Bus operator FlixBus launches trips on the route Kyiv-Warsaw, with stops in Zhytomyr, Rivne and Radom (Poland). According to the press service of the carrier, Kyiv-Warsaw buses depart from Kyiv at 16:00 on Wednesday and Saturday from the bus station Kyiv (32 Symona Petliury Street), at 15:30 on Tuesdays from Warsaw from the bus station Warszawa Zachodnia.

The company notes that all FlixBus lines have increased safety and hygiene standards. In particular, one must wear a protective mask in the bus, covering the nose and the mouth, and buses are disinfected in a professional way after each trip.

The carrier also reminds its customers to carefully check the rules of entry into the destination country.

In total, 11 FlixBus lines are currently operating in Ukraine: nine international (Odesa-Prague- Plzeň, Kyiv-Krakow-Prague, Kyiv-Warsaw, Kyiv-Vilnius, Kyiv-Krakow-Rostock, Kyiv-Cologne, Kyiv-Karlsruhe, Kyiv- Stuttgart, Kyiv-Budapest-Vienna) and three internal ones (Kyiv-Odesa-Zatoka, Kyiv-Lviv, Kyiv-Uzhgorod).

Two new industrial parks are to be opened in Dnipropetrovsk region, Head of Dnipropetrovsk Regional Administration Oleksandr Bondarenko has told the Interfax-Ukraine agency.

“We have three potential sites. Preliminary agreements have already been reached upon one of them. There is an estimate of the cost of lacking utilities and a fully developed algorithm for opening and registering an industrial park. We know what type of business to invite to enter these sites. There is a list of 15-20 companies that are interested in launching production processes,” Bondarenko said.

A managing company will be identified in the near future, ensuring the project launch and ongoing management.

According to the head of the regional state administration, the technological cluster previously opened in Pavlohrad (Dnipropetrovsk region) has not yet been filled with production facilities, hence it is difficult to attract business to the park.

“When visited, it turned out that there were no proper utilities. It is difficult to attract business to launch production in the technological park, which is not connected to water, electricity, and sanitation services. The platform should be ready to host the business. It is one of the key functions of the technological park,” Bondarenko said.

He added that now the relevant parliamentary committee is considering a draft law providing for the increase of tax preferences for technological parks, in particular, the abolition of VAT and duties on import of raw materials and equipment into the territory of the industrial park, as well as profit tax for five years.

“Hopefully, in the fall, it [the draft law] will enter the session hall and will be adopted. Industrial parks are growth points for the economy. Their launch and the reconstruction of the airport, so that it would be possible to accept even the largest passenger planes, will bring the economy of the region to a fundamentally new level,” Bondarenko added.

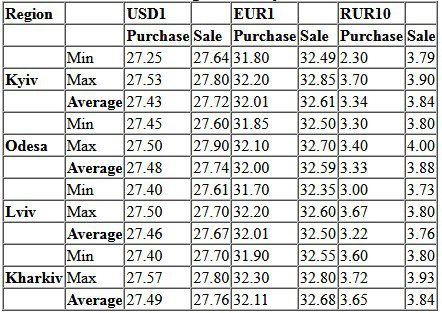

Ukrainian banks’ cash exchange rates today

©Source: Interfax-Ukraine

The Cabinet of Ministers on Wednesday intends to consider a bill on the list of 188 companies prohibited from privatization, according to the agenda of the government meeting. According to the text of the bill, the government allows the privatization of up to 50% of the shares of Naftogaz, Ukrzaliznytsia and Ukrposhta, but proposes to retain the state’s 100% share of corporate rights in National Nuclear Generating Company Energoatom, PrJSC Ukrhydroenergo, NEC Ukrenergo , Skhidny Ore Mining and Processing Plant (VostGOK), and Ukrainian Sea Ports Authority (USPA).

It is also proposed to include the SE Market Operator and the SE Guaranteed Buyer, created by the Cabinet of Ministers in 2019 in order to ensure the operation of the new electricity market, in the list of objects completely prohibited for privatization.

