The 17th annual meeting of Yalta European Strategy (YES), scheduled for September 10-12, 2020, has been postponed to 2021 due to the COVID-19 pandemic, YES press service reported. “YES and the Viktor Pinchuk Foundation remain committed to the mission: to integrate Ukraine into the world and ensure its proper role on the international agenda. The YES meeting in 2021 will again become a powerful discussion platform in Ukraine, which supports changes in the country and development of the new Ukraine supporters’ networks all over the world,” reads the statement.

Yalta European Strategy (YES) is a leading forum where the European future of Ukraine is discussed and developed in a global context. YES was founded in 2004 by businessman Victor Pinchuk.

From 2004 to 2013, annual YES meetings were held at Livadia Palace in Yalta. After the temporary occupation of Crimea by the Russian Federation, meetings were rescheduled in Kyiv.

Kernel-Trade, the agricultural exporter, tops the list of the largest recipients of budget value added tax (VAT) refunds for the third month in a row, having received UAH 1.03 billion in June against UAH 650 million in May and UAH 965 million in April.

According to the State Treasury Service, the second place on the list in June, as in May, was again occupied by ArcelorMittal Kryvyi Rih mining and metallurgical plant with almost UAH 977 million against UAH 501.45 million in April.

The top three recipients of budgetary VAT refunds also included Suntrade with UAH 681.8 million, while in April the company ranked fifth with UAH 359 million, according to the data of the State Treasury.

Mariupol-based Illich Iron and Steel Works affiliated with Metinvest Group improved its performance over the month with UAH 597.44 million against UAH 373 million in May. The top five largest recipients of budgetary VAT refunds also included Myronivsky Hliboproduct (MHP) with UAH 550 million (UAH 70 million in April).

The second five in June includes Poltava GOK with UAH 477.25 million (UAH 236.7 million). It is followed by Zaporizhstal steel plant from Metinvest Group with UAH 451.3 million (UAH 372.75 million), followed by Azovstal, which reduced its figure to UAH 289.4 million from UAH 336.45 million in May.

The top ten largest recipients of VAT reimbursement are closed by Pivdenny (Southern) GOK with UAH 283.2 million and Dniprovsky Iron and Steel Works with UAH 250.74 million.

Тhe Board of the National Bank of Ukraine (NBU) will remain a team and is ready to work further, adhering to the current policy to maintain the stability of the economy in Ukraine, but subject to maintaining their right to make decisions independently, First Deputy Governor of the NBU Kateryna Rozhkova said on Thursday.

“The NBU Board made a rather difficult decision to stay working now… We see our task not only in maintaining macrofinancial stability, but also independence and the institutional capacity of the NBU – and this is, in fact, key conditions – hoping that they will be supported, we remain working,” she said during an online meeting of the NBU Board with business, a meeting’s participant from the business told Interfax-Ukraine.

Rozhkova added that the NBU Board seeks an open and effective dialogue with the government, since only in cooperation it sees an opportunity to ensure the further development of the country.

“The board remains in office for the term of its tenure, and I don’t think that one-man show is here, decisions are made collectively. Therefore… changing the policy or changing the course with this team will be impossible,” NBU Governor Yakiv Smolii said at the meeting.

He also said that he sees no reason to change developments and the course that the central bank has chosen. “Therefore, we will hope that everything will be fine and will move in the direction in which we are working now,” Smolii said.

The governor of the NBU said that the IMF and stakeholders who worked on the placement of eurobonds should not “focus on personalities.”

“First of all, we are working and worked with institutions. If we say that we continue to preserve the principles that were laid down, such as institutional independence, then I see no reason for there to be any radical changes both in our policy and [relations] with investors,” he added.

According to Smolii, speaking of political pressure on the central bank, he had in mind the draft resolution on assessing the activities of the governor of the NBU recommended by the parliamentary committee on finance, tax and customs policy, lawsuits and decisions, as well as the submission from 64 MPs to the Constitutional Court of Ukraine about compliance of banking law required for cooperation with the IMF with the Constitution.

“Thus, the deputies want to disrupt cooperation with the IMF – only the approval of this law was the benchmark of our current program, and they also want to “help” in the fight for PrivatBank,” he said.

He called frequent public criticism of the central bank by the NBU Council and an attempt to discredit the Board by Head of the NBU Council Bohdan Danylyshyn as another element of pressure.

