From January 1, 2025 the international certificate “Green Card” will be valid only on the next day after its registration and entering into the Unified Centralized Database of the MTSBU. According to the website of the Motor (Transport) Insurance Bureau of Ukraine (MTSBU), such a norm is enshrined in the new law on CMTPL insurance, coming into force from the beginning of next year.

Previously, drivers had the opportunity to issue an insurance certificate “Green Card”, which began its effect on the day of its registration, just before crossing the state border.

In addition, it is reported that from January 1, 2025 free pricing will be introduced for all liability insurance contracts for drivers. This also applies to “Green Card” insurance certificates.

Today, pricing is regulated by the state by establishing uniform amounts of insurance payments, which insurance companies are obliged to apply in tariff setting.

“Starting from January 1, these restrictions will be abolished, and insurance companies will be able to independently determine the parameters that will affect the formation of the cost of policies, based on their own underwriting models and insurance portfolios, as well as other factors relating to the risks caused by the occurrence of an insured event,” the report says.

Another innovation from the beginning of next year will be the full-fledged operation of the electronic certificate of “Green Card” in all member countries of the system. That is, drivers will be able to present the insurance certificate in digital form, saving it, for example, in a PDF file on a mobile device in any country that is part of the insurance system.

At the same time, the MTSBU recommends Ukrainian drivers to print and keep the certificate in paper format before going abroad to present it at the request of authorized foreign regulatory authorities.

“Green Card” – a system of insurance protection of victims in a road traffic accident regardless of the country of their residence and registration of vehicles of the country. It is distributed on the territory of 44 countries in Asia and Europe.

In accordance with the decision of the Assembly of the Council of the Bureau of the International Motor Insurance System “Green Card” adopted in Luxembourg in May 2004, Ukraine since January 1, 2005 is an integral system.

Top adviser says vessels that sank and ran aground are part of aged fleet that will continue to cause large-scale damage

Ukraine has called on the international community to take action against Russia’s sanctions-busting oil fleet, after an ageing tanker sank in the Black Sea, causing a major environmental disaster.

The Russian cargo ship, Volgoneft-212, broke in half during a heavy storm off the coast of occupied Crimea on Sunday. A second tanker, Volgoneft-239, got into difficulties in the same area. It eventually ran aground near the port of Taman at the south end of the Kerch strait.

The two boats were carrying more than 9,000 tonnes of heavy fuel oil. According to satellite data, about 3,000 tonnes had leaked out. “Unfortunately some tanks were damaged. The remaining ones are sealed,” a marine scientist, Sergei Stanichny, told the Russian news agency Tass, confirming the spill.

A rescue operation involving tug boats and two helicopters was launched on Sunday. Video footage showed the bow of the snapped boat sticking vertically out of the water. Crew members stood on the bridge wearing lifejackets. One sailor died and 11 were taken to hospital with hypothermia.

Ukraine accused the Kremlin of recklessness and of violating basic operating rules. On Monday, Mykhailo Podolyak, an adviser to the head of the office of President Volodymyr Zelenskyy, said on social media that the pollution was the worst this century in the Black Sea region, and the second worst ever.

“It is now obvious that any sanctions against the Russian tanker fleet are always useful, but they are all too late,” he posted.

“The accidents on two rusty vessels in the #Kerch Strait resulted in another large-scale environmental disaster of our war. Thousands of tons of fuel oil spilled … causing tragic damage to the natural systems of the #Azov and Black Seas.”

Podolyak said the tankers were built more than 50 years ago and should never have been used in winter storms. He added that they belonged to a 1,000-strong shadow fleet used by Russia to export oil and to dodge western sanctions since its full-scale invasion in 2022.

Most boats were “hopelessly outdated”, Podalyak said, alleging that they had “fictitious insurance policies”, hid their real owners and “overloaded” oil at sea. Further large-scale accidents were “statistically inevitable”, and the cost of clean-up operations would fall on affected neighbouring countries.

The adviser called for “the most stringent sanctions” against the vessels and people associated with them. He said states should prohibit their entry into territorial and international waters and outlaw “the transhipment of Russian oil”. Tankers should be required to have proper protection and indemnity insurance, he said.

