The Economy Secretariat (Secretaría de Economía) of Mexico has announced the launch of an administrative procedure for reviewing safeguard duties imposed on hot rolled sheets originated from Ukraine and Russia.

According to the announcement made on March 26, 2020 on official website of the Mexican government bulletin, the duties are being reviewed as the duties imposed earlier expired.

According to the document, safeguard duties on hot rolled sheets were imposed by Mexico on March 28, 2000 in the amount of 46.66% for Ukraine and 30.31% for Russia. On March 17, 2006, the duties were extended. After the new revision on September 8, 2011 it was decided to cut the duties for Ukraine to 25% and to 21% for Russia. On January 28, 2016 it was decided to extend the duties.

Italian aviation authorities granted Ryanair, the Irish low-cost airline, temporary rights to operate 28 weekly flights between the cities of Italy and Ukraine until July 13, 2020, the National Civil Aviation Authority (ENAC) has said on its website.

Ryanair was allowed to fly to Kyiv from Bergamo, Bologna, Rome, and Catania; to Odesa and Lviv from Rome, Bergamo and Bologna; and also to Kharkiv from Bergamo.

Earlier, Ryanair announced the cancellation of most of its flights from March 24. At the same time, the carrier does not expect to resume flights in April and May due to coronavirus disease (COVID-19) spread and the introduction of significant restrictions on flights by various European countries.

Ryanair intended to launch flights from Italy to Ukraine in 2019.

“In Italy, we fly from Milan and Pisa. However, the Italian government provided certain advantages to the airline, which has only two flights. We filed a lawsuit and won the case, thus we will also fly from Italy to Ukraine,” the airline’s Chief Commercial Officer David O’Brien said.

ARX Insurance Company (formerly AXA Insurance, Kyiv) in March 2020 paid customers almost UAH 89 million, which is 15% more than in the same period in 2019.

According to a press release from the insurer, the amount of average daily payments remains unchanged at about UAH 4 million.

The largest payment in March exceeded UAH 2.550 million and was made to an individual under a car insurance contract.

In addition, the medical assistance and contact center of ARX continue to work 24/7. The number of calls they received in March exceeded 40,000.

The company emphasizes that during quarantine it remains in touch with customers offline, online, in social networks, instant messengers. All products that ARX offers are sold as normal.

ARX has been operating in the insurance market for 25 years, the number of its customers is about 1 million. It is represented by 70 offices in all large cities of Ukraine, has 1,530 insurance agents, 90 operators of contact centers.

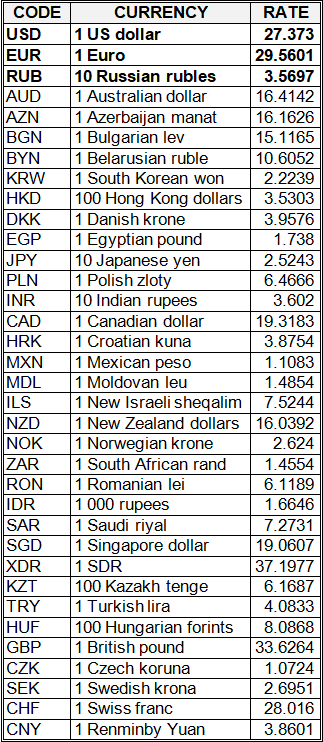

National bank of Ukraine’s official rates as of 06/04/20

Source: National Bank of Ukraine

The Kyivstar mobile communications operator has connected another 43 Ukrainian settlements to the 4G network, the company said on Monday.

The operator, in particular, connected the cities of Khmelnyk, Chyhyryn, Pustomyty, Komarno, Schyrets and others. Thus, the total number of settlements where high-speed mobile Internet services are available has exceeded 10,000.

According to the company, from 2018 to 2019, the volume of data traffic in the Kyivstar mobile network doubled, from 325 to 649 petabytes (PB).

As reported, Kyivstar in 2019 increased revenue by 19.6%, to UAH 22.392 billion, EBITDA by 39.4%, to UAH 14.683 billion. The number of mobile operator subscribers in the fourth quarter of 2019 decreased by 0.6% compared to the same period in 2018, to 26.2 million, while the number of fixed-line subscribers increased by 10.8%, to 1 million.

Kyivstar is the largest Ukrainian telecommunications operator. It provides communications and data transfer services based on a wide range of mobile and fixed technologies, including 3G. By the end of 2018, its services were used by about 26.4 million mobile subscribers and about 900,000 fixed Internet customers.

Ukrainian pharmaceutical companies are ready to produce around 1,000 PCR tests per day, which will allow them to satisfy the demand for PCR tests in Ukraine in full, Deputy Health Minister, chief sanitary doctor of Ukraine Viktor Liashko has said during a press briefing in Kyiv on Monday.

“We expect to receive 22,000 PCR test systems from Ukrainian producers, which will allow carrying out around 2 million tests. The systems are expected to be ready next week. Ukrainian producers are ready to make around 1,000 PCR tests per day, which will allow satisfying the demand for testing in Ukraine in full,” he said.

The deputy minister said that currently Ukraine has around 250,000 PCR test systems in stock and added that Ukraine carries out not less tests than other European countries during the epidemic.

“We should realize that Europe is 15-20 days ahead in terms of the epidemic development. We monitor the dynamics and developments in Spain, Italy and France. If we look at the number of tests, Ukraine carries out not less of them than other countries. Thus, the testing issue is not a problem. Ukraine is ready to carry out tests,” he said.

Liashko also said that the Health Ministry will open a hotline for the patients whose requests for coronavirus (COVID-19) testing were rejected.