Ukraine International Airlines (UIA) will resume flights on the Kyiv-Warsaw-Kyiv route from June 18, 2021, which were suspended due to the impact of the COVID-19 pandemic.

As the press service of the company said on Wednesday, these flights will be operated on Tuesdays, Fridays and Sundays.

Departures from Kyiv are planned at 09:55 (arrival at 10:30 local time), from Warsaw – at 14:05 (arrival at 16:35 local time).

Currently, flights from Kyiv to Warsaw are also operated by Wizz Air, Ryanair and LOT.

Italian coach Roberto De Zerbi will become the head coach of Football Club Shakhtar for the next two seasons, the club’s official website reported on Tuesday.

“On May 25, the Italian specialist arrived in Kyiv and met with the Shakhtar president Rinat Akhmetov. During his two-day visit, Roberto De Zerbi will get acquainted with the infrastructure in the capital of Ukraine – the Miners’ training complex in Sviatoshyno and the NSC Olimpiysky where the team play their home matches,” the message reads.

The Italian became the 34th head coach in the history of Shakhtar.

Roberto De Zerbi was born in Brescia on June 6, 1979

He started his player career in the Milan youth team. He also played for Monza (1998), Padova (1998-2000), Avellino (2000-2001; 2008-2009), Lecco (2001-2002), Foggia (2002-2004), Arezzo (2004-2005), Catania (2005-2006), Napoli (2006-2008; 2009-2010), Brescia (2008), Romanian CFR Cluj (2010-2012) and Trento (2013).

His worked as a coach in such football clubs as Darfo Boario (2013-2014), Foggia (2014–2016), Palermo (2016), Benevento (2017-2018), and Sassuolo (2018-2021).

