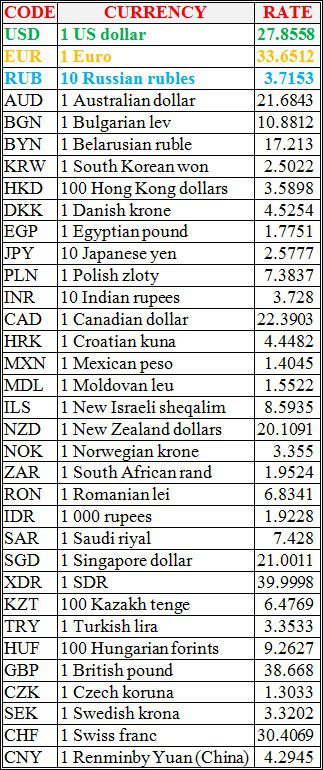

National bank of Ukraine’s official rates as of 27/04/21

Source: National Bank of Ukraine

Ukraine International Airlines (UIA) in 2020 posted a loss of UAH 4.518 billion against UAH 1.649 billion of profit in 2019.

According to the company’s statement in the information disclosure system of the National Securities and Stock Market Commission on the annual meeting of shareholders on May 28, UIA assets at the end of last year decreased by 1.6 times, to UAH 9.226 billion, and uncovered loss increased by 1.6 times, to UAH 11.6 billion.

Total debtor indebtedness increased to UAH 1.619 billion against UAH 969 million in 2019, long-term liabilities decreased by 28.3%, to UAH 7.4 billion, current liabilities increased by 15.3%, to UAH 13.2 billion.

Earlier, UIA stated that in just three months of the spring lockdown in 2020 and the complete suspension of regular flights, the company incurred losses in the amount of about $ 60 million.

Some 68% of Ukrainian citizens believe that the direction of events in the country is wrong, according to the results of a sociological survey conducted by the Ukrainian Institute for the Future (UIF) with the assistance of New Image Marketing Group from April 9 to April 18 and presented at Interfax-Ukraine on Monday.

According to the survey, only 17% of respondents say that Ukraine moves in the right direction, and another 15% cannot decide.

One of the most pressing problems in Ukraine, 40% of those polled called the war in Donbas, 36% linked the problems with low wages and pensions, 31% with corruption, 29% with high utility rates, and 27% with a pandemic.

At the same time, it is noted that in March it was the problem of the war in Donbas that ranked first in the anti-rating.

Some 56% of citizens are sure that their rights and freedoms are not violated, and 44% noted that such violations are present.

In case of violation of their rights, citizens would choose mostly peaceful and non-violent methods to protect their rights and freedoms. First of all, this is the collection of signatures (26%), sanctioned rallies and actions (22%), and electronic petitions (16%). Road closures (15%) are the single most popular protest methods that go beyond the sanctioned limits. In general, radical actions gain no more than 5-6% and lag significantly behind moderate measures.

The number of citizens who are not ready to defend their rights has remained almost unchanged since March (41%).

The sociological survey was conducted by the “face-to-face” method using a structured interactive questionnaire. Audience included the population of Ukraine aged 18 and over in all regions, except for the temporarily occupied territories of Crimea and Donbas. The sample was 2,400 respondents.

The error of the representativeness of the survey with a confidence level of 0.95 does not exceed 2.05%.

The Zeppelin German industrial concern is investing EUR 10 million in the construction of a new head office and service center for its Ukrainian representative office, the Zeppelin Ukraine company, in Vyshneve, Kyiv region, the representative office told Interfax-Ukraine.

“Such investments are a good example of cooperation between Ukraine and Germany, which confirms the intentions of the readiness of further cooperation between the two states,” the company said.

The project of the main office is being developed by the Delta Austrian design bureau, and the estimated construction period, which started in January 2021, is until July 2022.

“After 25 years of fruitful work in Ukraine, Zeppelin created the opportunity to construct its own headquarters in Ukraine. In honor of the start of construction on April 15, 2021, a time capsule was laid with the wishes of our partners and colleagues, which our followers will open in 25 years,” the company said.

The area of the territory to be reconstructed is 3.7 hectares, and the area of buildings is 6,700 square meters.

It is planned, in particular, to locate a two-storey main office with a total area of over 2,600 square meters on the territory with underground parking, a service workshop with an area of 1,550 square meters and a warehouse for storing oils, as well as a licensed warehouse of equipment on an area of 5,500 square meters and a demo site.

At the same time, taking into account the focus of the Zeppelin group on a responsible attitude to environmental, social and economic aspects, natural resources and the latest technologies will be maximized in the design of the new office. In particular, buildings will be equipped with solar panels, heat pumps will be used for heating, which will also be used to ventilate the premises.

In order to save resources for air conditioning, sun blinds will be installed on the windows, and to save water resources, a purification system will be installed with the possibility of reusing water in the repair shop, as well as organizing the collection and treatment of rainwater with an oil separator in order to reduce the load on the city sewer system.

Zeppelin Ukraine company with its head office in Kyiv has been operating in the country since 1996 and is the only official dealer of Caterpillar on the territory of Ukraine. It has 12 branches with over 600 employees.

J.P. Morgan is committed to its forecast of 5.6% growth for Ukraine’s economy in 2021, despite continuing quarantine restrictions, the bank said in its April commentary.

The bank still believes that in 2021 growth will exceed 5%, mainly due to internal factors, but will also be supported by external demand. As the European and global economy recovers in the second half of 2021, Ukrainian exports should increase in volume and contribute to growth,” the analysts said.

They pointed to good performance in the fourth quarter of last year and strong growth in retail sales, confirming the view that consumption will be an important driver of growth this year as well.

J.P. Morgan said that a serious decline in investment and a reduction in inventories were the main negative factors in the decline in GDP by 4% last year, but this year the situation in these areas will improve. In particular, the analysts expect investments to rebound by almost 30% after falling by more than 24% last year and reaching pre-crisis levels. In their opinion, restocking will provide significant additional impetus to growth in 2021.

According to the bank’s forecast, vaccination will progress very slowly, more than half of the population will be vaccinated by about the middle of 2022; therefore, consumer spending will be mostly domestic.

J.P. Morgan pointed out a possible serious aggravation of the situation with COVID-19 or geopolitical events among the risks.

Commenting on cooperation with the IMF, the analysts maintain expectations that Ukraine will receive financing from the IMF in the third quarter, despite the slow implementation of the commitments. In their opinion, the IMF mission is likely to return in the second quarter of 2021 and among the main issues will be the discussion of the laws on the High Council of Justice, NABU and strengthening responsibility for electronic declarations introduced to the Rada, as well as the preservation of the NBU’s independence. J.P. Morgan also said that U.S. officials named the resumption of cooperation with the IMF and IFIs, as well as reforms in the justice sector, among the conditions of financial support for Ukraine.

Speaking of inflation, the analysts expect it to rise to about 9% by the third quarter of 2021 and increase the key policy rate by the National Bank by 50 basis points – to 7% at the next meeting. In their opinion, further this year the key policy rate will reach 7.5%, and next year – 9.5%. J.P. Morgan believes that 2022 will be more challenging for the NBU, as rather high real interest rates will be required to bring inflation down to 5%, especially given the expected current account deficit compared to a large surplus in 2020.

According to the document, a high GDP deflator (9.8% last year) implies an increase in budget receipts in 2021, in connection with which the analysts predict the budget deficit this year is slightly higher than 4% of GDP compared to 5.5% of GDP in the official forecast.