Wholesale prices for sugar in the 2019/2020 marketing year (MY, September-August) will increase by 18%, to UAH 13,000 per tonne due to a decrease in production, the press service of the Ukrtsukor National Association of Sugar Manufacturers has said. According to the association, sugar production in the 2019/2020 MY will amount to 1.1-1.2 million tonnes.

“The decrease is primarily due to the reduction in the area under sugar beets and adverse weather conditions. The lack of moisture in the soil affected the development of sugar beets and as of August 1 sugar beets are massively losing the weight of the tops, which, in turn, will lead to low sugar content,” еhe press service said citing deputy chairman of the board of Ukrtsukor Ruslan Yanenko.

In addition, agronomists note common root diseases.

“According to our estimates, 32 sugar enterprises will work this season,” Yanenko said.

As reported, sugar production in the 2018/2019 MY decreased by 15%, to 1.82 million tonnes. In the season, 42 sugar factories worked.

The Institute of International Finance (IIF) predicts a slowdown in real gross domestic product (GDP) growth in Ukraine from 3.3% in 2018 to 2.8% in 2019 and its subsequent slight acceleration to 2.9% in 2020.

The National Bank of Ukraine has improved its macro forecast for 2019–2021: the estimate of the real growth of the economy this year has been raised from 2.5% to 3%, and in the next year from 2.9% to 3.2%.

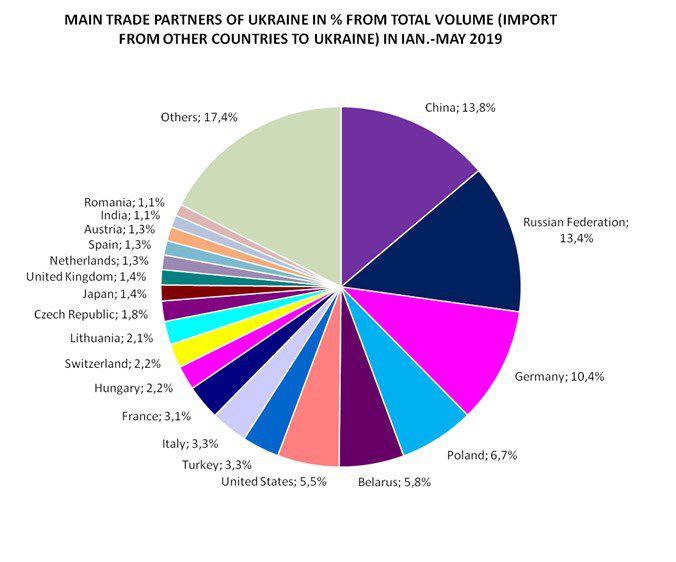

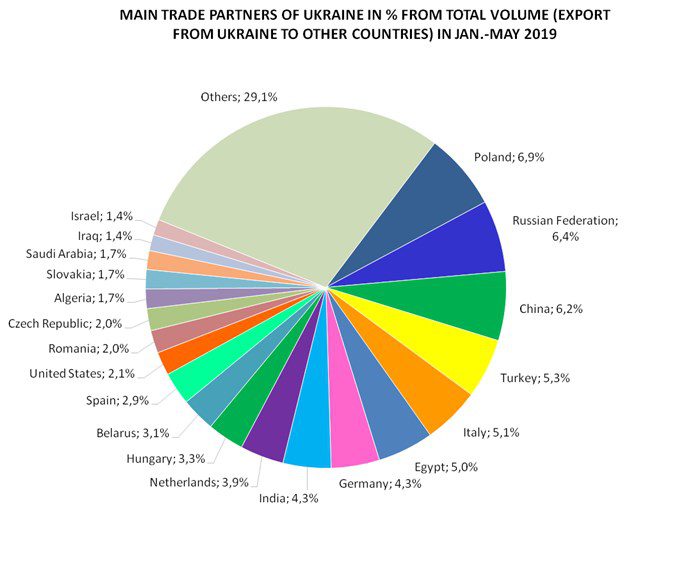

The deficit of Ukraine’s foreign trade in goods in January-May 2019 increased by 27.4% compared with January-May 2018, to $2.634 billion, the State Statistics Service has reported.

