Distribution system operators (DSOs) DTEK Networks continued to repair energy infrastructure in the first half of 2025, investing almost UAH 2.3 billion in its restoration and construction, according to the company’s press service.

“In the first half of the year, we invested almost UAH 2.3 billion in new construction, technical re-equipment, and reconstruction of electrical networks and power equipment, including UAH 686 million for the introduction and development of commercial electricity metering and other areas, and about UAH 930 million. We also invested almost UAH 352 million in repairs in four regions of Ukraine over the six months,” said Alina Bondarenko, CEO of DTEK Networks, as quoted in the press release.

According to the DTEK Networks press release, 4,370 km of overhead power lines, 2,870 cable lines, and more than 3,600 energy facilities in Kyiv, Kyiv, Dnipropetrovsk, and Odesa regions were upgraded.

As part of the investment program in the first half of the year, three transformer and four distribution substations were reconstructed, seven new transformer stations were built, and over 101,000 smart meters were installed.

“DTEK Networks is actively implementing its 2025 repair program, preparing the energy infrastructure of four regions—Kyiv, Kyiv, Dnipropetrovsk, and Odesa—for the upcoming heating season,” the operating holding company said.

In particular, in the first half of the year, energy companies have already completed over 60% of the planned repairs to power lines.

According to her, in the first six months, DTEK energy companies also repaired 634 transformer substations and distribution points and almost 3,000 other energy facilities.

DTEK Networks develops its business in electricity distribution and power grid operation in Kyiv, Kyiv, Dnipropetrovsk, Donetsk, and Odesa regions. The company’s power grids serve 5.1 million households and 150,000 businesses.

The Department of Health of the Kyiv City State Administration reports a multiple increase in the number of hospitalizations due to COVID-19 in the Ukrainian capital since the beginning of July.

“If as of July 1, 15 people were in the infectious disease departments of inpatient communal medical institutions, at the moment – 68, 24 of them – children. It is clear that in hospitals get those whose course of illness can not be called mild and who need constant monitoring of medics, serious treatment, oxygen support, etc.,” – reported on the page of the Department in Facebook on Thursday evening.

The post notes that staying in shelters – enclosed spaces with limited ventilation – increases the risk of infection, including COVID-19. “Don’t forget your mask in closed confined spaces…. Wash your hands regularly or use antiseptic. Stay at home and seek medical attention at the first symptoms,” the department advised.

Naftogaz Group companies paid UAH 44.4 billion in taxes in the first six months of 2025, of which UAH 40.7 billion went to the state budget, according to Serhiy Koretsky, chairman of the board of Naftogaz of Ukraine.

“In the first half of 2025, Naftogaz Group companies paid UAH 44.4 billion in taxes to budgets of all levels, which is almost 7% of all tax revenues to the country’s budget,” he said in a Facebook post on Friday.

He noted that of this amount, UAH 40.7 billion went to the state budget and another UAH 3.7 billion to local budgets.

“Supporting the financial stability of the state is an integral part of our responsibility as a company operating in a strategic sector of the economy,” Koretsky commented.

As reported, the consolidated revenue of the Naftogaz Group in 2024 increased by 22.0% to UAH 298.75 billion, and net profit by 63.9% to UAH 37.91 billion.