In addition, it is proposed to include in the specified list the state-owned enterprise Document, Ukraina Printing Plant for the production of securities, Kyiv offset factory, and Pivdenne (Yuzhne) Design Bureau.

Acting Energy Minister Olha Buslavets intends to sign in Germany a memorandum on a new energy partnership, providing for the development of hydrogen technologies in Ukraine, said chairman of the Ukrainian Hydrogen Council Association Oleksandr Repkin.

“On August 25-27, head of the Ministry of Energy Olha Buslavets will visit Germany, where it is planned to sign a memorandum on a new energy partnership, of which hydrogen energy is a part. Ukraine is going there to propose certain pilot projects with a scale of 100 MW, similar to the project being implemented in Morocco – a solar-hydrogen plant with a capacity of 100 MW,”Repkin said during an online discussion on the prospects for the development of hydrogen energy in Ukraine, organized by the energy committee of the Ukrainian Venture Capital Association on Tuesday.

He said Germany considered that it would not have enough of its own resources for the production of renewable hydrogen, therefore it considers Ukraine as a partner for obtaining this resource.

He also announced on August 14 the first meeting of the expert working group under the Ministry of Energy under his leadership, at which, in particular, the issue of adapting Ukraine’s energy strategy regarding hydrogen technologies will be considered.

“We are starting concrete steps to keep up with the EU countries,” Repkin said.

He also noted that according to the European Hydrogen Strategy, recently presented by the Executive Vice-President of the European Commission Frans Timmermans, Europe regards Ukraine as a partner, but it is necessary to develop the internal hydrogen market for this.

“In Europe, they see us as a 10GW partner. What does this mean? There is such an opportunity, and they will support us. But there is one thing, which is not spelled out, but it is said. They will support only those countries that create an internal hydrogen market in their country. “Timmermans made it clear: friends, we are ready to help you with 7.5 GW so that you create and import them, but for 2.5 GW you must create your own market,” Repkin said, noting that by the end of 2023, “We are expected to half a million tonnes of import of renewable hydrogen, and in the future – 3 million tonnes annually.”

According to him, in order to enter the European market in Ukraine, conditions must be provided, in particular for the use of hydrogen transport, there must also be the use of hydrogen in the metallurgical and chemical industries.

He said that in Ukraine there is already an example of the construction of the first hydrogen filling station in partnership with the Danes.

“Entrepreneurs from Kharkiv have joined our association. Their idea is to convert all public transport to hydrogen,” said the head of the association.

At the same time, he predicted that the development of hydrogen technologies in the country will proceed more actively than expected.

As reported, Ukrainian Foreign Minister Dmytro Kuleba said that Ukraine can become a reliable supplier of hydrogen to the EU, in particular to Germany.

In July, the European Union adopted a strategy for the introduction of renewable hydrogen. It involves the addition of an integrated energy system with a massive industrial production of renewable hydrogen. It can serve as a source of energy where the use of electricity is difficult. In the future, it will be produced mainly using wind and solar energy.

Myronivsky Hliboproduct (MHP) has announced the opening of the fifth store of a new format, Miasomarket (Meat Market), in Cherkasy on August 28, in Kropyvnytsky and Kyiv in September. According to a press release from the company, MHP intends to open about 50 stores throughout Ukraine by the end of the year. New retail outlets are already operating in Kovel, Sumy, Mykolaiv and Dubno.

“The opening of new format stores is in line with MHP’s strategy of transforming from a raw material company into a culinary one. Thus, in addition to a wide selection of fresh meat, the stores offer consumers meat in marinades, sausages and other products,” MHP said.

The agricultural holding indicated that MHP had received many applications and requests from partners to open stores of a new format throughout Ukraine.

As reported, by the end of the year, MHP intends to open new retail outlets in 20 more cities of Ukraine. The new format of its business is developing according to the franchising system. Meat Markets will be opened with both existing and new investors.

MHP is the largest poultry producer in Ukraine. It is also engaged in production of grain, sunflower oil, meat. MHP supplies the European market with chilled half-carcasses of chickens, which are processed, in particular, at its factories in the Netherlands and Slovakia.