Citibank’s (Kyiv) net profit for January-March 2020 amounted to UAH 411.59 million, which is UAH 1.9 million or 0.5% more than for the same period in 2019 (UAH 409.66 million), according to the quarterly statements of the bank. According to the report on the bank’s website, its net interest income for the first quarter amounted to UAH 501.8 million, which is 5.1% more than for the first quarter of last year.

The bank’s assets for the reporting period increased by 0.9%, to UAH 31.68 billion, in particular NBU deposit certificates by 13.2%, to UAH 14.5 billion, and loans to customers decreased by 23.5%, to UAH 4.2 billion.

Liabilities rose by UAH 26.8 million or by 0.1%, to UAH 28.18 billion, in particular customer deposits by UAH 45.4 million or by 0.16%, to UAH 27.7 billion.

Net worth increased by UAH 248.9 million, or 1.14%, to UAH 3.5 billion. Charter capital remained at the level of UAH 200 million.

Citibank, founded in 1998, is a subsidiary of the American Citibank NA.

According to the National Bank of Ukraine, by January 1, 2020 Citibank ranked 13th among 75 banks operating in the country in terms of total assets (UAH 31.457 billion).

Hungarian low-cost airline Wizz Air and German Lufthansa plan to resume flights from Ukraine in late May or early June.

The relevant information is available in the booking systems of the airlines.

In particular, Wizz Air has opened booking tickets for flights from Kyiv, Zaporizhia, Lviv, Odesa and Kharkiv since May 23. Most flights will start to operate in June.

Lufthansa has opened booking flights from Kyiv to Berlin since June.

Earlier, the resumption of direct flights from Ukraine was announced by Czech national airline Czech Airlines, namely, from Prague to Kyiv and Odesa at the end of May 2020.

There is a decrease in the number of patients with pneumonia in Ukraine, Minister of Health Maksym Stepanov said during a press briefing in Kyiv on Wednesday morning.

“We have increased the number of PCR tests for coronavirus up to 8,000 per day, but the number of patients has not exceeded 600 for three weeks in a row. In addition, there is good statistics regarding patients with pneumonia. If earlier we tested about 800-900 people with pneumonia per day, today this number does not exceed 250-300 people, and we test absolutely everyone. That is, we see a decrease in patients with pneumonia. Still, quarantine measures produce their effect,” he said.

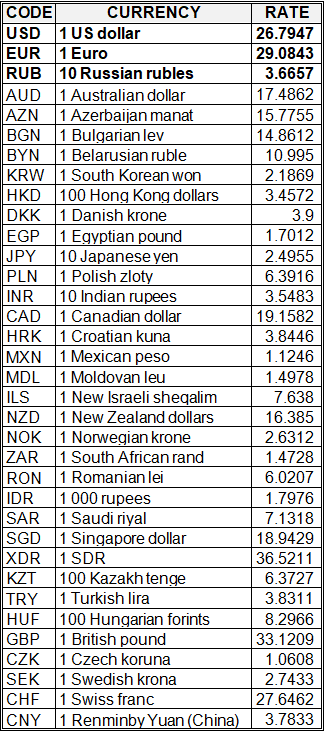

National bank of Ukraine’s official rates as of 13/05/20

Source: National Bank of Ukraine