After signing an agreement with the United States to establish the terms and conditions of the Ukraine Recovery Investment Fund, the Cabinet of Ministers will approve a delegation to draft an international agreement on the Fund, Prime Minister Denys Shmyhal said.

“The next steps after the signing are the creation of an appropriate delegation, which will be approved by a government decision, as required by the law of Ukraine on international treaties. The delegation will receive the relevant directives. Next, there will be relevant intergovernmental work between the government of Ukraine and the government of the United States to draft an agreement on the establishment of the Investment Fund for the Development and Construction of Ukraine,” Shmyhal said during an hour of questions to the government in the Verkhovna Rada on Friday, which was broadcast live on YouTube by MP Oleksiy Honcharenko (European Solidarity faction).

The Prime Minister emphasized that all the next steps are clearly spelled out in the law on international treaties.

“The agreement on the creation of the Investment Fund will have the character of an international agreement, so it will be approved by the government and ratified by the parliament. It will describe all the specifics of how the fund will work,” Shmyhal said.

The creation of the Investment Fund is envisaged by the so-called subsoil agreement to be signed on Friday in the United States.

Former Kyiv City Council deputy Vyacheslav Suprunenko has invested $2 million in the bankrupt Kyiv Rosinka plant, which he bought in 2023 and will resume operations in May 2025, Forbes Ukraina reports.

According to the publication, the launch of production cost $1 million. The company plans to invest more than $1 million in 2025-2026. The company expects to recoup the investment in five years.

“In 2024, Rosinka has already resumed production of contract bottled lemonades at the Orlan plant in Kyiv and at a plant in Cherkasy region.

The company has obtained a license to extract mineral water from a spring on the plant’s territory at a depth of 327 meters. The first line of Sofia Kyivska mineral water will be launched in April-May 2025. This will be followed by juice drinks with four flavors. The production of classic lemonades at the Rosinka plant is scheduled for 2026, said Inna Yarmolenko, director of the Rosinka plant in Kyiv.

“Sophia of Kyiv will be bottled in 0.5-liter and 1.5-liter bottles, and juice drinks will be packaged in 180-200 ml soft packs. The redesign of Sofia Kyivska has already been completed, and the next step is to change the label of Rosinka. The names of the drinks will not change.

“The plant plans to launch production of functional drinks in 5 years, including kombucha, energy drinks and vitaminized drinks,” Yarmolenko said, adding that they will be produced under different brands, not just Rosinka.

Currently, the Kyiv-based Rosinka plant is negotiating sales with national retailers such as ATB and Silpo.

As reported, in August 2023, Prozorro.Sale successfully held an auction for the sale of the bankrupt Rosinka plant, which was sold for UAH 138.5 million to the Cyprus-based Alviva Group LTD, whose beneficiary is former Kyiv City Council member Viacheslav Suprunenko.

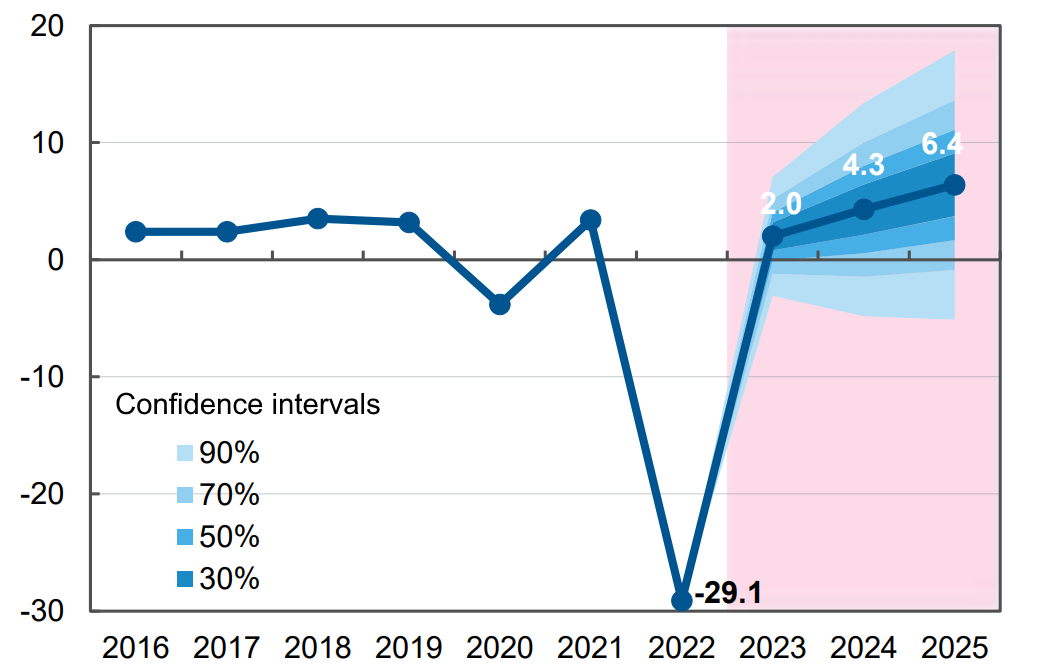

Forecast of dynamics of changes in Ukrainian GDP in % for 2022-2025 in relation to previous period

Source: Open4Business.com.ua

The volume of global debt, including liabilities of governments, households, financial and non-financial companies, increased by $7.2 trillion to a record $318.4 trillion in 2024, according to the Institute of International Finance (IIF).

However, the report notes that the growth was significantly lower than in 2023, when debt increased by $16 trillion due to the monetary policy of the U.S. Federal Reserve.

