The relaxation of the rules of connecting to power grids would allow Ukraine to climb in the Doing Business rating from 64th position to the top 30, Ukrainian Prime Minister Denys Shmyhal has said.

“In 2012, we started from one hundred and fiftieths positions, then we gradually moved to 71st, and today we are in the 64th position in the world among almost 190 countries. Our goal is the top 30,” he said in an exclusive interview with Interfax-Ukraine.

As the prime minister said, this is not about status, but about specific indicators that are important for investors.

“Today, they say that Ukraine is very good for investment, but just a few parameters bother them. The key parameter is the connection to the power grid. We are between 120 and 130 places in terms of connection to the power grid. If we improve this indicator, then automatically, without other efforts, we enter the top 30 of the overall rating,” Shmyhal said.

He said that this would mean that regional competition with neighboring countries of Poland, Hungary, and Romania is won.

Electricity consumption in Ukraine, taking into account in-process losses in power grids, decreased by 5.8% (by 3.121 billion kWh) in January-April 2020, compared to the same period in 2019, to 50.810 billion kWh, the Ministry of Energy and Environment Protection has told Interfax-Ukraine.

Excluding in-process losses, electricity consumption over the first four months decreased by 5% (by 2.166 billion kWh), to 40.769 billion kWh.

The country’s industry, excluding technological losses, reduced electricity consumption by 6.6%, to 16.288 billion kWh. In particular, metallurgical industry consumed 8.938 billion kWh (9.7% less compared to January-April 2019), fuel industry some 1.099 billion kWh (7.2% less), machine building industry some 1.172 billion kWh (17.7% less), chemical and petrochemical some 1.307 billion (17.1% more), food and processing some 1.408 billion kWh (3.6% less), construction some 670.5 million kWh (2.1% less), others some 1.694 billion kWh (1.1% more).

In addition, agricultural enterprises consumed 1.120 billion kWh (2.6% less), transport some 2.145 billion kWh (9.8% less), developers some 354.6 million kWh (8.3% less).

In January-April 2020 the country’s population consumed 13.108 billion kWh (0.9% less), households some 5.101 billion kWh (8.8% less) and other non-industrial consumers some 2.653 billion kWh (3.9% less).

The share of industry in total electricity consumption over the first four months fell from 40.6% to 40%, while the share of the population grew to 32.2% from 30.8%.

In April 2020, electricity consumption, taking into account in-process losses, decreased by 7% (by 835.6 million kWh) compared to the same month of 2019, to 11.086 billion kWh, excluding in-process losses it fell by 7.8% (763.1 million kWh), to 9.28 billion kWh.

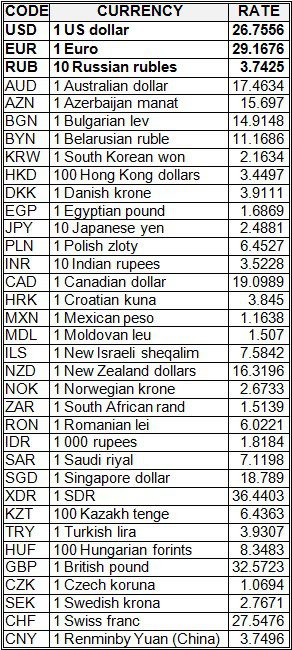

National bank of Ukraine’s official rates as of 25/05/20

Source: National Bank of Ukraine

Elektrostal steel smelting enterprise (Kurakhove, Donetsk region) produced 36,000 tonnes of continuous cast steel billets in January-April 2020, compared to 28,000 tonnes in the same period in 2019.

A representative of the enterprise told Interfax-Ukraine that in April the plant smelted 7,000 tonnes of products.

He said that the enterprise stood idle from January to the middle of March, and partially resumed its operation from the middle of March 2019. Then the enterprise worked at one third of its capacities or less.