Ukraine International Airlines (UIA) will resume flights from Kyiv to Kherson International Airport, the head of Kherson Regional State Administration has said.

“I would like to inform that Ukraine International Airlines will resume flights from Kyiv to Kherson on June 19,” he wrote on his Facebook page.

“Today negotiations with airlines to establish flights between Lviv and Kherson were held. We hope that soon residents of western Ukraine will be able to easily reach our region and enjoy summer in the south,” he said.

Alfa-Bank and Globus Bank (both Kyiv-based) made agreements with the government of the Republic of Belarus on providing Ukrainian entrepreneurs with loans for the purchase of Belarusian goods on preferential terms using the resources of the latter, the press services of the banks said.

“According to the terms of the program, Alfa-Bank Ukraine will receive compensation for loan interest for the purchase of Belarusian machinery for a period of up to five years in the amount of two thirds of the National Bank of Ukraine discount rate, valid on the date when the loan is issued,” Alfa-Bank said on its website.

Under the preferential loan program, Ukrainians will be able to purchase Belarusian machinery, in particular agricultural, automotive and road-construction.

The compensation is provided under the agreement and decree No. 466 on some measures for the sale of goods produced in the Republic of Belarus of the president of Belarus dated September 24, 2009.

According to the National Bank of Ukraine (NBU), at the beginning of 2020, the largest shareholders of Alfa-Bank were indirectly Mykhailo Fridman (31.483767%), German Khan (20.085856%), Oleksiy Kuzmichov (15.638704%), Petr Aven (11.881235%) and UniCredit SpA (Italy, 9.484448%).

Bank Globus was registered in 2007. Its major participants as of January 1, 2019 were Olena Sylniahina and Dmytro Polkovsky indirectly through Ukrainian Media Technologies LLC (100%).

The Ukrainian Golf Federation has resumed golf tournaments following a quarantine mitigation. On Saturday, June 6, the Kozyn Golf Club hosted a women’s golf competition within the Ladies Open Golf Tour. Ukrainian golfers from all over the country gathered on the Kozyn golf course. To support the female athletes, men competed in a separate event.

Olena Rudik ranked first in the tournament, Marina Diachenko – second, Olena Movchan – third, gross score – Olena Movchan. Mariya Orlova won the “closes to the pin” nomination, Yuliya Lishchuk – “longest drive.” Hanna Freydinova came first in the “Junior” category in a special competition.

In the picture: Mykola Proskurko, Oleksandr Yavorsky, Olena Movchan, Olena Rudik, Marina Diachenko, Vitaliy Khomutynnik

In the picture: Mariya Orlova

“The Ukrainian Golf Federation holds the annual series of competitions within its program aimed at the promotion of women’s and junior golf, improvement of players’ skills, cooperation and promotion of golf clubs and courses in Ukraine. This year the finals of the Ladies Open Golf Tour is included to the world golf tournament schedule of the European Golf Association EGA,” President of the Ukrainian Golf Federation Vitaliy Khomutynnik said in his speech to congratulate the winners.

In 2020, the Golf Federation has introduced a range of changes that helped to speed up the development of this kind of sports in the territory of Ukraine, he said, adding that golf has become more affordable.

“Every time I see more and more golfers appearing in our country and golf becoming even more popular, I get an enormous burst of energy and I realize that all the way from an idea to a large golf tournament was not in vain. Unfortunately, COVID-19 slightly changed our plans and our pace, but now “full steam ahead” towards new achievements,” Director of the Open Ladies Golf Tour, Board Member of the Ukrainian Golf Federation Olena Rudik said.

In the picture: Olena Rudik

Famous golfers – boxer Wladimir Klitschko and head coach of the Ukrainian national football team Andriy Shevchenko – also attended the golf tournament.

In the picture: Wladimir Klitschko, Olena Rudik, Hennadiy Butkevych

In October last year, Andriy Shevchenko joined the Board of the Ukrainian Golf Federation.

In the picture: Vitaliy Khomutynnik, Olena Rudik, Andriy Shevchenko

Foreign Minister of Ukraine Dmytro Kuleba and Foreign Minister of Greece Nikolas Dendias in a telephone talk expressed a readiness to resume flights between Ukraine and Greece from July 1 under condition of stable epidemiological situation in two countries, the Foreign Ministry of Ukraine. The foreign ministers of the two countries also exchanged experiences on countering the spread of COVID-19 coronavirus and overcoming the consequences of the pandemic.

Dendias invited Kuleba to pay a working visit to Greece, when circumstances allow. Kuleba accepted the invitation.

He congratulated his colleague on the Greek Chairmanship of the Committee of Ministers of the Council of Europe and urged him to give priority to Ukraine’s topics in the focus of attention to this organization. The Greek minister in response assured that Greece has always supported Ukraine’s European integration aspirations.

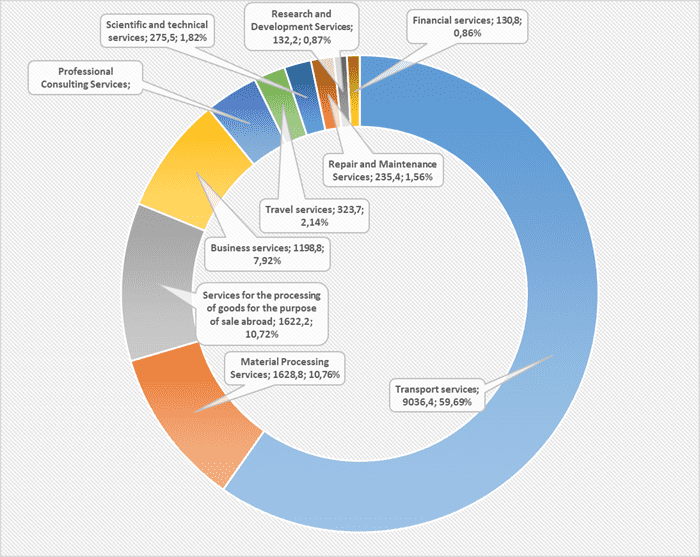

Structure of export of services in 2019 (graphically)

Head of the Office of the President of Ukraine Andriy Yermak has said that a new ambassador of Ukraine to France will be appointed next week.

“Finally we will have a new ambassador to France, next week,” he said during a meeting of President of Ukraine Volodymyr Zelensky with businessmen in Khmelnytsky region on Wednesday, when asked by a participant of the meeting to help businesses establish contact with Ukraine’s embassies in a range of countries.

Oleh Shamshur has been working as Ambassador of Ukraine to France since October 2014.