The debt-to-GDP ratio rose 1.5 percentage points to 328% last year due to a slowdown in the global economy. The rise in the ratio was recorded for the first time in four years, i.e. since the COVID-19 pandemic.

About 65% of the growth in global debt in 2024 was in emerging markets, primarily China, India, Saudi Arabia and Turkey. In mature markets, debt accumulation was mainly in the US, UK, Canada and Sweden.

The public sector accounted for almost two-thirds of the increase in debt. Global government debt has surpassed $95.3 trillion, up from $70 trillion in the run-up to the pandemic in 2019.

IIF forecasts global government debt to increase by more than $5 trillion in 2025, mainly due to increased borrowing by the US, PRC, India, France and Brazil.

Total debt in emerging markets grew by $4.5 trillion in 2024 and reached an all-time high of 245% of GDP. These nations need to repay a record $8.2 trillion in liabilities this year, with about 10% of that debt denominated in foreign currencies.

“We expect the pace of global debt accumulation to slow further, especially in the first half of 2025,” the report said. – With global economic policy uncertainty at a record high – above that seen at the peak of the pandemic – and borrowing costs still high, a more cautious stance by borrowers is likely to curb private sector demand for credit.”

Earlier, the Experts Club think tank analyzed the level of debts of the world’s countries to their GDP, video analysis is available in the dynamics from 1950 to 2023, –

https://www.youtube.com/shorts/oT_5cTOnM8k

Demand for commercial space in residential complexes is growing, with rental rates almost back to pre-war levels, Intergal-Bud’s commercial director Anna Laevska told Interfax-Ukraine.

“Today, the demand for commercial space in residential complexes is growing rapidly. This is especially true for shops, supermarkets, services, educational institutions – schools, kindergartens. Operators are actively expanding, entering new premises, and in general, this segment is developing even better than the apartment market,” said Laevska.

According to her, the developer retains in its own rental stock premises with a payback period of up to 12 years. If it is longer, they are usually sold, and the developer offers flexible payment terms, loyalty programs for those who pay the full amount at once, and installment options.

Investors are interested in commercial premises at different stages: both at the excavation stage and when the facility is ready. It all depends on the location and payment terms. As for the area, supermarkets are usually looking for 800 to 1500 square meters, cafes or coffee shops – up to 100 square meters, private clinics can be 150-300 square meters. Smaller premises sell faster because of their lower cost.

“We always take a targeted approach to the choice of residents. We want the complex to include a pharmacy, a clinic, a grocery operator, educational institutions, and services. In other words, we are creating a complete infrastructure. If, for example, there is a grocery store, we offer the rest of the premises to a business that will meet another need of the residents,” she said.

According to her, rental rates have almost returned to the pre-war level, but it all depends on the specific object, its location, traffic, and functionality. In residential complexes with high occupancy, the price may be even higher due to the large flow of people and cars.

All commercial lots take into account the requirements for inclusiveness, energy efficiency and security.

In particular, all premises have either an entrance from ground level or a ramp with the correct angle. Generators provide backup power for all premises, although this is not always critical for commercial facilities, as they are usually located on the ground floor. Tenants are now actively buying out storerooms in basements and equipping individual shelters for their employees, so these premises are now used not only as warehouses but also as protective zones.

Intergal-Bud has been operating in the residential real estate market since 2003. The company’s portfolio includes 184 projects. In 2024, almost 358.5 thousand square meters of real estate were built and put into operation, which corresponds to 3.8 thousand apartments in 20 buildings.

According to Opendatabot, revenue for 2023 amounted to UAH 959.2 million, with a net loss of UAH 22.9 million. For the three quarters of 2024, revenue amounted to UAH 636.4 million, net loss – UAH 51 million 457 thousand.

Since 2019, Interpipe, a vertically integrated pipe and wheel company, has shipped more than 7,800 wheelsets for the Iberian gauge to customers.

According to a press release, the company has delivered the first batch of ULT SP wheelsets under the KLW brand for the Iberian gauge, and since its launch, the “long” wheelset has quickly gained popularity among customers.

Interpipe’s railway business is currently celebrating the 5th anniversary of its entry into the niche market. It is specified that the ULT SP wheelset is part of the Ultimate line of low-load railway products for freight cars. This design was developed specifically for use on the Iberian gauge. The latter combines rail systems with 1668 mm gauge tracks, which is 233 mm wider than the standard European gauge. The product meets the latest standards for freight wheels and axles, as well as the special requirements of the Spanish and Portuguese rail markets, which are dominated by this type of railroad gauge.

“Interpipe has further strengthened its position not only as a manufacturer, but also as a developer of advanced wheel, axle and wheelset designs. The Ultimate line is in demand among customers in many European countries, now including operators of various types of railways,” the statement emphasizes.

“Interpipe is a Ukrainian industrial company, a manufacturer of steel pipes and railway products. The company’s products are supplied to more than 50 countries through a network of sales offices located in key markets in the Middle East, North America and Europe. In 2023, Interpipe sold 387 thousand tons of pipe products and 95 thousand tons of railway products under the KLW brand.

The company has five industrial assets: “Interpipe Nizhnedneprovsky Pipe Rolling Plant (NTZ), Interpipe Novomoskovsky Pipe Rolling Plant (NMPP), Interpipe Niko Tube, Dnipropetrovs’k Vtormet and Dnipro Steel, an electric steelmaking complex under the Interpipe Steel brand.

The total number of employees of the company is about 9.5 thousand.

The ultimate owner of Interpipe Limited is Ukrainian businessman and philanthropist Victor Pinchuk and his family members.