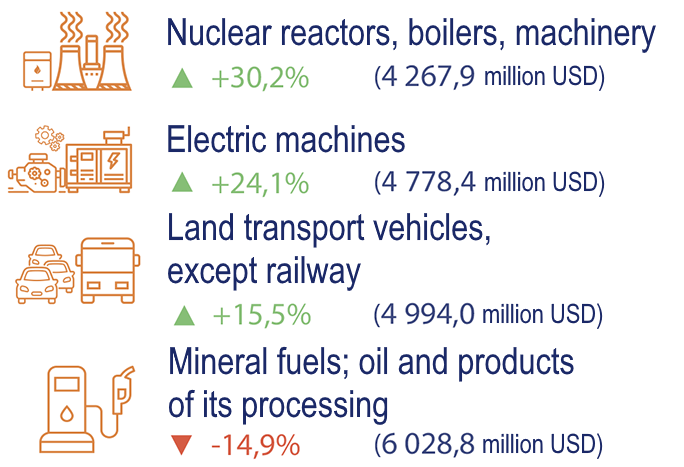

Dynamics of import of goods in january-august 2024 by the most important items in relation to the same period of 2023, %

Open4Business.com.ua

In January-November this year, Ukraine increased imports of coke and semi-coke in physical terms by 2.05 times compared to the same period last year, up to 622.694 thousand tons.

According to statistics released by the State Customs Service (SCS) on Monday, coke imports in monetary terms increased by 87% to $222.891 million over the period.

Imports were mainly from Poland (84.90% of supplies in monetary terms), Colombia (8.18%) and Hungary (2.85%).

For 11 months of the year, the country exported 1.593 thousand tons of coke for $366 thousand to Moldova (99.73%) and Latvia (0.27%), while in January, March, October and November 2024 there were no exports, while for 11 months of 2023 exports amounted to 3.383 thousand tons for $787 thousand.

As reported, in 2023, Ukraine reduced imports of coke and semi-coke in physical terms by 8.5% compared to 2022 – to 328.697 thousand tons, while imports in monetary terms decreased by 25.8% to $129.472 million.

In 2023, Ukraine exported 3,383 thousand tons of coke, down 12.3% compared to 2022. In monetary terms, it decreased by 22.2% to $787 thousand.

Exports were carried out to Moldova (100% of supplies in monetary terms), while imports came mainly from Poland (88.47%), Colombia (7.72%) and the Czech Republic (3.15%).

In January-September 2024, PJSC “Ukrainian Agrarian Insurance Company” (UASC, Kyiv) collected UAH 9.643 million of gross premiums, which is 46.02% less than in the same period last year.

This was reported by the rating agency Standard-Rating, which confirmed the company’s financial strength rating at the level of uaAA on the national scale.

According to the report on the RA website, in particular, revenues from individuals increased by 14.44% to UAH 0.206 million, and there were no premiums from reinsurers in the period under review. Thus, according to the results of nine months of 2024, taking into account the share of individuals in gross premiums at 2.14%, legal entities prevailed in the insurer’s client portfolio.

Insurance payments sent to reinsurers for the three quarters of 2024 decreased by 57.52% compared to the same period in 2023 – to UAH 3,650 million, and the reinsurer participation ratio in insurance premiums decreased by 10.25 percentage points to 37.85%.

In the analyzed period, the company’s net written premiums decreased by 35.36% to UAH 5.993 million, and net earned premiums decreased by 22.57% to UAH 8.161 million.

In the first nine months of 2024, the company paid UAH 4.528 million in insurance claims and reimbursements to its clients, which is 64.00% more than in the same period of 2023. The level of payments in the period under review increased by 31.50 percentage points to 46.96%.

In the first nine months of 2024, the financial result from operating activities amounted to UAH 6.992 million (compared to an operating loss in the first nine months of 2023), and net profit increased 8.35 times to UAH 9.182 million in the same period of 2023.

As of November 1, 2024, the company’s assets decreased by 1.56% to UAH 80.473 million, equity showed an increase of 6.87% to UAH 68.314 million, liabilities decreased by 31.80% to UAH 12.159 million, cash and cash equivalents decreased by 31.56% to UAH 14.334 million.

RA also informs that as of the reporting date, UASC has formed a portfolio of current financial investments in the amount of UAH 63.462 million, which consisted of investments in government bonds.

IC “Ukrainian Agrarian Insurance Company” (formerly IC “Salamandra-Dnipro”) has been operating in the country’s market since 1995.

According to the Unified State Register of Legal Entities and Individual Entrepreneurs, 84.750% of UASC’s authorized capital is owned by Dobrobut Agrofirm, Astarta-Kyiv LLC holds 5.5%, and Poltavazernoprodukt Investment and Industrial Company LLC holds 9.75%.

Metinvest Group’s Kametstal plant, which was set up at the facilities of Dnipro Metallurgical Plant (DMK, Kamianske, Dnipro Oblast), continues to expand its product range.

According to the company, new products are being manufactured on an individual order basis.

In November, the company rolled and shipped rebar with a nominal cross section of 9.5 and 11.5 mm on the 400/200 mill for the first time. Along with 10 and 12 mm rebar profiles, it is used in the construction industry, in particular in the construction of housing and infrastructure facilities. Non-standard parameters of the profile sizes allow customers to optimize metal consumption for the construction of concrete structures of buildings and structures, while ensuring the required strength.

