Ovostar Union, a leading egg and egg products manufacturer in Ukraine, supplied 466,000 eggs or 40 tonnes to Israel in April, which is 0.003% of its monthly production volume, the company’s press service has told Interfax-Ukraine.

“Israel is a country with high requirements for safety and quality of food, and we are proud that our products passed the control of the Israeli veterinary service, and we have the opportunity to supply eggs to this market. Israel is currently experiencing a shortage of this product, and, in addition to Ukraine, buys eggs in other European countries. On April 1, 2020, the Israeli Veterinary Service allowed producers of table eggs from Ukraine to export them to the country,” the company said.

Ovostar Union said that the company has been consistently implementing its export development strategy since 2015. Ovostar products are delivered to 55 countries, including to the markets of the EU, the Middle East, Southeast Asia and Africa. The export volume in 2019 amounted to an average of 43 million units per month, in 2018 – 48 million units per month.

Ovostar, citing the State Statistics Service, reported that the production of industrial eggs in Ukraine is growing annually, and in January-February 2020, egg production by specialized enterprises increased 8.6% compared to the same period in 2019.

“At the same time, the volume of the domestic market, taking into account the significant share of eggs collected by households, remains almost unchanged. The egg is one of the key export goods of the agricultural sector of Ukraine. With an average monthly production of 780 million pieces by poultry farms in general, 190 million eggs are exported, making our country one of the key players in the global egg industry,” the company said.

Speaking about the company’s work during the coronavirus disease (COVID-19) pandemic in Ukraine, Ovostar said that since the introduction of quarantine restrictions, the company, despite the additional costs of ensuring sanitary standards at enterprises, exchange rate fluctuations and rising cost of feed, has not changed selling prices for packaged products delivered to retail chains.

State Emergency Service needs several days to put out torf fires, which have been left after a fire in Chornobyl exclusion zone and around it, Emergency Minister Mykola Chechotkin told President of Ukraine Volodymyr Zelensky at a daily selection conference.

As the president’s press service reported, Zelensky receives a report about this every day so that to keep a situation under control.

Being asked by the president when precisely the fire in the exclusion zone is halted, Chechotkin said that there was no fire.

Zelensky was also informed that the day before, after 16.00 p.m. on April 13, the situation worsened due to a heavy wind, so the fire was difficult to control. Therefore, the Emergency Service sent more equipment and personnel to eliminate the fire. The rain in this area helped firefighters cope with the situation faster.

On the whole, yesterday fire brigade made 227 sorties, 500 tons of water were used. The radiation background in the exclusion zone remains normal and does not increase, said Chechotkin.

The Emergency Minister said that simultaneously with extinguishing of the fire in the exclusion zone, firefighters did not allow the fire to be transferred to military ammunition warehouses, Shelter and Vector facilities, the Chornobyl nuclear power distribution station, and spent nuclear fuel storage.

The National Police reported that on the eve near the two fires arsonists were detained, investigative actions are being carried out

“I’m very glad that the Verkhovna Rada yesterday voted to raise fines for arson and forest destruction. This is a quick and correct reaction of the authorities to serious challenges. Previous fines of several thousand hryvnias were too miserable punishment for such serious crimes,” Zelensky emphasized.

Ukrainian hoteliers predict the late start of the summer season in the country (not earlier than July), at the same time, country hotels will be able to adapt more quickly and start working after the long quarantine.

“Few people want to open summer hotels and beaches before July. The work of restaurants, entertainment centers will also depend on this. Events such as the Odesa Film Festival or concerts in the summer are unlikely to take place. Given the need to keep the pandemic from spreading, the start of the season in June is unlikely,” Managing Director of the five-star Kadorr Hotel Resort & Spa (Odesa) Olena Kalynovska said during the online conference entitled “Hotel Market in Times of Crisis.”

According to Director General of the five-star suburban complex Edem Resort Medical & Spa (the village of Bibrka near Lviv) Oleksiy Voloshyn, it will be easier for resort and country hotels to recover after quarantine ends.

“After quarantine, some hotels and restaurants will not open at all, some will open on the first day, some will decide to wait and open a little later. I believe that resort and country hotels will rise faster than business hotels that are more focused on foreigners and air travel,” he said.

Voloshyn said that the crisis will not hit hard, including Edem Resort Medical & Spa.

