The Ministry of Health of Ukraine will propose to the Cabinet of Ministers to extend the quarantine for the summer period while maintaining the main quarantine restrictions, said Health Minister Viktor Liashko during a government meeting on Wednesday.

“We will invite the government to consider extending the quarantine restrictions for the summer period. We must leave the main restrictions, in particular, the mandatory wearing of masks in public places, transport, as well as keeping a distance. If the situation worsens, we will promptly respond and introduce ‘yellow,’ ‘orange’ or ‘red’ epidemiological level,” he said.

Liashko added that the Ministry of Health had already developed proposals for a model of stay and activity in a “green” level of epidemic danger, which will provide more opportunities for recreation in the summer, business and travel.

“In particular, we plan to abolish the requirements for the occupancy of the halls, allow the full functioning of gyms and simplify the process of passing the borders for returning from vacations,” the minister said.

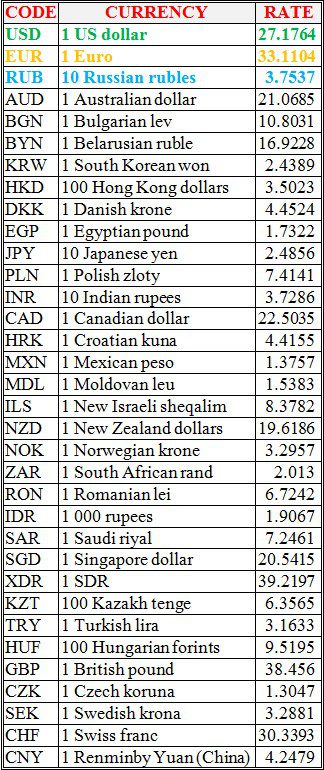

National bank of Ukraine’s official rates as of 09/06/21

Source: National Bank of Ukraine

The Ministry of Culture and Information Policy of Ukraine (MCIP) presented a new visual brand of the department.

“The rebranding aims to show the ministry as a modern state institution that meets today’s challenges. The new brand style represents the current Ukrainian culture – attractive and understandable for modern Ukrainians,” the ministry’s press service said.

It is noted that the new logo of the Ministry of Culture is “light and graceful”, the sketches of the letters in the logo have careful references to ancient Russian calligraphy, such as “The Tale of Igor’s Campaign” and the manuscripts of Kyivan Rus.

“The abbreviation MCIP is sewn into the new logo, the thin outline and rounding are subconsciously read as soft and friendly elements that create dynamics like a reflection of a new round of history and culture. The intersection of letters in the abbreviation reminds of the interdisciplinarity of the areas of MCIp’s work. The logo can be used as a full-color sign, combining two colors, and as a monochrome sign, which provides for the use of only black or white,” the message says.

The logo is based on two colors: yellow and red, which are supposed to be used only on a contrasting background.

It is noted that minimalism is taken as the basis for the new corporate identity of the ministry.

“When developing the new identity, the main attention was paid to such strategic directions as: culture, creative economy, information policy, tourism, as well as major restoration,” the ministry said.

The ministry’s new identity was reportedly developed by Green Penguin creative agency with the support of USAID Transformation Communications Activity.

The actual price of crude oil and condensate used in determining the payment for subsoil use in May 2021 amounted to UAH 13,257 per tonne, which is 5.2% more than in April 2021 (UAH 12,605 per tonne).

The relevant data was posted on the website of the Ministry for Development of Economy of Ukraine.

As reported, in January 2020, the actual selling price of oil and gas condensate amounted to UAH 11,114 per tonne, in February – UAH 9,648, in March – UAH 5,913, in April – UAH 3,960, in May – UAH 6,199, in June – UAH 8,115, in July – UAH 8,847, in August – UAH 8,887, in September – UAH 8,467, in October – UAH 8,447, in November – UAH 9,034, in December – UAH 10,127 per tonne.

In January 2021 the selling price was UAH 11,114 per tonne, in February 2021 it was 12,302 per tonne, in March it was UAH 12,832 per tonne, and in April it was UAH 12,605 per tonne.

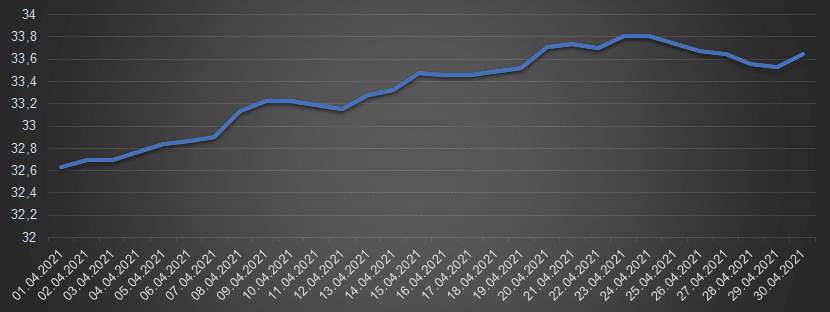

QUOTES OF INTERBANK CURRENCY MARKET OF UKRAINE (UAH FOR €1, IN 01.04.2021-30.04.2021)