The Cabinet of Ministers of Ukraine on July 10 approved the strategy for the development of exports of agricultural, food and processing industry products until 2026, as well as a plan for its implementation, the press service of the Ministry of Agrarian Policy and Food has said.

Ukraine’s Investment Attractiveness Index in January-June 2019 fell to the level of 2016, being 2.85 points on a 5-grade scale compared with 3.07 in H2 2018, according to findings of the European Business Association (EBA).

The actual inflation rate in Ukraine in June 2019 was higher than the forecast published in the Inflation Report (April 2019), according to the NBU’s commentary on the inflation rate posted on the central bank’s website.

Consumer prices in Ukraine in June 2019 fell by 0.5% compared with May 2019, while in annual terms inflation of 9% was seen, the State Statistics Service of Ukraine reported.

The surplus of Ukraine’s national budget in H1 2019 totaled UAH 2.1 billion, including the deficit of the general fund of the national budget being UAH 6.8 billion, while in January-May 2019 the surplus of the national budget was UAH 7.7 billion with the deficit of the general fund of UAH 2.14 billion, Ukraine’s Finance Ministry has reported on its website, referring to preliminary data from the State Treasury Service of Ukraine.

The deficit of the national budget of Ukraine in January-June 2019 amounted to UAH 871 million, in particular the general fund deficit was UAH 8.67 billion with the target being UAH 22.99 billion, the State Treasury Service has said.

The assets of the National Bank of Ukraine (NBU) in January-June 2019 decreased by 5.3% and amounted to UAH 993.707 billion, the corresponding financial indicators were published by the central bank in the Uriadovy Kurier edition.

The consolidated balance of payments of Ukraine in May 2019 saw a deficit of $750 million against a deficit of $45 million in April, a surplus of $652 million in March 2019 and $266 million in May 2018, which is associated with large payments on public debt and an increase in cash outside banks.

Industrial production in Ukraine in June 2019 decreased by 2.3% compared with June 2018, after growing in May by 1.6%, April by 5.2%, in March by 2.1% , Ukraine’s State Statistics Service reported.

The transport enterprises of Ukraine (excluding the territory of the Autonomous Republic of Crimea and Sevastopol, as well as part of the JFO area) in January-June 2019 increased freight transportation by 8.2% compared to the same period of 2018, to 328.5 million tonnes, the State Statistics Service has reported.

The transport companies of Ukraine in January-June 2019 carried 2.137 billion people, which is 6.3% less than in the same period of 2018, the State Statistics Service has reported.

The volume of construction work performed in Ukraine in June 2019 increased by 1.7% compared with June 2018, while the indicator in May 2019 vs May 2018 rose by 15.7%.

In January-June 2019, retail trade in Ukraine increased by 10.3% in comparable prices year-over-year, the State Statistics Service reported.

Trade partners of ukraine in % from total volume (import to ukraine) in jan-may 2019

Trade partners of ukraine in % from total volume (export from ukraine) in jan-may 2019

Chemical Alliance LLC (ChemAlliance) has launched a plant for the production of liquid complex fertilizers with a capacity of 5,000 tonnes per month in Zaporizhia region, owner of the company Vitaliy Popov has said.

“On July 1, we launched a plant for the production of liquid complex fertilizers with a capacity of 5,000 tonnes per month in Zaporizhia region. Investments amounted to about $1 million,” he told Interfax-Ukraine.

According to Popov, now the company is looking for a site for the second, more powerful production, which is to be launched in the spring of 2020.

“We plan to build two more plants in different parts of Ukraine. Ideally, these are Zhytomyr and Poltava or Cherkasy. I hope that we will implement these projects by the end of 2020. In total, we will reach 30,000 tonnes of liquid complex fertilizers per month,” he noted.

Popov said that Ukrainian raw materials and those imported from the EU (50/50) are used for the production of fertilizers.

Chemical Alliance LLC (Poltava) was established in 2010. It is engaged in production and sale of liquid mineral fertilizers and sale of granular ones.