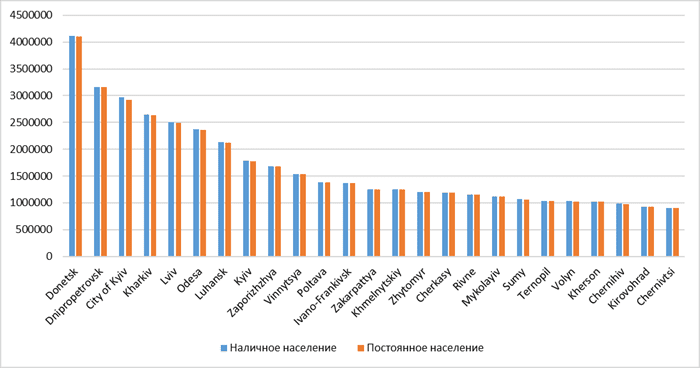

Ukrainian population by regions as of June 31, 2020 (graphically).

Source: SSC of Ukraine

Zero duty on the import of wine from the EU will be introduced from 2021 in accordance with Ukraine’s commitments to zero import duties on a number of goods within a seven-year period after the signing of the economic part of the Association Agreement with the European Union, the Development Director of the Ukrainian Horticultural Association, the international consultant to the UN FAO, Yekateryna Zvereva, has said.

“From 2021, a zero duty will be introduced on the import of wine into Ukraine (from the countries of the European Union). At the same time, the situation in the wine market is not the best today – wine import to Ukraine increased by 25-30% compared to last year,” she wrote in a column to the Interfax-Ukraine agency.

She clarified that at present the duty on the import of wine from the EU is EUR 0.3-0.4/liter.

With reference to the data of the State Statistics Service, Zvereva reported that in 2019 Ukraine exported $11.9 million worth of wine. At the same time, Kazakhstan became the largest foreign market for Ukrainian winemakers, where products worth $1.3 million were delivered. In addition, one of the largest markets remains Germany, where $1 million worth of wine was exported.

At the same time, according to the expert, import of wine last year amounted to $ 146.7 million.

In addition, in the first half of this year, according to the State Customs Service, Ukraine exported $6.1 million worth of wine, while imports amounted to $67.9 million, the expert said.

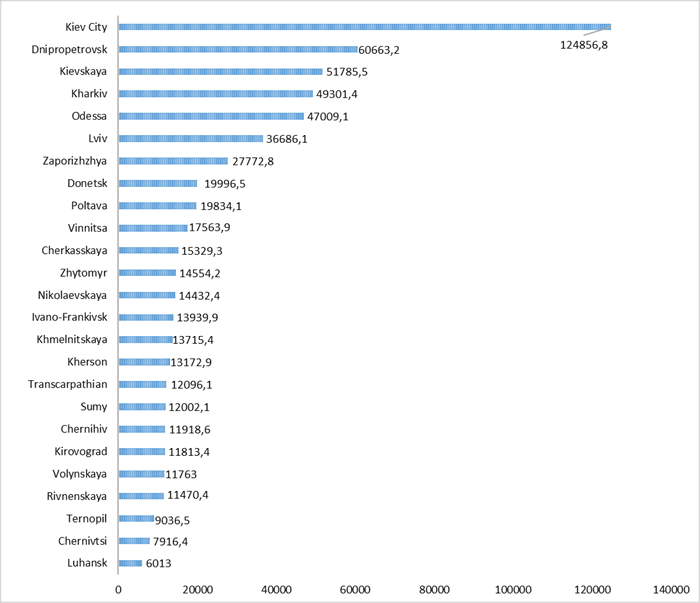

Retail turnover in Ukraine by regions in Jan-July 2020 (UAH MLN).

ProCredit Bank (Kyi) has completed an increase in the charter capital by 10.4%, or by UAH 147.76 million, to UAH 1.57 billion by attracting additional contributions through placing 310,000 ordinary registered shares of the existing par value, the bank said in the information disclosure system of the National Securities and Stock Market Commission.

The bank recalled that the decision to increase the charter capital was made by the shareholder on August 30, 2019.

ProCredit Bank was founded in 2001. Its only shareholder at the beginning of 2020 was ProCredit Holding (Germany).

According to the National Bank of Ukraine, as of September 1, 2020 in terms of total assets (UAH 27.274 billion) ProCredit Bank ranked 16th among 75 banks operating in the country.

At the 22nd Ukraine-EU Summit, Kyiv signed three agreements with the European Commission and three agreements with the European Investment Bank (EIB) aimed at financing various projects.

In particular, an agreement to finance the EU4ResilientRegions programme for EUR 30 million was signed between the Ukrainian government and the European Commission.

According to the document, the EU4ResilientRegions programme aims at enhancing the resilience of eastern and southern Ukraine to the negative impacts of the ongoing conflict, including to hybrid threats and other destabilizing factors. The action will also address most recent destabilization factors such as the COVID-19 pandemic and its social and economic impact. In response to the conflict in eastern Ukraine and the illegal annexation of Crimea and Sevastopol, this action will aim to enhance Ukraine’s overall resilience, notably to hybrid threats.