On Monday the EU adopted a new round of sanctions against Russia in response to its war on Ukraine. It added 52 vessels from Russia’s shadow fleet, bringing the total to 79. Tougher measures were also taken against several Chinese entities, the EU commission said.

Separately, Norway said it was allocating $242m to boost Ukraine’s small navy and to help it deter Russian threats coming from the Black Sea. The cash would help protect Ukraine’s population from missile attacks and safeguard the exports of grain from Odesa and other ports, the Norwegian prime minister, Jonas Gahr Støre, said.

Ukraine lost three quarters of its naval assets in 2014 when Russian special forces seized the Crimean peninsula and took control of the Kerch strait. Since 2022, however, Kyiv has used marine drones to sink some of Russia’s Black Sea fleet, which has relocated from occupied Sevastopol to the port of Novorossiysk.

According to Greenpeace the two stricken tankers were on their way to deliver fuel to the Russian navy. They set off from the river port of Volgograd 12 days ago with traffic location systems switched off, and were due to deliver their cargo in Kerch, on Crimea’s eastern coast.

“Any oil or petrochemical spill in these waters has the potential to be serious. It is likely to be driven by prevailing wind and currents and in the current weather conditions is likely to be extremely difficult to contain,” said Paul Johnson, the head of Greenpeace’s research laboratories at the University of Exeter.

“If it is driven ashore, then it will cause fouling of the shoreline. It will be extremely difficult to clean up.”

Key points of the past week:

– White cabbage is the leader in sales, and its supply is growing

– The fruit segment was dominated by apples and persimmons

– The number of borscht set vegetables increased

– Despite the high season, the supply of tangerines remains low.

– Pumpkin returned to the top of sales again

– Salad and greens were offered more often than a week earlier

– Cucumber is getting cheaper in Ukraine and more expensive in Uzbekistan

– White cabbage and beetroot were in the greatest demand

– In the technological group, fertilizers and plant protection products were most often offered

Read about these and other trends in the fruit and vegetable markets of the region in the weekly review of EastFruittrading platforms .

Last week, participants from 14 countries sold their products on the EastFruit Trade Platform group, while the total number of ads posted increased compared to the previous week. This was primarily due to an increase in the supply of products from Egypt, Uzbekistan, Ukraine and Iran. At the same time, the activity of users from Turkey and Poland decreased. As a result, the top five most active countries in terms of the number of offers per week are as follows: Ukraine, Uzbekistan, Egypt, Iran and Turkey.

The supply of white cabbage in the trade group continues to grow, making it the top seller last week. The number of ads for other borscht set vegetables, especially onions and potatoes, has also increased. By the way, this season Tajikistan harvested a record potato crop, and there is a noticeable shortage of seed potatoes on the Ukrainian market. The supply of broccoli, Chinese and cauliflower has decreased, while lettuce and greens have become more common. Pumpkin returned to the top of sales, which was actively sold by participants from Ukraine and Uzbekistan.

The fruit segment of the marketplace continues to be dominated by apple and persimmon sales, with apples offered less frequently and persimmons more often than the previous week. Uzbekistan actively traded in pomegranate and table grapes, while Egypt sold garden strawberries and orange. Pear returned to the top of sales. At the same time, tangerine sales remained low despite the season. Meanwhile, Russia has banned the import of Abkhazian tangerines.

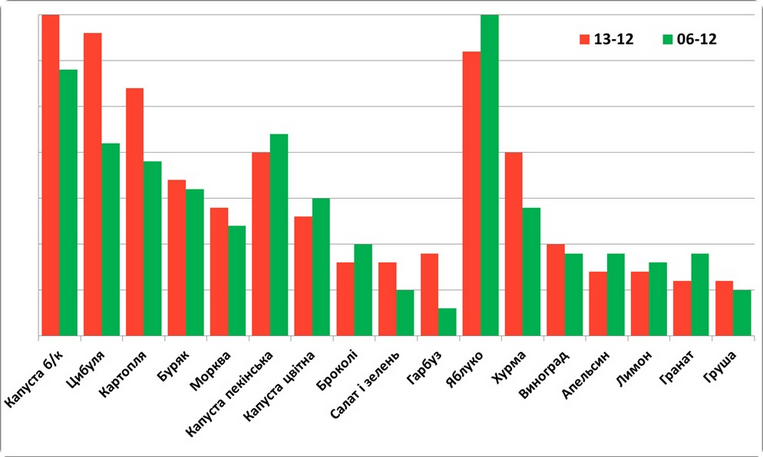

The chart below shows the weekly top sentences in quantitative terms compared to the previous period.