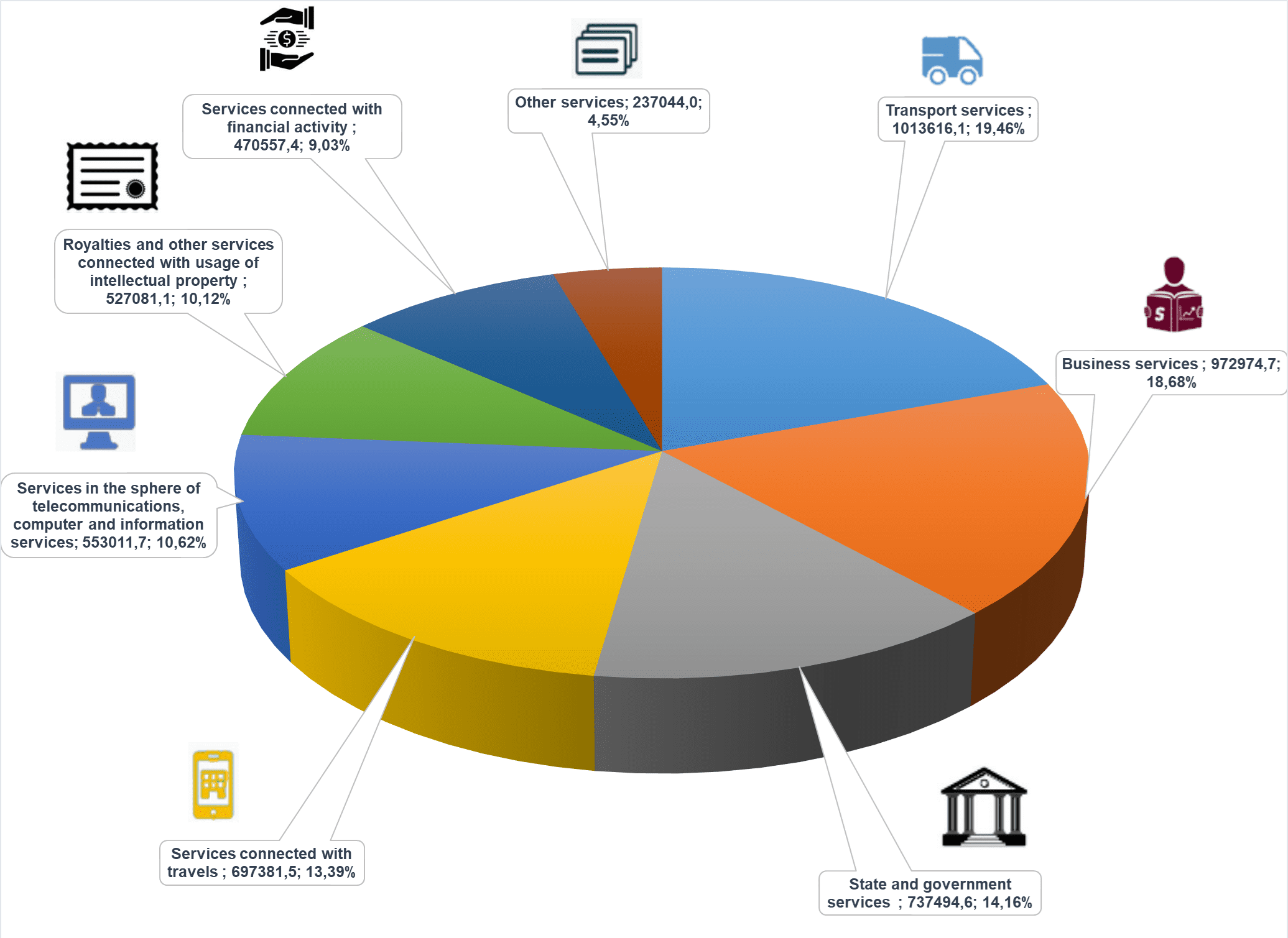

STRUCTURE OF IMPORT OF SERVICES FOR 2020 (GRAPHICALLY)

The Belarusian airline Belavia has cancelled all flights to Ukraine until August 25, 2021, Belavia said in a statement on its website.

“Due to the ban of the Ukrainian authorities on Belavia flights, the airline is forced to cancel flights to/from Kyiv, Lviv, Odesa, and Kharkiv from May 26 to August 25, 2021,” Belavia said.

On May 25, night flights to Kyiv and Odesa were also canceled, it said.

“Passengers who purchased tickets on the indicated dates will be able to refund their full price without penalties or change the date of departure during the validity period of the ticket,” the airline said.

Ukraine suspended air traffic with Belarus on May 26.

A Ryanair flight from Athens to Vilnius was forced to land at the Minsk airport while passing through Belarus’ airspace on May 23.

On President Alexander Lukashenko’s orders, Belarus scrambled a MiG-29 fighter jet to accompany it. The Ryanair plane was carrying Raman Pratasevich, former editor-in-chief of Nexta and editor of Belarus Golovnogo Mozga (Belarus of the Brain), Telegram channels that are both designated as extremist in Belarus, and his companion, Sofia Sapega, a Russian citizen and a student of European Humanities University in Vilnius. Both were detained by the Belarusian authorities.

The European Union and the United States have condemned the forced landing of the Ryanair plane in Minsk, demanding that Pratasevich be released.

Minsk, in turn, said that an email message about a bomb allegedly planted on the Ryanair plane en route from Athens to Vilnius had been signed by “Hamas soldiers.”

The volume of sales of enterprises in the service sector of Ukraine in the first quarter of 2021 amounted to UAH 237.7 billion, which in comparable prices is 1% higher than the level of the fourth quarter of 2020, the State Statistics Service has said.

According to the report, the volume of services sold to the population amounted to 21% of the total volume of services rendered.

The State Statistics Service reminded that in the first quarter of 2020 the volume of sales of service enterprises grew by 23.1%.

The catch of fish and other aquatic biological resources by fisheries of Ukraine in January-April 2021 increased by 4.8% compared to January-April 2020, to 23,210 tonnes, of which ocean catch on the territory of other states increased by 11%, to 18,280 tonnes.

According to a press release of the State Fisheries Agency of Ukraine on Tuesday, during the specified period, the catch of fish and other aquatic biological resources increased in the reservoirs of the Dnipro River by 9%, to 988 tonnes, the Azov Sea – 827 tonnes (more by 48%), the Danube River – 325 tonnes (more by 70%), the Black Sea – 300 tonnes (more by 41%), and the Dnipro-Bug Canal – 174 tonnes (more by 22%).

The State Fisheries Agency said that industrial fisheries caught 497 tonnes of aquatic biological resources in the lower reaches of the Dniester River with the estuary and the Kuchurhan reservoir and 10 tonnes of aquatic biological resources were caught in the Black Sea estuaries.

The agency said that special fisheries combining elements of aquaculture and industrial fish catch operate in Ukrainian lakes and water reservoirs, which have caught 1,100 tonnes of aquatic biological resources in the first four months of 2021, which is 32.4% less than in the first four months of 2020.