The developers of this solution made changes to the production technology, calibration table, rolling scheme, and calibrated the rolls, etc.

In November, 1,000 tons of 9.5 rebar and 1,500 tons of 11.5 rebar were produced and shipped to Ukrainian customers.

Oleksandr Oliynyk, Chief Rolling Officer of Kametstal, noted that the expansion of the steel product range, including customized products, allows the company to maintain its status as a customer-oriented producer in the Ukrainian and European steel markets.

“If there is a need in the market for such non-standard rebar, we promptly respond to customer requests. Our specialists have enough experience, knowledge and skills to master a new type of rolled steel in demand in a short time,” explained the manager.

“KAMETSTAL was established on the basis of PJSC Dneprovsky Coke and Chemical Plant (DKKhZ) and the Centralized Rolling Mill of PJSC Dneprovsky Metallurgical Plant (DMK).

According to the 2020 report of Metinvest Group’s parent company, Metinvest B.V. (Netherlands) owned 100% of the shares in DCCP.

By the decision of the extraordinary general meeting of participants of ALC “Insurance Company ‘Guardian’ (Kiev) on December 5, 2024, Tatyana Shchuchieva was appointed CEO of the company, according to the information of the company. It is specified that Shchuchieva will assume her duties from December 11, 2024.

As reported, Tatiana Shchuchieva from May 2008 to October 2024 headed IC “Express Insurance”.

IC “Guardian” has been working in the insurance market since 2007. According to NBU data it is among the top 15 risky insurance companies of Ukraine by collected premiums following the results of nine months of 2024.

It is a member of the Presidium of the League of Insurance Organizations of Ukraine. Since January 2020 it has received the status of a full member of the Motor (Transport) Insurance Bureau of Ukraine (MTSBU), has the right to sell “Green Card” policies.

MHP Food and Agricultural Holding, Ukraine’s largest chicken producer, has submitted a binding offer to acquire UVESA Group (UVESA), the market leader in the Spanish food industry in the production of poultry and pork, the company’s press service reports.

“The transaction is an open tender offer addressed to all current shareholders of UVESA, which is subject to certain conditions, including, but not limited to, reaching the minimum acceptance threshold of 50.01%. If regulatory approvals are required to close the deal, MHP will ensure that all requirements are met,” the statement said.

The agroholding emphasized that this acquisition is another step in MHP’s development in international markets and strengthening the company’s position as an important player in the global food market and the European market in particular. Expanding its international presence is in line with MHP’s strategy of transforming itself into an international culinary company with operations in key regional markets.

MHP is one of the largest investors in Ukraine. Since the full-scale invasion, MHP has invested UAH 14.8 billion in business development in Ukraine.

“MHP’s main priority remains the further development of its business in Ukraine. We are working to ensure food safety, stable operation of enterprises, strengthening the country’s economy, supporting the military, our teams and communities, investing in Ukrainian businesses that expand the MHP culinary ecosystem,” the agroholding said, adding that despite the war, MHP demonstrates resilience and growth, scaling up its practices at foreign assets.

The company already has successful experience in acquiring and developing companies in the European Union – in 2019, Perutnina Ptuj (Slovenia, Serbia, Croatia, Bosnia and Herzegovina) became part of MHP Group.

MHP has considerable expertise in poultry production – for the second year in a row, the company has retained the status of the largest poultry producer in Europe according to the WATT Poultry International rating.

In addition, thanks to MHP’s business approaches, solutions and expertise, the European company has significantly increased its efficiency – Perutnina Ptuj’s EBIDTA grew from $34 million in 2018 to $91 million in 2023.

“This experience of MHP will make it possible to make a significant contribution to the agricultural and food sectors in Spain. The deal will help meet the growing demand for high quality and affordable food in the world. This step is of great importance for strengthening the food security of the European Union and is fully in line with Ukraine’s European integration aspirations to become part of the single European market,” MHP summarized.

UVESA Group was founded in 1964 by a group of veterinarians who acquired the Piensos Uve feed mill (Tudela, Navarra province). Between 1972 and 1984, the group expanded its assets to three feed mills, and in 1985 acquired its own slaughterhouse. In 2001, it opened a poultry factory with slaughter and processing facilities in Málaga, in 2008 a new poultry processing plant and in 2016 a poultry hatchery in Navarre. In 2017, Prado Vega and Saconda merged to become Uvesa Cuellar Uvesa Catarroja. By 2020, the company owned 600 integrated farms and launched the production and export of raw sausage under the Alpico brand, as well as a line of halal meat products under the Basmahal brand.

“MHP is the largest chicken producer in Ukraine. The company produces cereals, sunflower oil, and processed meat products.

As reported, the company received $142 million in net profit in 2023 compared to $231 million in net loss a year earlier. The group’s revenue last year increased by 14% to $3.021 billion.

In the third quarter of this year, MHP earned $96 million in net profit, which is 75% higher than in the third quarter of 2023, while revenue increased by 5% to $773 million, gross profit grew by 47% to $249 million, operating profit by 62% to $154 million, and adjusted EBITDA by 56% to $173 million.