The number of ads for the purchase of fruit and vegetables continues to grow. Last week, white cabbage and beets were in the highest demand among users. Users also bought carrots and tangerines quite often. There was a request from Moldova for frozen pitted cherries. And participants from Germany were looking for suppliers of pomegranate, pineapple, and orange juice and concentrates.

And remember, last year at the same time, apple was the top-selling product, and its sales were conducted by participants from 5 countries. The number of tangerine sellers was growing. Mandarin from Georgia began to appear on sale. Borsch vegetables were offered much less frequently than today, and they were cheaper. Participants from Ukraine and Uzbekistan often offered greens, while those from Iran and Turkmenistan offered tomatoes.

The prices for the main commodity items in individual countries of the region and how they have changed over the past week are discussed below.

Prices of the EastFruit Trade Platform – Ukraine

In Ukraine, the growth of potato prices has resumed. Prices for white cabbage and carrots continued to rise. Onions were sold at a higher price than a week earlier. Against the backdrop of low demand and rising imports , selling prices for cucumbers began to decline again. At the same time, sweet peppers fell in price, and the price range for tomatoes widened. In the eggplant segment, only imported products remained on the market, and as a result, prices doubled. Broccoli and cauliflower went up in price. Garlic prices declined, while herbs rose significantly.

In the fruit segment, demand was stronger, resulting in higher prices. The only exceptions were grapes and lemon, which fell in price.

Prices of the EastFruit Trade Platform trading group – Uzbekistan

In Uzbekistan, on the contrary, cucumber prices rose sharply. The minimum price level for potatoes increased. At the same time, the prices for apples and pears have decreased. Meanwhile, greenhouse farms in Uzbekistan will be temporarily left without gas.

Prices of the EastFruit Trade Platform – EGYPT trading group

Egyptian exporters have announced the first price offers for grapefruit. At the same time, prices for the main items remained at the level of the previous week.

And a few more price offers from participants from other countries.

Lithuania: potatoes – 0.28 € EXW

Moldova: white cabbage – 0.45 € EXW

The number of ads posted in the EastFruit Fruittechnology technology group continues to decrease. As in the previous week, the most frequently offered items were various fertilizers and plant protection products. Seedlings of fruit trees were actively sold, but the number of sellers decreased again. Instead, the range of containers expanded. Last week, the trade group offered vacuum bags, foam, plastic, wooden, banana boxes, pallets and other packaging. Technological materials were represented by reinforced concrete poles, greenhouse film, tunnel film, seedling protection netting, thermal sensors, drip tubes, and agrofibre. And Proeftuin Randwijk has conducted extensive tests of a new robot designed for apple harvesting.

For the analysis of the dynamics of fruit and vegetable supply on our trading platforms over the previous week , please click here. And how to effectively promote products in Telegram groups here.

On Monday, members of the Bundestag passed a vote of no confidence in the government of German Chancellor Olaf Scholz, Bavarian Radio reports.

“The chancellor put up a confidence vote in the Bundestag and lost it as planned. This means that the president will dissolve the parliament, and elections will be held in February,” the radio station notes.

394 MPs expressed no confidence in Scholz’s government, 207 supported the government, and 116 abstained.

Scholz himself had previously called for such a vote, as European media reported that it would allow him to hold early elections. Now, Scholz is expected to ask German President Frank-Walter Steinmeier to dissolve the Bundestag. If the parliament is dissolved, elections in Germany must be held within 60 days from the date of dissolution.

Earlier, Scholz, who heads the Social Democratic Party of Germany (SPD), agreed with opposition parties on plans to hold early elections on February 23, 2025.

In November, the ruling coalition in Germany collapsed due to disagreements over Scholz’s economic policy.

At the same time, German parties are already preparing for early elections. The SPD leadership has decided to re-nominate Scholz as a candidate for chancellor. This decision still has to be approved by the party congress on January 11, 2025, but German media noted that this is just a formality. So far, the CDU leader Friedrich Merz, German Vice Chancellor Robert Habeck from the Union 90/Greens party, and the head of the far-right Alternative for Germany (AfD) party Alice Weidel have also been considered candidates for the chancellorship.

