Ukrainian Products and Services” is supported by world and Ukrainian reputable organizations, including: Ministry of Economy of Ukraine, Kyiv Chamber of Commerce and Industry, Entrepreneurship And Export Promotion Office, Euromonitor International and Others. The general media partner of the exposition is the Interfax-Ukraine News Agency.

You can learn more about the “Digital expo – Ukrainian Products and Services” Project and apply for participation at the link: https://inspiredbythebestofukraine.ticketforevent.com/ru/home/40010/

DIGITAL EXPO, GOODS, ONLINE PROJECT, SERVICES, THE CLUB OF EXPORTERS

As many as 153 members of Ukraine’s Verkhovna Rada have endorsed the initiative of Vladlen Nekliudov of the parliamentary faction of the Servant of the People party requesting that Ukrainian President Volodymyr Zelensky impose sanctions on the enterprises of the Roshen confectionery corporation for “financing the budget of the aggressor state Russian Federation.”

The relevant decision was made at a parliamentary session on Friday.

Roshen, a leading confectionary producer in Ukraine, operates confectionery factories in Kyiv, Mariupol, Kremenchuk, Boryspil, Vinnytsia, Klaipeda (Lithuania), and Bonbonetti Choco in Hungary. The operations of the factory in Lipetsk, Russia, were halted on April 1, 2017.

According to the Unified State Register of Legal Entities and Individual Entrepreneurs, Roshen’s end beneficiary is Poroshenko’s son Oleksiy.

In December 2016, the Basmanny District Court of Moscow froze the assets of Roshen’s Lipetsk factory as part of a criminal case of embezzlement from the Russian budget.

Ukraine will provide assistance to Moldova with gas supplies, Secretary of the National Security and Defense Council (NSDC) Oleksiy Danilov said.

“We decided to instruct the Cabinet of Ministers to consider this issue. We understand that we can do such assistance to the Republic of Moldova in the near future,” Danilov said at a briefing on Friday following the results of the NSDC meeting.

According to him, Prime Minister of Moldova Natalia Gavrilița has made such a request to the Ukrainian government.

“The Prime Minister of Ukraine received a letter from his colleague with a request to help with gas in order to avoid a difficult situation, which has developed taking into account the blackmail that Gazprom is doing there,” Danilov said.

Later, he said that it would be gas on credit, not for money, and then Moldova would return the supplied resource. According to him, this must be done, since Ukraine and Moldova are united, and there are territories in Ukraine that are supplied with gas from Moldova.

The Spanish low cost airline Vueling will open direct flights from Kyiv (Boryspil International Airport) to Paris (Orly International Airport) from December 5, 2021.

According to the ticket booking system, the airline will fly on the route twice a week: in December with a shifted schedule, and from January 2022 – on Tuesdays and Sundays with a departure from Paris at 06:55 and from Kyiv at 12:10.

Previously, flights between Ukraine and France were operated by UIA, Air France and SkyUp.

As reported, the Hungarian low cost airline Wizz Air announced plans to start operating flights to Paris from Kyiv and Lviv.

Vueling Airlines is a low cost airline based in Barcelona (Spain).

Ukraine and the European Union signed the Common Aviation Area Agreement on October 12. On June 28, 2021, the EU Council agreed to sign with Ukraine, as well as with three other countries – Armenia, Tunisia and Qatar – the Common Aviation Area Agreement. The process of uniting the Ukrainian aviation space with the EU was launched back in 1999. On December 12, 2006, the EU Council authorized the EC to start relevant negotiations with Ukraine. In October 2013, the text of the Common Aviation Area Agreement was agreed upon by the parties, however, due to foreign policy conditions, its signing was postponed indefinitely.

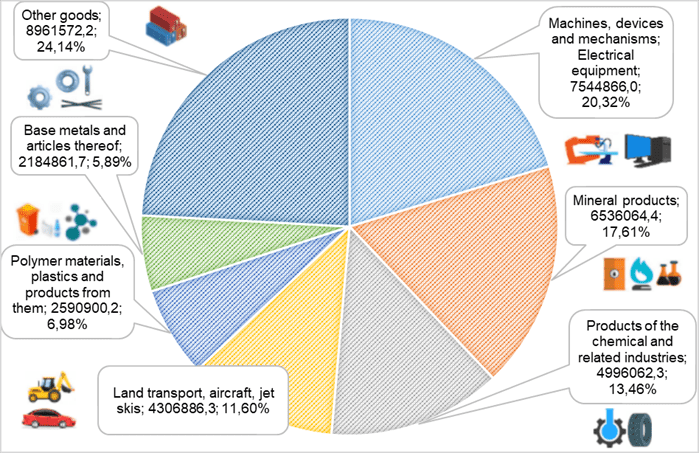

FOREIGN TRADE TURNOVER BY THE MOST IMPORTANT POSITIONS JAN-JULY 2021 (IMPORT)

In the very heart of Kyiv, at 8a Lva Tolstoho Street, a multi-brand showroom Dim Brendiv has opened.

The showroom presents various collections of Ukrainian brands. Buyers got the opportunity to immerse in the world of fashion, beauty and style, and designers – to present their collections and find new fans of their brand.

The showroom collected various products by style, texture and age criterion. There are also daily casual blouses and skirts, suits, evening dresses and outerwear.

It also presents various accessories that women of fashion will be able to effectively complement their image.

The showroom is bright and spacious, shopping lovers will be able to view themselves and their friends in magnificent large mirrors, and the staff will prepare a cup of fragrant tea with sweets so that customers can rest after trying on their outfits.

The assortment and brands presented can be viewed on the Dim Brendiv Instagram page. New collections and models of clothes are presented every day.

“In my showroom there are a lot of cool and exclusive items of famous Ukrainian brands that are not presented anywhere else in Kyiv. I fell in love with these things from the first collection, and with each new look book, you can find models that you really want to buy. The assortment is constantly updated, and we immediately post the most stylish items on our Instagram page. We are open to both buyers and Ukrainian designers who want to present their collections in our stylish premium class showroom. Come to us, our doors are always open!” the owner of the showroom, a girl with a great taste, Maryna Kharetonchuk, who chooses clothes from Ukrainian designers, told Open4Business.com.ua .

It is worth noting that the showroom is located near the Lva Tolstoho metro station in the very center of Kyiv, at 8a Lva Tolstoho Street, opening hours are from 11:00 to 20:00 daily.