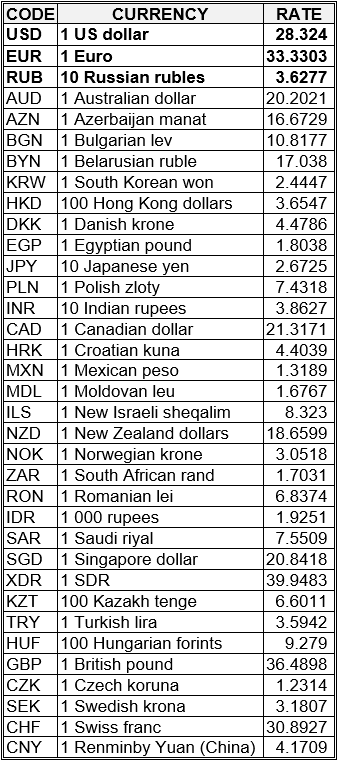

National bank of Ukraine’s official rates as of 08/10/20

Source: National Bank of Ukraine

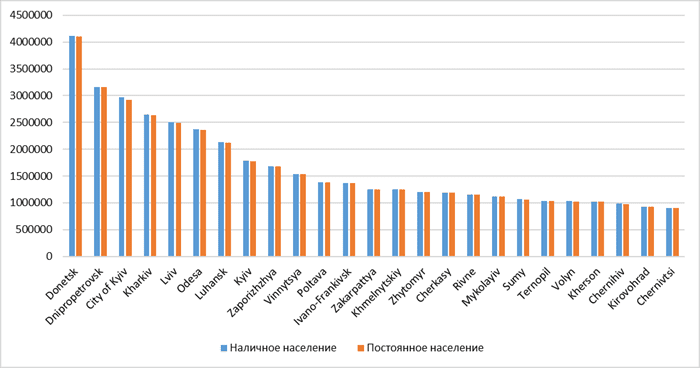

Ukrainian population by regions as of June 31, 2020 (graphically).

Source: SSC of Ukraine

Zero duty on the import of wine from the EU will be introduced from 2021 in accordance with Ukraine’s commitments to zero import duties on a number of goods within a seven-year period after the signing of the economic part of the Association Agreement with the European Union, the Development Director of the Ukrainian Horticultural Association, the international consultant to the UN FAO, Yekateryna Zvereva, has said.

“From 2021, a zero duty will be introduced on the import of wine into Ukraine (from the countries of the European Union). At the same time, the situation in the wine market is not the best today – wine import to Ukraine increased by 25-30% compared to last year,” she wrote in a column to the Interfax-Ukraine agency.

She clarified that at present the duty on the import of wine from the EU is EUR 0.3-0.4/liter.

With reference to the data of the State Statistics Service, Zvereva reported that in 2019 Ukraine exported $11.9 million worth of wine. At the same time, Kazakhstan became the largest foreign market for Ukrainian winemakers, where products worth $1.3 million were delivered. In addition, one of the largest markets remains Germany, where $1 million worth of wine was exported.

At the same time, according to the expert, import of wine last year amounted to $ 146.7 million.

In addition, in the first half of this year, according to the State Customs Service, Ukraine exported $6.1 million worth of wine, while imports amounted to $67.9 million, the expert said.

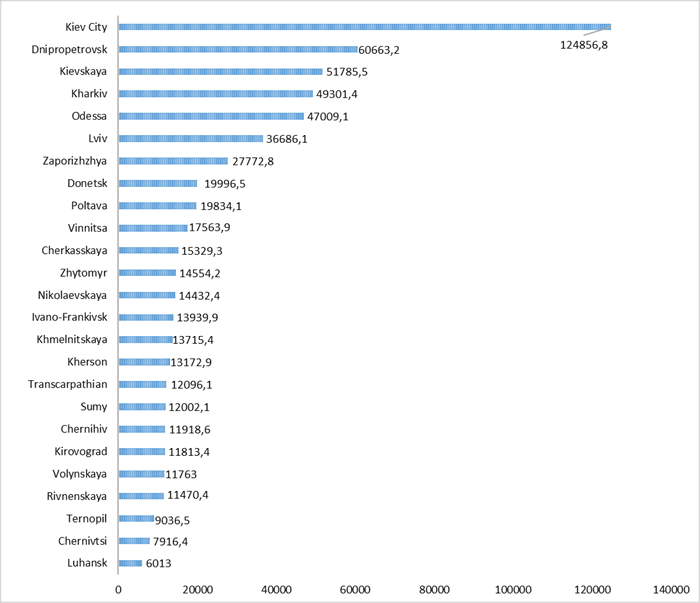

Retail turnover in Ukraine by regions in Jan-July 2020 (UAH MLN).

ProCredit Bank (Kyi) has completed an increase in the charter capital by 10.4%, or by UAH 147.76 million, to UAH 1.57 billion by attracting additional contributions through placing 310,000 ordinary registered shares of the existing par value, the bank said in the information disclosure system of the National Securities and Stock Market Commission.

The bank recalled that the decision to increase the charter capital was made by the shareholder on August 30, 2019.

ProCredit Bank was founded in 2001. Its only shareholder at the beginning of 2020 was ProCredit Holding (Germany).

According to the National Bank of Ukraine, as of September 1, 2020 in terms of total assets (UAH 27.274 billion) ProCredit Bank ranked 16th among 75 banks operating in the country.