“We see a direct political motivation for the positions and decisions of some individual members of the NBU Council, in particular the head. I recall that the head of the NBU Council has repeatedly publicly expressed his position regarding negotiations with the former owners of PrivatBank, de facto about returning the already healthy bank, which the state has capitalized, to them,” Smolii said.

He also recalled the unjustified, according to the NBU, refusal to include the extension of the powers of Deputy Head of the National Bank Oleh Churiy, whose tenure ends on July 10, in the agenda of the meeting of the NBU Council on June 30.

“With the pressure in which we have been living for more than a year, when people speak black and white, when low inflation is “a disaster for Ukraine,” it’s impossible to continue to do the things that we do. This is my challenge in order to preserve the independence of the central bank, to preserve the institutional ability that we tried to maintain,” the NBU governor said.

Smolii also said that after his resignation under the NBU law, Rozhkova will have the powers of the NBU board head, if the appointment of a new board does not occur on that day.

During the meeting, business representatives thanked Smolii for his work.

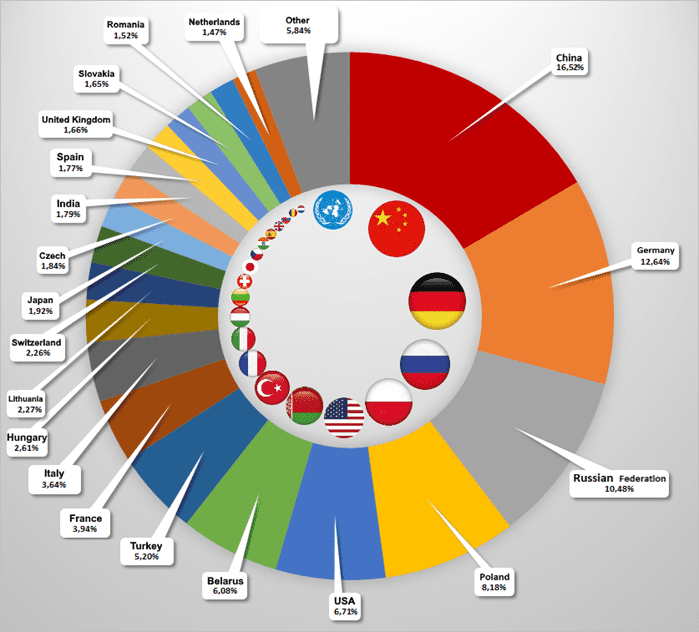

Main trade partners of Ukraine in % from total volume (import from other countries to Ukraine) in 1-st quarter of 2020

On Wednesday, July 8, at 11.00, the press center of the Interfax-Ukraine News Agency will host a press conference entitled: “‘New Decree of the Cabinet of Ministers of Ukraine: How does State Put New Obstacles for Ukrainian Citizens for Purchase of Cars?.” Participating will be Columb Trade Co-founder Volodymyr Kovel, Columb Trade Co-founder Pavlo Kazaryan, lawyer Roman Voloshyn (8/5a Reitarska Street).The broadcast will be available on the YouTube channel of Interfax-Ukraine. Admission requires press accreditation.

RUSH LLC (Dnipro), which manages a network of about 1,000 Eva perfumery and cosmetic stores in Ukraine, has decided to increase investments in the reconstruction of the online store’s warehouse on the site in Brovary by reducing the store opening plan in the third quarter of 2020 to 25 outlets.

“By reducing the plan for opening stores in the third quarter, we were able to increase investments in the reconstruction of the online store’s warehouse at our site in Brovary. This year, the plans were to equip and automate the online store’s warehouse, which should handle 10,000 orders per day. Due to the rapid growth of online orders, we decided to increase investments and invest an additional UAH 27 million. We planned to carry out the next stage of expansion of this facility next year, but decided to do it this year,” Executive Director of RUSH LLC Olha Shevchenko said in a blitz interview with Interfax-Ukraine.

According to her, an increase in funding for this project will improve effectiveness from 10,000 to 20,000 orders per day.

“Whether we can reach such a level of orders in the online store in 2020 is still unknown. I think most likely not. But this will allow us to prepare for future growth,” Shevchenko said.

In the first quarter of 2020, the Eva chain opened 29 new stores, in the second quarter – 25 stores.