JSC Ukrzaliznytsia has served the first transit train on the Sanya-Slawkow (China-Poland) route, head of the company Yevhen Kravtsov said on his Facebook page.

“The first container train from China to the European Union traveled 39 hours and 54 minutes through the territory of Ukraine. For the first time, the train traveled on the wide gauge LHS without an overload on the border. Colleagues met it in Poland’s Slawkow. The China-E transit route through Ukraine is reliable, cheap and convenient for all participants in the logistics chain, and this train is a good and first important sign in organizing large-scale projects with China and Central Asia for Ukrzaliznytsia,” Kravtsov said.

He also said that Ukrzaliznytsia has a number of advantages for such routes and their development in the future, as it can be part of the land, sea and TITR routes (Trans-Caspian International Transport Route).

At the same time, he noted a decrease in the volume of transit traffic of the country as a whole.

“Since 2008, the volume of transit traffic of Ukraine has been falling. Transit from China to the EU countries has a number of artificial barriers with political coloring. This is not a business issue, but geopolitics,” Kravtsov explained, adding that Ukrzaliznytsia is the most reliable partner for transit, as it offers alternative and profitable routes.

According to the head of Ukrzaliznytsia, the indicated container train left China’s Xi’an for Slawkow, the travel time was 12 days. According to Kravtsov, for the Ukrainian railway company this is an effective beginning of the year in freight traffic.

The Ministry of Digital Transformation of Ukraine together with the relevant committee of the Verkhovna Rada are working on the preparation of a tax reform for the IT industry, which provides for the establishment of a single tax at the level of 4-7% of the companies’ turnover. Deputy Minister of Digital Transformation Oleksandr Bornyakov gave this information on his Facebook page.

“We propose discussing a single tax for legal entities without a turnover limit and setting it at 4-7%… According to this regime, a legal entity-exporter of services will pay a single tax and will be a tax agent for an employee, paying two single social security contributions and a military tax,” Bornyakov said.

He also said that the following requirements for those who join this taxation regime are being discussed: staff of more than 10 employees; the share of exports in profit and the share of the salary fund in the cost of production being more than 75%; and the average salary being at least five minimum wages.

According to the Ministry of Digital Transformation, this will create legal working environment for the industry, make it more attractive for investment, creating a transparent and understandable corporate structure. In addition, this will create equal competitive working conditions in the industry, as well as conditions for the export of other services.

“At the same time, the model preserves the mechanism for ensuring social guarantees for employees and does not increase the tax burden and administration. After all, on the one hand, tax and reporting are introduced for IT companies, and on the other, we cancel a number of taxes for employees,” the deputy minister said.

He also cited statistics according to which in the first half of 2019, according to the Ministry of Digital Transformation, 158,000 IT private entrepreneurs with income of UAH 52.3 billion worked in Ukraine. At the same time, in Ukraine, there are only about 60,000 officially employed employees of IT companies, whose payroll amounted to about UAH 6.5 billion in the first half of last year.

“And no, we are not sure that this is the only right decision. But, after spending hours of analysis, we consider it to be the best idea that will literally create an industry where not 200,000 legally unrelated private entrepreneurs will work, but fully-featured transparent companies,” Bornyakov said.

He also recalled that the previously formulated idea to create a fifth group of private entrepreneurs for IT specialists was criticized because it violated the principles of equality of taxpayers and did not eliminate any risks in the system.

As reported, previously a group of 20 deputies of the Servant of the People parliamentary faction proposed to the parliament to exempt startups from taxes for a period of nine months from the moment of their registration, making appropriate changes to the Tax Code of Ukraine.

For this purpose, it was planned to introduce an additional fifth single tax group, which will include startups using exclusively cash registers and/or cash settlement software and which income during the first nine months of activity does not exceed UAH 300,000.