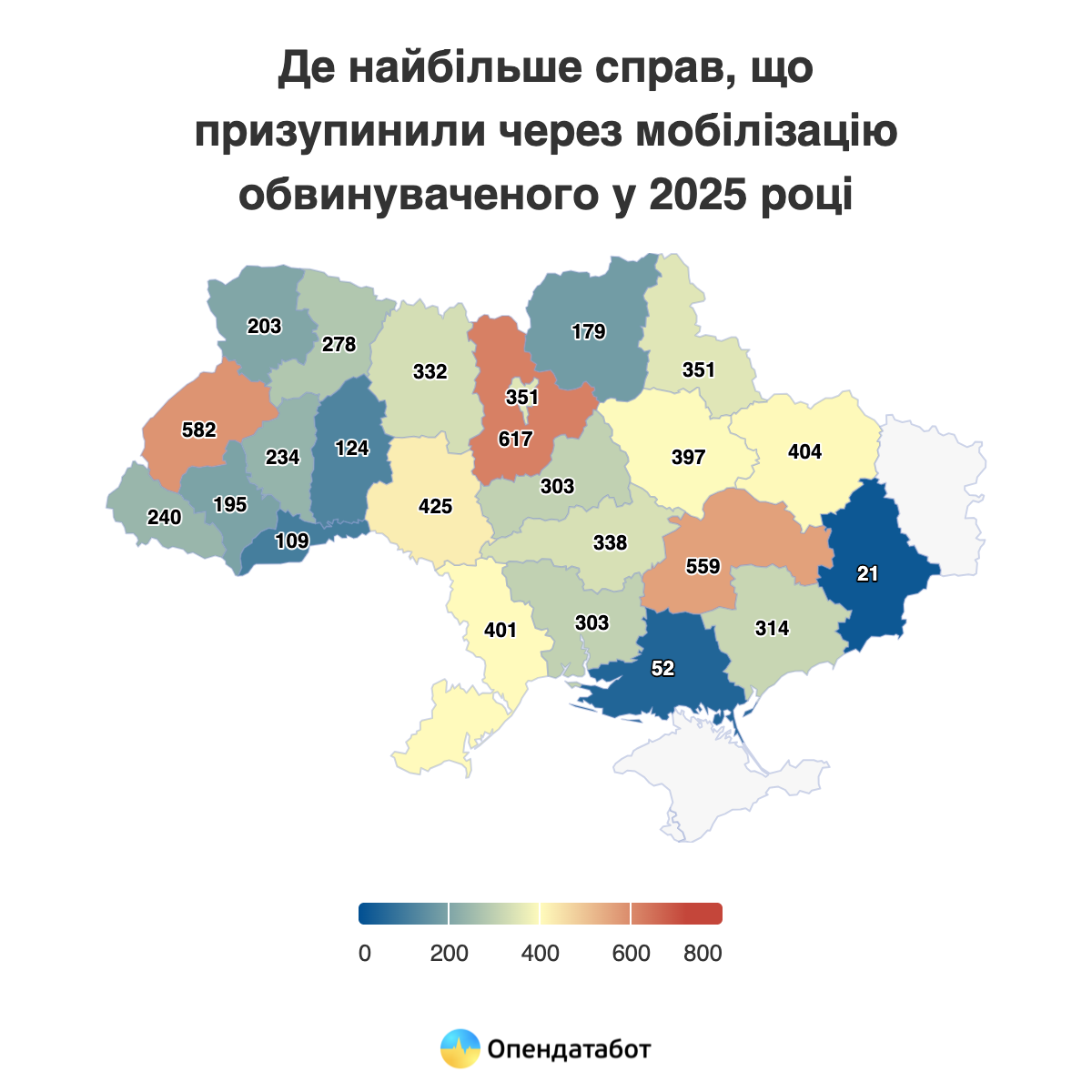

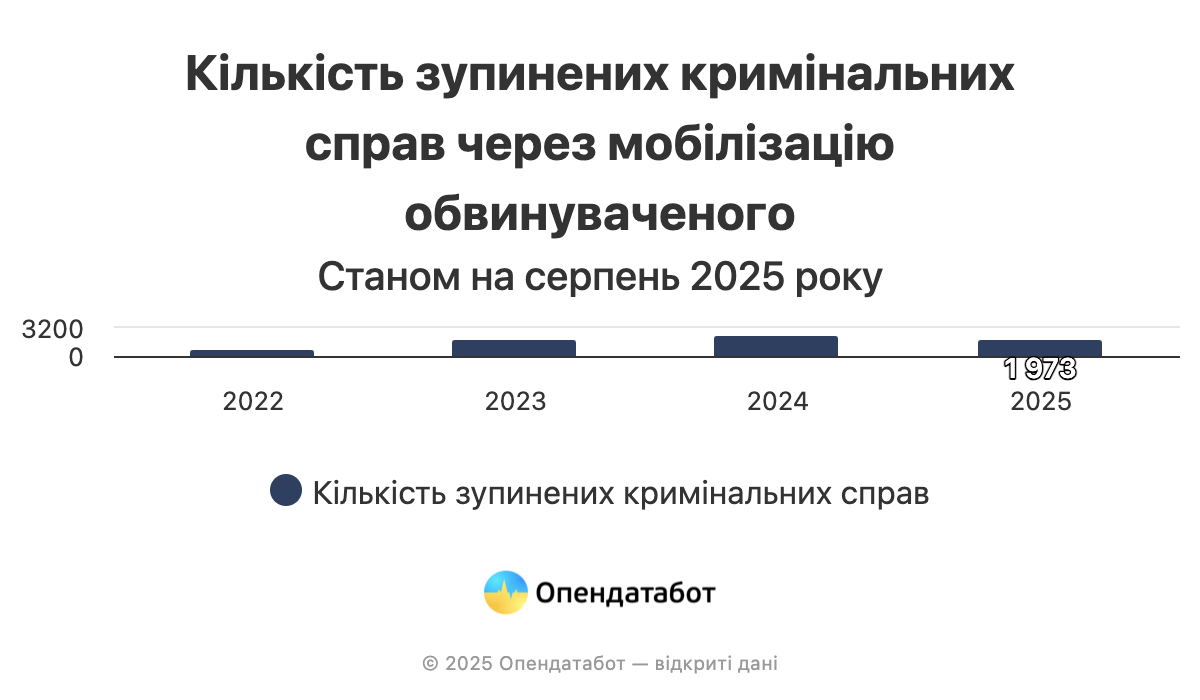

At least 7.3 thousand criminal cases have been suspended due to the defendant’s conscription into the army since the beginning of the full-scale invasion, according to the court registry search engine Babusya. Thus, this year, more than 1,900 cases have been suspended due to the mobilization of the accused. This is almost as many as for the whole of 2023. The largest number of such cases this year is in Kyiv, Lviv, and Dnipro regions.