“My forecast is very positive: I think that by the end of April we will reach the indicators that we had. This summer we were provided with advance payments for about 40-50 events. These are mainly weddings and celebrations. Today, we don’t have any request for a refund,” the CEO said.

The owner of the family hotel complex Taor Karpaty (the village of Lastivka, Lviv region, 9 km from Skhidnytsia) Olena Sozanska also confirmed the guests’ interest in accommodation outside the city, including during the quarantine period.

“For many guests, this is an opportunity to escape from large cities with their families and protect themselves from infection while living in high-rise buildings. I think there is a demand for such self-isolation in the Carpathians,” she said.

According to Sozanska, the last guest left Taor Karpaty at the end of March, but the facility is ready to receive guests upon request with accommodation for at least five nights.

“We don’t want to close completely, because we are preparing for the summer season and then it will be difficult to start… We are ready to open, but we will receive guests who are willing to check in for a long time – for five and more days. That is, we do not accept booking for one or two days,” she said.

The Good Zone Hotel, a family country complex, is completely quarantined, except for technical services. According to Managing Director Serhiy Rudko, now the facility does not count on a quick resumption of operations.

“Country hotels will come to life a little earlier. Nevertheless, we previously determined two dates when the market would be ready to consume services: optimistic and pessimistic – June 15 and August 15… Removing the quarantine does not mean that demand will recover. Yes, there will probably be domestic tourism, but only in the medium plus segment and above,” he said.

Nika-Tera sea terminal (Mykolaiv), part of Dmytro Firtash’s Group DF, handled 2 million tonnes of cargo from January 1 to April 10, 2020, the company said on Facebook.

“After 49,000 tonnes of Ukrainian corn for export had been loaded on board the Panamax GRIZZLY, on April 10 Nika-Tera port’s cargo turnover amounted to 2 million tonnes from the beginning of 2020. This batch of corn is sent by Louis Dreyfus to Spain,” the report says.

The GRIZZLY bulk carrier was loaded at the eleventh berth of the port simultaneously with two loading machines, which allowed Nika-Tera to achieve a daily loading rate of 36,000 tonnes.

According to the company, in the first quarter of 2020, Nika-Tera’s cargo turnover amounted to 1.87 million tonnes, which is 1.5% more than in the same period last year.

In general, in the first three months of operation, the port handled 85 vessels, including two bulk carriers with additional loading at the roads, as well as four tankers with sunflower oil.

In the structure of cargo turnover, the main cargo remains cereals, legumes and oilseeds, which accounted for 65% of the quarterly transshipment volume or 1.22 million tonnes. Bulk cargo amounted to 14% or 270,000 tonnes, meal some 17% (320,000 tonnes), and oil transshipment some 4% (70,000 tonnes).

Ukraine in January-March 2020 increased import of oil (according to foreign economic activity code 2709) by 22.7% (by 33,400 tonnes) compared to the same period in 2019, to 180,673 tonnes.

According to the State Customs Service, in the first quarter, $99.746 million worth of raw materials were imported, which is 41.3% more than in January-March 2019 ($70.581 million).

So, oil supplies from Azerbaijan totaled $37.884 million (a share of 37.98%), Libya some $31.745 million (31.83%), the United States some $30.118 million (30.19%).

Ukraine did not export crude oil in January-March 2020 and in 2019.

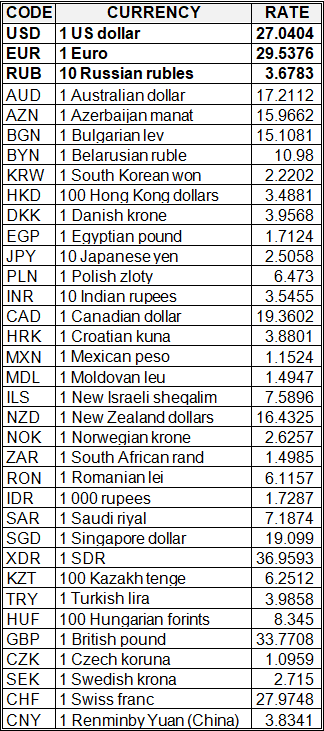

National bank of Ukraine’s official rates as of 14/04/20

Source: National Bank of Ukraine