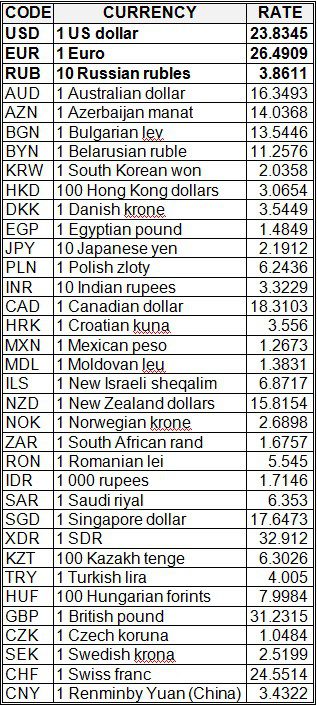

National bank of Ukraine’s official rates as of 09/01/20

Source: National Bank of Ukraine

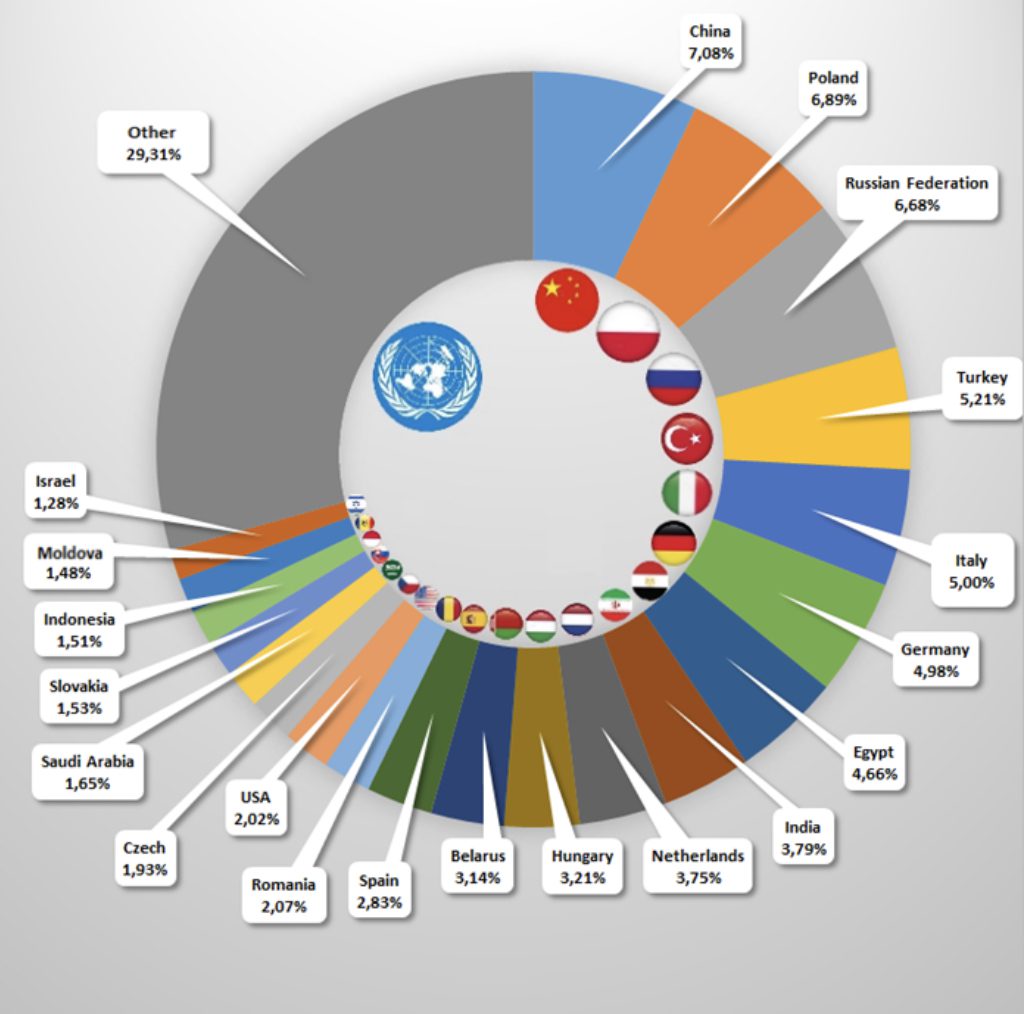

Main trade partners of Ukraine in % from total volume (import from other countries to Ukraine) in Jan-Oct 2019

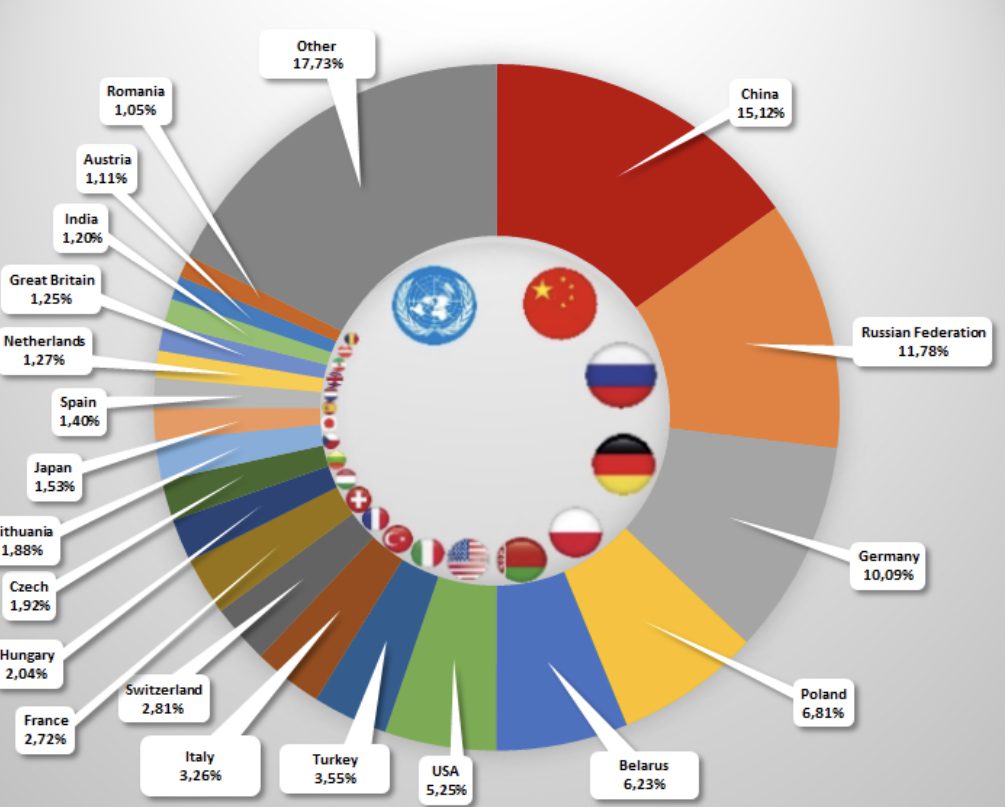

Main trade partners of Ukraine in % from total volume (export from Ukraine to other countries) in Jan-Oct 2019