At least 7,312 criminal proceedings have been suspended due to the mobilization of the accused into the Armed Forces since the beginning of the full-scale invasion. This legal mechanism appeared in 2022, when the Criminal Procedure Code of Ukraine was amended, and since then it has been actively used by the courts.

The number of such suspensions is growing from year to year. For example, 858 cases were suspended in the first year of the full-scale program, and the number of such cases has only increased every year. The record year was 2024, when 2,406 cases were stopped where the accused joined the Armed Forces. This year, there are already 1973 suspended cases.

Most of the decisions to suspend cases due to mobilization were made in Kyiv region – 617. The second place is occupied by Lviv region (582), and the third place is occupied by Dnipropetrovs’k region (559).

It should be understood that the suspension of proceedings is not the same as automatic exemption from liability. However, in fact, the case is postponed indefinitely. This creates an opportunity for abuse – especially in high-profile corruption cases or when it comes to rear-guard positions where participation in hostilities is not required.

That is why the Verkhovna Rada has registered draft law No. 13284, which proposes to amend the Criminal Code and the Criminal Procedure Code regarding the specifics of prosecuting persons called up for military service. In particular, it provides for the possibility of continuing pre-trial investigation and trial of cases on certain categories of crimes, even despite the mobilization of the accused.

The new draft law should also reduce opportunities for abuse of mobilization: the suspension of proceedings should be clearly limited to cases of direct participation of the accused in defense measures, confirmed by a combat order (instruction) issued by the commander of a military unit or subdivision.

“Currently, there is obviously a lack of a mechanism to appeal the suspension of proceedings and resume the proceedings in cases where the court or a party abuses its right. Of course, mobilization should not become a circumstance that offsets the fundamental principles of criminal procedure, in particular, the implementation of the principle of access to justice, competition and inevitability of punishment. However, we should also think about a person who, risking his life, wants to at least whitewash his reputation, but is unable to defend himself in court while at war,” comments Tetiana Popovska, senior associate at Asters.

https://opendatabot.ua/analytics/mobilization-and-court

Gold prices rose to a record high on news that the US would impose tariffs on 1-kilogram gold bars imported from Switzerland. During Friday trading on the Comex exchange, December futures for the precious metal reached $3,534.1 per ounce, a historic high. They are currently trading at $3,484.5 per ounce, up 0.9% from the previous close.

The US Customs and Border Protection agency said that gold bars weighing 1 kg and 100 ounces (2.8 kg) should be classified under a customs code that is subject to import duties, according to a July 31 ruling seen by the Financial Times.

The customs decision came as a surprise to the industry. Experts had assumed that these types of gold bars would be classified under a different customs code that would not be subject to the new duties imposed by US President Donald Trump.

Kilogram bars are the most common form of trade on Comex, the world’s largest gold futures market, and account for the bulk of gold bar exports from Switzerland to the US.

Relations between Washington and Bern deteriorated after the US announced last week that it would impose 39% import duties on products from that country. According to customs data, gold is one of Switzerland’s main exports to the US.

“The prevailing opinion was that precious metals remelted by Swiss refineries and exported to the US could be shipped without paying duties,” said Christoph Wild, president of the Swiss Precious Metals Association. The decision to impose the duty is “another blow” to gold trading between Switzerland and the US, he believes.

Imports of goods from Ukraine in January-July 2025 amounted to $45.9 billion in monetary terms, which is 17.4% more than in the same period of 2024, while exports grew by 2.7% from $22.6 billion to $23.2 billion, according to the State Customs Service (SCS).

“At the same time, taxable imports amounted to $34.7 billion, which is 76% of the total volume of imported goods. The tax burden per 1 kg of taxable imports in January-July 2025 was $0.52/kg,” according to a publication on the agency’s Telegram channel on Thursday.

Traditionally, the largest importers of goods to Ukraine were China ($9.9 billion), Poland ($4.4 billion), and Germany ($3.7 billion).

The largest exporters from Ukraine were Poland ($2.9 billion), Turkey ($1.9 billion), and Italy ($1.3 billion).

It is noted that in the total volume of goods imported in January-July 2025, 68% were machinery, equipment, and transport – $18 billion (during customs clearance, 112.7 billion hryvnia, or 29% of customs payments, were paid to the budget), chemical industry products – $7.3 billion (57 billion hryvnia, or 15%), fuel and energy – $5.9 billion (105.5 billion hryvnia, or 27%).

The top three most exported goods also remain unchanged: food products ($13 billion), metals and metal products ($2.6 billion), machinery, equipment, and transport ($2.2 billion).

During the seven months of customs clearance of goods subject to export duties, UAH 159.1 million was paid to the budget.