DTEK Energy Holding of Rinat Akhmetov increased coal imports by 2.3 times, to 1.492 million tonnes in January-June 2018 compared to the same period last year, the company said on the website of the London Stock Exchange.

At the same time, DTEK’s coal production in the reporting period fell by 12.9%, to 12.889 million tonnes. In particular, extraction of gas coal in Ukraine decreased by 1.2%, to 11.426 million tonnes, while anthracite and steam coal were not produced in Ukraine. At the same time, DTEK in January-June 2018 increased production of anthracite in Russia by 7.6%, to 1.463 million tonnes.

DTEK’s coal exports in the reporting period fell by 54.8%, to 206,000 tonnes.

Production of coal concentrate by DTEK in January-June 2018 fell by 22.8%, to 5.806 million tonnes. In particular, concentrate production in Ukraine fell by 44.6%, to 486,500 tonnes, and in Russia by 6%, to 907,900 tonnes.

Ukraine as of July 25 had threshed 20 million tonnes of early grain and leguminous crops from 6.3 million hectares (65% of the forecast for these crops) with the yield being 31.9 centners per ha.

According to the Ministry of Agrarian Policy and Food, farmers harvested 15 million tonnes of winter wheat from 4.4 million hectares (70% of the forecast) with the yield of 34.2 centners/ha, 37,000 tonnes of spring wheat from 16,000 hectares (9%) with a yield of 23 centners/ha, 2.9 million tonnes of winter barley from 816,000 hectares (99%) with the yield being 35.1 centners per ha, 1.3 million tonnes of spring barley from 628,000 hectares (41%) with a yield of 19.9 centners/ha, and 541,000 tonnes of peas from 319,000 hectares (75%) with a yield of 17 centners/ha.

The country also harvested 67,000 tonnes of rye from 27,500 hectares (19%) with a yield of 24.5 centners/ha and 16,000 tonnes of oats from 9,300 hectares (5%) with a yield of 17.5 centners/ha.

In addition, farmers threshed 2.3 million tonnes of winter rapeseeds from 902,000 hectares (92%) with a yield of 25.8 centners per ha and 11,000 tonnes of spring rapeseeds from 7,500 hectares (14%) with the yield standing at 15 centners/ha.

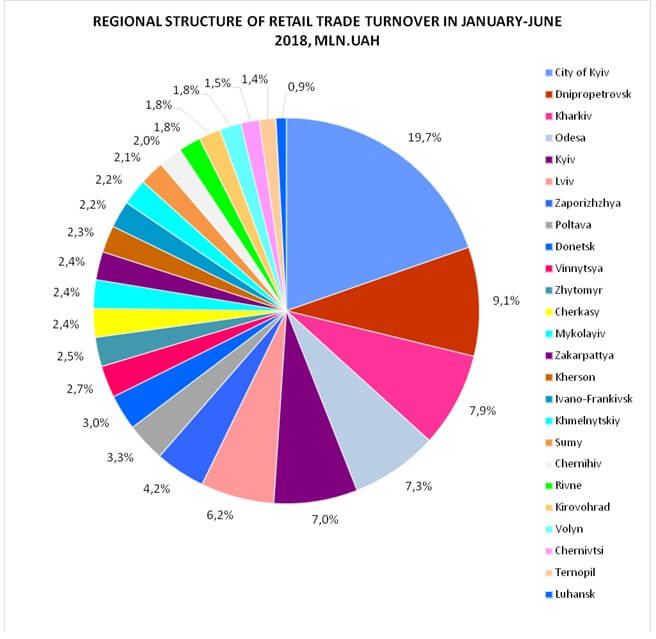

Ukraine’s retail trade in January-June 2018 increased by 6.2%.

Four regions (City of Kyiv with Kyiv region, Dnipropetrovsk region, Kharkiv region and Odesa region) amount to 51% of total trade turnover.

Luhansk and Ternopil are on the last places.

In June 2018 alone, retail trade decreased by 0.8% compared to May 2018, but it grew by 6.3% compared to June 2017.

DNIPROPETROVSK, KHARKIV, KYIV, KYIV REGION, ODESA, TRADE TURNOVER

Dnipro Agro Alliance Ltd. (Nicosia, Cyprus) plans to acquire PJSC Bozhedarivsky Elevator belonged to Renaisco B.V., a subsidiary of Switzerland’s Glencore International. According to the materials of the Antimonopoly Committee of Ukraine, Dnipro Agro Alliance Ltd. applied to the committee for getting permit to buy over 50% in Bozhedarivsky Elevator.

Dnipro Agro Alliance Ltd. Plants grain, leguminous crops and oilseeds. The ultimate beneficiaries of the company are co-owners of Dnipro Agro Group Mykhailo Koshliak, Yevhen and Vasyl Astion. Dnipro Agro Group is a vertically integrated group of companies, the core business of which is the production, storage, sale of grain and oilseeds.

The National Bank of Ukraine (NBU) has asked the law enforcement agencies to investigate into activities of Royal Standard LLC, which attracted funds of depositors at high rates – 24-33% per annum in hryvnias and 18-22% in U.S. dollars, the NBU has reported. “The NBU does not grant licenses for attracting deposits or lending to entities that do not have the status of a bank, while the company has not received these licenses from other financial sector regulators – the national commission for financial service markets regulation and the National Commission for Securities and the Stock Market. Moreover, Royal Standard LLC does not have the status of a financial institution. That is, the company by law cannot attract deposits and issue loans,” the National Bank wrote on its Facebook’s page.

According to the NBU, Royal Standard offers investors to deposit cash directly at the office of the company or transfer it to its bank account, and the interest is promised to be paid to a bank card, the details of which are specified in the contract. As a guarantee of the deposit with the depositor, a pledge of rights to movable/immovable property is concluded, whereby the depositor receives a security deposit for property worth twice more than the value of the deposit. “People are explained that, in addition to accepting deposits, the company also provides loans to other persons securing them by property, namely, the rights to this property are transferred to depositors as a guarantee of the deposit. Market value and the existence of this property raise doubts,” the National Bank said.

FINANCIAL ACTIVITIES, INVESTIGATE, NATIONAL BANK, ROYAL STANDARD