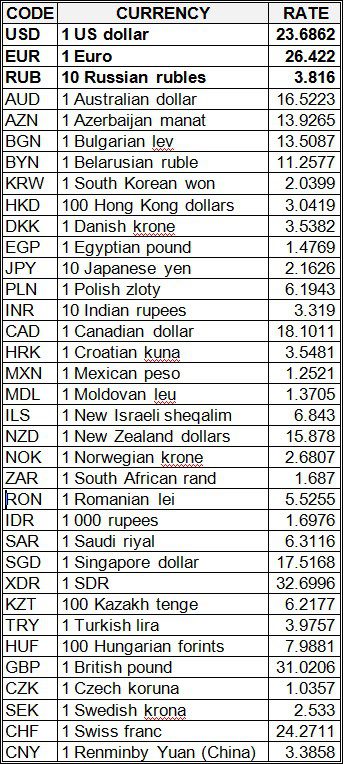

National bank of Ukraine’s official rates as of 28/12/19

Source: National Bank of Ukraine

The grandiose «Winter Fairy Tale» show-program, dedicated to the New Year and Christmas holidays is taking place in the «Kyivan Rus Park». Till January, 19 bright shows with special effects and horse-trick performances, ancient Slavic Winter amusements, tasty dishes prepared on fire, horse riding, master-classes, round dances, games and prize draws will be waiting for the guests.

On December, 28 and 29 the festive New Year performance with the demonstration of the «Kogel mogel» interactive musical performance, horse-trick performances, horse riding, master-classes, round dances, games and prize draws will take place in the Principality.

On December, 30 the guests will get a chance to visit the Principality, enjoy its architecture, make bright photos in the medieval city.

If you want to celebrate New Year 2020 in a princely, bright, original way and remember this holiday forever, then go to Ancient Kyiv. Here you can gather a big company or make new friends and have a lot of fun.

On the night from December, 31 2019 from 20:00 to January, 1 2020 a grandiose New Year’s performance with a masquerade, a twin show, horse-trick performances, live vocals, an interactive musical with fire special effects will take place in the Principality. Ancient Kyiv will be shine with bright lights and garlands, bonfires and torches. Tasty dishes prepared on fire, hot drinks and medieval tinctures, free horse riding (from 19:00 till 21:00), gifts and treats for everyone will be waiting for the guests, and at the end – fireworks.

The beginning of the program on December, 31 at 20:00. The end around 3:00.

It will be possible to warm up in the Main New Year`s Residence, near the bonfires, with hot dishes prepared on fire and mulled wine, fiery dances, in the warm Princely tavern by previous booking.

On January, 1 Ancient Kyiv invites to start the New Year in a nice and bright way, and spend an unforgettable day on fresh frosty air, surrounded by the masterpieces of wooden architecture of Kyivan Rus.

On January, 2 – 5 Princess Winter calls the guests once again to the « Winter fairy tale » show-program with horse-trick shows and the musical performance in which both adults and children will get a chance to participate. And also: winter amusements, horse riding, master-classes, games, competitions and round dances.

On January, 6 and 7 the inhabitants of Ancient Kyiv invite everybody to the Christmas celebration according to ancient Slavic traditions, with ancient rites and winter amusements, horse-trick performances, costumed characters, the interactive musical performance presentation. The real Christmas nativity scene will come to life in front of the viewers. The action will pass in ancient Slavic. After this the guests will be invited to a master-class on Christmas carols learning and singing.

Details: https://parkkyivrus.com

The Interfax subscribers can save money with the “openbusiness-20” promo code for a 20%-discount for the adult ticket (at full price) to the Principality of Kyivan Rus:

– by previous order by tel.: +38 044 461-99-37, +38 050 385-20-35

– or at the cash desk at the entrance to the «Kyivan Rus Park».

The European Trade Union Confederation is concerned about a lack of social dialogue in Ukraine and will send its monitoring mission to the country, Natalia Zemlianska, Chairman of the All-Ukrainian Trade Union of Production Workers and Entrepreneurs of Ukraine Natalia Zemlianska has said. “On December 17, the European Trade Union Confederation issued a statement expressing very strong concern over a lack of social dialogue in Ukraine,” Zemlianska said at a press conference at Interfax-Ukraine.

According to her, precisely because of the absence of such a dialogue, the parliament passed bills that discriminate against individual entrepreneurs, the Cabinet of Ministers is trying to agree on a new Labor Code, and people are forced to go outside in order to be heard.

“The European Trade Union Confederation is committed, firstly, to raise this issue at the level of the European Commission and the European Parliament, and secondly, it will now organize a mission to Ukraine to monitor the situation on the spot,” the expert stated.

Triumph Media Group LLC (Kyiv) plans to continue increasing the market share of the Planeta Kino movie theater network in 2020, and aims to generate more than UAH 1 billion from the sale of tickets and sales in bars. “Our plans for 2020 do not change dramatically: we will continue to strengthen our market position as a technological and innovative leader, we will continue to develop our brand, open a cinema in Dnipro, and increase the market share and the overall performance of all cinemas in the network. With regard to revenue, we plan to earn more than UAH 1 billion from tickets and sales in bars,” network co-owner Dmytro Derkach told Interfax-Ukraine.

He did not specify what revenue the company expects over 2019, but noted that it increased by 15% compared to 2018.

At the same time, Derkach noted a slight decrease in attendance in the network this year.

“The year ends quite successfully for us: we achieved the targets, we managed to raise the market share, in particular due to the opening of a new cinema in the River Mall trade center in Kyiv … On average, we managed to grow by 15%, we work more effectively than competitors in terms of attendance and revenue rates,” he said.

According to him, Planeta Kino plans in the spring of 2020 to open a new cinema in the Apollo shopping center (Dnipro).

The Planeta Kino network as of December 2019 has eight cinemas in Kyiv, Odesa, Lviv, Kharkiv, and Sumy. In addition to the Apollo shopping center, the company plans to open a new cinema in the Ocean Mall shopping center (Kyiv).

The Cabinet of Ministers has transferred 530 state-owned enterprises for privatization, Prime Minister Oleksiy Honcharuk has stated. “The government transferred 530 state enterprises for privatization. In almost four months, more state objects were transferred for privatization than in all 28 years of independence,” Honcharuk wrote on Telegram.

The total book value of the assets agreed for sale exceeded UAH 12 billion.