Vodafone Ukraine (PrJSC VF Ukraine) at the end of 2020 cut its net profit by 52.4% compared to 2019, to UAH 1.2 billion.

Vodafone Ukraine CEO Olha Ustynova said that the drop in net profit was due to the exchange rate difference.

“The only and main factor why this happened is the exchange rate difference on our loan. The U.S. dollar exchange rate has changed, the $500 million loan, which is more than [UAH] 1 billion of loss as a result to our net profit,” she said during the presentation last year’s results on Tuesday.

According to her, the company’s revenue last year increased 14% and amounted to UAH 18 billion, and the OIBDA (operating income before depreciation of fixed assets and intangible assets) grew by 18% year-over-year, reaching UAH 9.8 billion.

The number of Vodafone Ukraine customers in the country at the end of the year amounted to 19 million. The operator’s 4G network covers 81% of the country’s territory, which is 12% higher than the previous indicator for 2019.

At the end of 2020, the number of Vodafone Ukraine data users was 12.2 million, and the number of 4G users was 7.3 million.

Over the past year, the use of data traffic grew by 26%.

Vodafone Ukraine is the second largest mobile network operator in Ukraine.

Milk and dairy products (especially butter) were most often falsified among food products in the first quarter of 2021, and the most common violation in the production of butter is the presence of non-dairy fats, the State Service of Ukraine on Food Safety and Consumer Protection said.

According to the agency, the second common type of violation this year is the inconsistency of food labeling.

The service clarified that since the beginning of the year, it has carried out 85 scheduled and 2,900 unscheduled inspections. As a result, more than 31 tonnes of products were withdrawn from circulation, including 6 tonnes of milk and dairy products, 4.7 tonnes of fish, 3.3 tonnes of poultry, 2 tonnes of meat and meat products. The department made 49 decisions to suspend the circulation of food products, transferred 11 cases to law enforcement agencies and issued fines to violators in the amount of over UAH 1.6 million.

“The food products that Ukrainian consumers buy must be safe and meet all legislative norms and requirements. We must protect consumers. Work in this direction will only intensify,” head of the department Vladyslava Mahaletska said.

As reported, the State Service of Ukraine on Food Safety and Consumer Protection in March introduced a unified quality standard for raw milk, within the framework of which the Milk Module was launched – software for the automatic collection of research results for dairy raw materials.

According to Mahaletska, the Milk Module calculates the level of total bacterial contamination and the number of somatic cells in milk raw materials. Milk producing farms and milk preparation points in nine regions of Ukraine are involved in the raw milk control program. The project is already being implemented in Kharkiv, Vinnytsia, Mykolaiv and Poltava regions, while Khmelnytsky, Donetsk, Dnipropetrovsk, Kyiv, Volyn and Sumy regions are ready for its launch.

PrJSC Severodonetsk Azot, part of Group DF of businessman Dmytro Firtash, in January-March 2021 increased the production of mineral fertilizers by 47.4% compared to the same period in 2020, to 265,620 tonnes, according to the company’s press release published on Tuesday.

During this period, the production of ammonium nitrate decreased by 9.2%, to 141,610 tonnes, urea increased by 3.7 times, to 119,600 tonnes, urea-ammonium nitrate (UAN) by 4.6 times, to 17,400 tonnes, and the production of ammonia water decreased by almost 94.7%, to 150 tonnes.

In addition, the enterprise produced 147,810 tonnes of ammonia; 1,590 tonnes of liquid carbon dioxide and 20,170 cubic meters of medical oxygen in cylinders.

“We managed to increase the utilization of the company’s production capacities from 30% to 50%. Further growth of production volumes will depend on the level of demand for mineral fertilizers and on how the ICIT [Interdepartmental Commission on International Trade] resolves the issue of limiting imports of nitrogen fertilizers in Ukraine,” Board Chairman of Severodonetsk Azot Leonid Buhayov said.

He said that the enterprise will be able to continue to load workshops and increase production if imports are limited due to quotas.

In May 2020, Severodonetsk Azot restored the full production cycle, it began production of its own ammonia and the production of ammonium nitrate, urea, and urea-ammonium nitrate, which made it possible to load production capacities by about a third. According to the company, all concluded contracts are fully implemented, despite the special working conditions during the quarantine period. The enterprise said that some workshops had been idle for more than seven years due to hostilities in the region, lack of reliable power supply and damaged infrastructure.

PrJSC Severodonetsk Azot is one of the largest Ukrainian chemical enterprises. It has been part of Dmytro Firtash’s Group DF since 2011. The core business of the enterprise is the production of mineral nitrogen fertilizers.

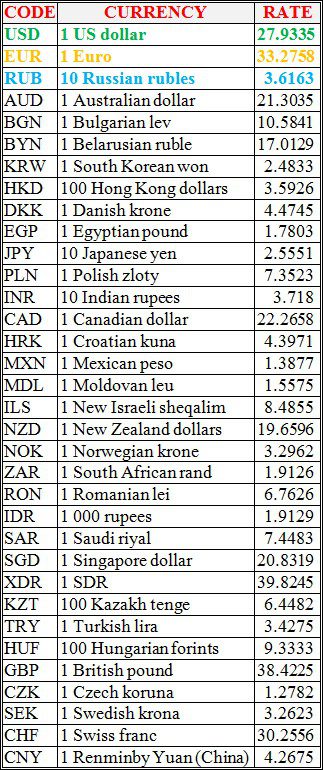

National bank of Ukraine’s official rates as of 13/04/21

Source: National Bank of Ukraine