The Civil Society Facility programme for EUR 20 million was also signed between the Ukrainian government and the European Commission. The programme focuses on social innovation and active citizenship as core principles for civic engagement and the premises for sustainable democratic societies. It aims to support the capacity of civil society organizations to engage in policy dialogue, to act as governance actors and to drive the country’s social and economic development.

In addition, the Climate package for a sustainable economy (CASE) programme for EUR 10 million was signed between the Ukrainian government and the European Commission.

This programme supports Ukraine in the implementation of measures towards a climate neutral, clean and resource-efficient economy. This includes support in areas such as circular economy and waste management, energy efficiency, emission-free urban transport as well as support to climate mitigation and adaptation.

In addition, this agreement provides for the creation of a joint resource center for climate innovation between Ukraine and the EU and the implementation of “green” measures within the framework of the National Transport Strategy until 2030.

All three documents were signed by Deputy Prime Minister of Ukraine for European and Euro-Atlantic Integration Olha Stefanishyna and Member of the European Commission for European Neighbourhood Policy and Enlargement Negotiations Olivér Várhelyi.

Three agreements with the EIB were signed.

Minister for Communities and Territories Development of Ukraine Oleksiy Chernyshov and Vice-President of the European Investment Bank Teresa Czerwińska signed an Agreement between the Government of Ukraine and the EIB on financing the Energy Efficiency of Public Buildings in Ukraine project. The loan will enable the installation of modern equipment in buildings, such as meters and energy consumption control systems, the modernization of heating, ventilation and lighting systems, and upgrades to exterior surfaces (facades, roofs, slab insulation, basement ceilings, replacement of windows and doors).

Also a EUR 30 million loan provided for by the guarantee agreement Logistic Network (Ukrposhta modernization and digitalization) was signed by Ukrainian Infrastructure Minister Vladyslav Krykliy, CEO of Ukrposhta JSC Ihor Smelyansky and Vice-President of the EIB Lilyana Pavlova.

The loan will allow Ukrposhta to start modernizing its logistics network with three new sorting hubs, 20 postal depots and IT infrastructure. The beneficiary is to return the loans within 20 years.

Ukraine and the European Union have agreed on further economic integration and regulatory convergence in a number of areas.

A joint statement by the leaders of Ukraine and the EU, adopted at the end of the summit in Brussels on Tuesday, says.

“We looked forward to further enhancing economic integration and regulatory approximation within the framework of the Association Agreement in the following fields: on digital, we took note of the on-site assessment of the implementation of Ukraine’s commitments in the AA/DCFTA. We also discussed the EU’s engagement in further supporting Ukraine and its institutions in approximation with and gradual implementation of the EU Digital Single Market acquis and institutional capacities, to fully benefit from the Association Agreement. We agreed to prepare by the end of 2020 a joint working plan for co-operation between EU and Ukraine on electronic trust services with a view to a possible agreement which must be based on approximation to the EU legislation and standards,” the statement reads.

The leaders welcomed progress on the update of the Annexes on telecommunication, environment, climate and financial cooperation of the Association Agreement. “Welcoming Ukraine’s ambition to approximate its policies and legislation with the European Green Deal, we stressed the importance of progress in Ukraine’s commitments in the areas of climate change, environment, marine ecosystem, education, energy, transport and agriculture, building on existing established sectoral dialogues, and agreed on a focused dialogue on the necessary steps in these areas,” the statements says.

In addition, they acknowledged the importance of fully complying with DCFTA commitments, notably in the areas of intellectual property rights, public procurement, trade defence, and sanitary and phytosanitary standards with a view to building an open and predictable business and investment climate in Ukraine. “We agreed to further discuss and review the ways to improve DCFTA implementation in order to further develop and facilitate bilateral trade,” the leaders said.

They also welcomed the launch of the pre-assessment on Ukraine’s preparedness on an Agreement on Conformity Assessment and Acceptance of Industrial Products.

The EU also welcomed Ukraine’s willingness to associate to the incoming EU’s Research and Innovation Framework Programme Horizon Europe and EU4Health Programme, which will be a significant enabler for green and digital post-COVID recovery.

“We recalled the importance and reaffirmed our commitment to concluding the Common Aviation Area Agreement at the earliest possible date,” the statement notes.

What is more, the EU reaffirmed Ukraine’s role as a strategic transit country for gas and welcomed the agreement on gas transit to the EU after 2019. “We underlined the importance of pursuing the modernization of the Ukrainian national gas transmission system and further cooperation on strengthening European energy security. We stressed the importance of Ukraine’s cooperation with the EU, with a view to its integration with the EU energy market based on effective implementation of the updated Annex XXVII of the Association Agreement as well as coordination of further steps for the integration of gas and electricity markets,” it says.

The parties also agreed to improve connectivity between Ukraine, the EU and other countries of the Eastern Partnership with a view to facilitating trade, further developing safe and sustainable transport links and supporting people-to-people contacts.

“We welcomed the participation of Ukraine in EU programmes and underlined the importance of Erasmus+ for education, training, youth and sport and Creative Europe for culture. We looked forward to intensifying the relevant cooperation in the framework of current and future programmes,” the leaders said.