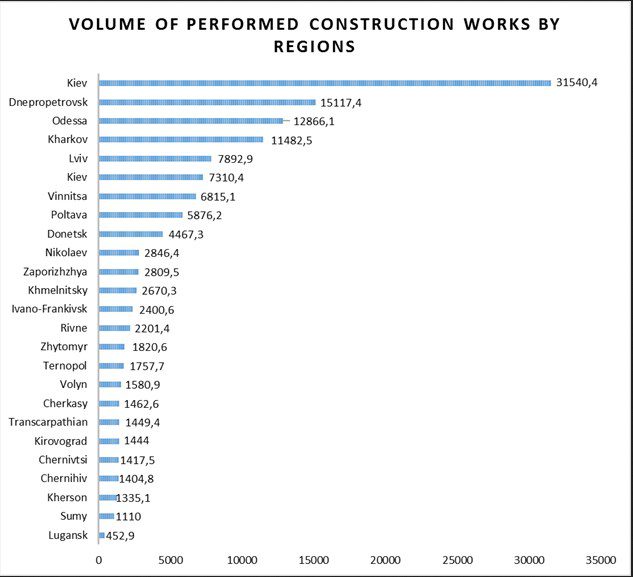

Volume of performed construction works by Ukrainian regions

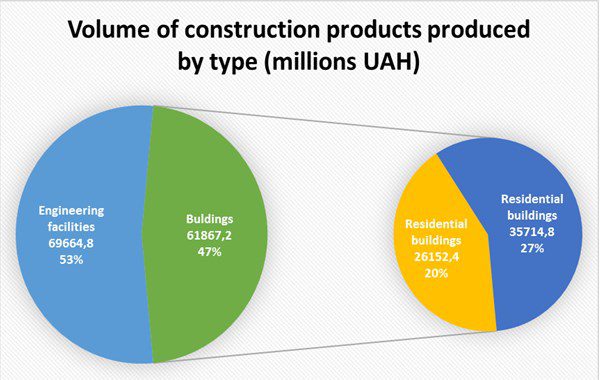

Volume of construction products produced by type in Jan-Oct in Ukraine

The affordable price becomes the important criterion for choosing effective medicines, Indian Ambassador to Ukraine Partha Satpathy has said.

“Today, the low price offered for an effective and high-quality drug is becoming a very important criterion for choosing medicines. Leading Indian pharmaceutical companies introduce medicines manufactured at modern production sites, taking into account the laws of countries with Stringent Regulatory Authorities, the requirements of EU regulatory agencies and the FDA, to the Ukrainian market,” he said during the third annual business seminar entitled “India – a Global Force in Pharmaceuticals, a Reliable Partner for Ukraine” organized by the Indian Pharmaceutical Manufacturers’ Association (IPMA) in cooperation with the Embassy of India in Ukraine last week in Kyiv.

The ambassador said that the government of India has determined the production of effective and affordable medicines, which the country can provide not only with the needs of the domestic market, but also with export, as one of the directions of state policy.

“The Indian pharmaceutical industry is so successful that it is capable to satisfy the needs of not only the domestic market of India, but the whole world. These needs are met on the basis of two principles: the availability of medicines and their reasonable price. Indeed, the health of many people depends on the availability of efficiency and the price of medicines,” he said.

Satpathy recalled that “the Indian government has taken certain steps: it has identified priority medicines, encouraged the manufacturing companies of these medicines and determined the basis for the implementation of the state regulatory policy to ensure the quality and effectiveness of medicines.”

The ambassador also said that Indian medicines can play a significant role in the implementation of the government’s Affordable Medicines program in Ukraine.

“It is high-quality medicines at a reasonable price that play an important role in this program. Therefore, the Indian side can be useful in this direction,” he said.

In addition, Satpathy noted the potential of Indian pharmaceutical companies in the segment of vaccines, oncology and drugs for the treatment of cardiovascular diseases for the entire world, as well as in the production of innovative medicines.

According to Proxima Research, in January-October 2019, 41.3 million packages of Indian medicines were sold on the retail market of Ukraine for a total of UAH 4.369 billion, which is 6.3% in cash and 4.6% in kind of the entire retail pharmaceutical market of Ukraine.

In turn, IPMA President Dr. Menon Ramanan Unni Parambath emphasized the willingness of leading Indian manufacturers to provide Ukrainian patients with a wide range of effective and high-quality medications at affordable prices.

For his part, Deputy Minister of Health of Ukraine Dmytro Koval said that the quality of registered Indian drugs is in line with international standards, and leading health experts acknowledge this.

According to the data announced during the seminar, the top 10 in terms of sales in the Ukrainian retail market among Indian companies in January-October 2019included, in particular, Dr. Reddy’s Laboratories Ltd. (UAH 632.078 million or 5.392 million packages), Organosyn Life Sciences (UAH 460.279 million), Abryl Formulations (UAH 268.204 million), Sun Pharma (UAH 216.326 million), Euro Lifecare (UAH 188.365 million) and Macleods Pharmaceuticals (UAH 157.947 million). They are members of IPMA.

NJSC Naftogaz Ukrainy in 2020 plans to create an exchange to trade with gas, Head of Naftogaz integrated gas business unit Andriy Favorov has said.

“Our idea, our strategy, is that next year we will create an exchange where Naftogaz will act as a buyer and seller of gas,” he said in an exclusive interview with Interfax-Ukraine.

According to him, the decision has already been approved by the board and the supervisory board of the company. The required preparatory work is ongoing to launch the exchange. In particular, a tender was held to implement the ETRM (Energy Trade Risk Management) system, which will take into account all transactions and market fluctuations.

“The introduction of this system will give us the required tools to control commercial risks,” Favorov said.

Milk production in Ukraine in January-November 2019 decreased by 3.7% compared to the same period in 2018, to 9.08 million tonnes. According to the State Statistics Service, in January-November 2019, farmers produced 3.05 million tonnes of meat (live weight), which is 5.8% more than in the same period of 2018.

Egg production grew by 3.5%, to 15.51 billion units.