Earlier, the Experts Club think tank released a video review of the most important elections in the world – https://youtu.be/73DB0GbJy4M?si=k5LDANC7lkpbK0Nh

Poninkivska Cardboard and Paper Mill-Ukraine (PKPF-Ukraine, Khmelnytsky region), a major Ukrainian corrugated cardboard producer, increased its corrugated packaging output by 18.7% in January-November 2024 compared to the same period in 2023, to 89.7 million square meters.

As reported, in the first ten months of the year, the increase in corrugated packaging production was also 18.7% compared to the same period in 2023.

According to Ukrpapir Association statistics provided to Interfax-Ukraine, the mill continues to be one of the top three producers of corrugated packaging after Kyiv Cardboard and Paper Mill and Trypillia Packaging Mill.

Over 11 months, the company also increased its production of containerboard (including corrugated paper) by 3.5% to 73.2 thousand tons, and paper by 28% to 0.92 thousand tons.

In monetary terms, in January-November, PCPF-Ukraine produced products worth UAH 2 billion 487.3 million (+17.9%).

As reported with reference to the data collected by the association from the main enterprises of the industry, in January-November, the production of paper and cardboard in Ukraine increased by 2.6% compared to the same period in 2023 – up to 549.7 thousand tons, cardboard boxes – by 13.4%, to 539.7 million square meters.

Poninkivska Paper Mill (formerly Poninkiv Cardboard and Paper Mill), once the largest producer of school notebooks, now has one main production facility – paper and cardboard, producing mainly corrugated cardboard and corrugated packaging, as well as wrapping and waste paper.

The plant is part of the United Cardboard Company-Ukraine (UCC, Lutsk) owned by businessman Mykola Lobov, whose production assets include, among others, Lutsk KPF-Ukraine (Volyn region), which produced 58.3 thousand tons of various cardboard (down 3.7%) and 44.65 million square meters of corrugated boxes in 11 months (according to Ukrpapir), compared to 13.5 million square meters a year earlier.

As reported, in 2023, PCPF-Ukraine produced products worth almost UAH 2 billion 450 million, up 3% year-on-year. Net profit increased 2.7 times to UAH 27 million.

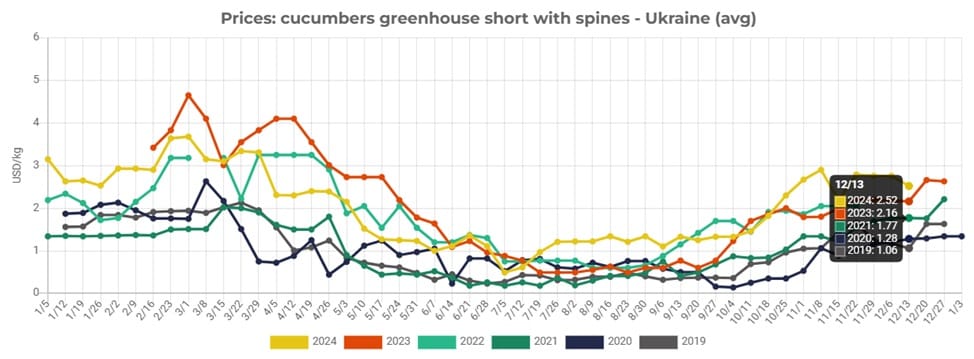

This week, wholesale prices for cucumbers in Ukraine have started to decline again, according to analysts from the EastFruit project. Sellers describe this step as a necessary measure due to the unusually low demand for greenhouse cucumbers in mid-December.

Currently, greenhouse cucumbers are being sold at 80-110 UAH/kg ($1.92-2.64/kg), which is on average 11% cheaper than the previous week. Market operators attribute this price drop to wholesale companies and retail chains increasingly refusing to purchase large batches of greenhouse cucumbers, citing low retail sales. As a result, significant volumes of unsold products have accumulated in warehouses, with their quality deteriorating.

However, it is worth noting that greenhouse cucumbers in Ukraine are still, on average, 21% more expensive than during the same period last year. Most market operators consider this situation temporary and do not rule out the possibility that prices in this segment may start to rise again as early as next week.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.