The Main Service Center of the Ministry of Internal Affairs of Ukraine is planning to conduct an unscheduled internal audit and at least replace the entire management team. It is possible that a similar measure will be applied to other Service Centers in the country.

This was reported by the Ministry of Internal Affairs on December 4. This was the ministry’s response to a journalistic investigation by Bihus.Info.

According to the Ministry of Internal Affairs, the Service Centers expect a “large-scale reboot” of all work processes. In particular, a working group has already been set up to improve the digital services of the TSCs.

“As for the management and officials of TSC No. 8041 in Kyiv, the Ministry of Internal Affairs has already asked the NACP to conduct a thorough monitoring of the lifestyles of the persons involved in the journalistic investigation,” the ministry said.

TSC 8041 (Kyiv, 20 Peremohy St.) is the subject of the next Bihus.info story.

“Service centers work inefficiently and cannot cope with servicing citizens. People spend the night outside the service center in line to get vouchers for the practical exam, they have to hunt for an electronic voucher around the clock because of the system’s malfunction, and “runners” sell them for money. Meanwhile, the employees of the SC drive to work in cars that are not listed in their declarations because they are registered either to relatives or to strangers,” the investigation states.

Last year, the National Police investigated a case against the management of this Center, which “artificially created a shortage of coupons” by allowing “runners” to sell the Center’s services for 3-4 thousand UAH. But the case ended with a sentence only for the “runner,” “and the problem with the shortage of coupons has not been resolved since,” the journalists say.

This TSC is headed by Oleksandr Boyko. His declaration states that he lives in someone else’s apartment and drives his father’s 10-year-old Toyota Land Cruiser. However, his wife flaunts cars on Instagram that “were not listed in the declarations”: BMW X3 (from $50 thousand), Volkswagen ID.4 electric cars (from $30 thousand) and BMW IX3 (from $60 thousand). Moreover, the cars were registered in the name of Boyko’s father-in-law and all were bought new.

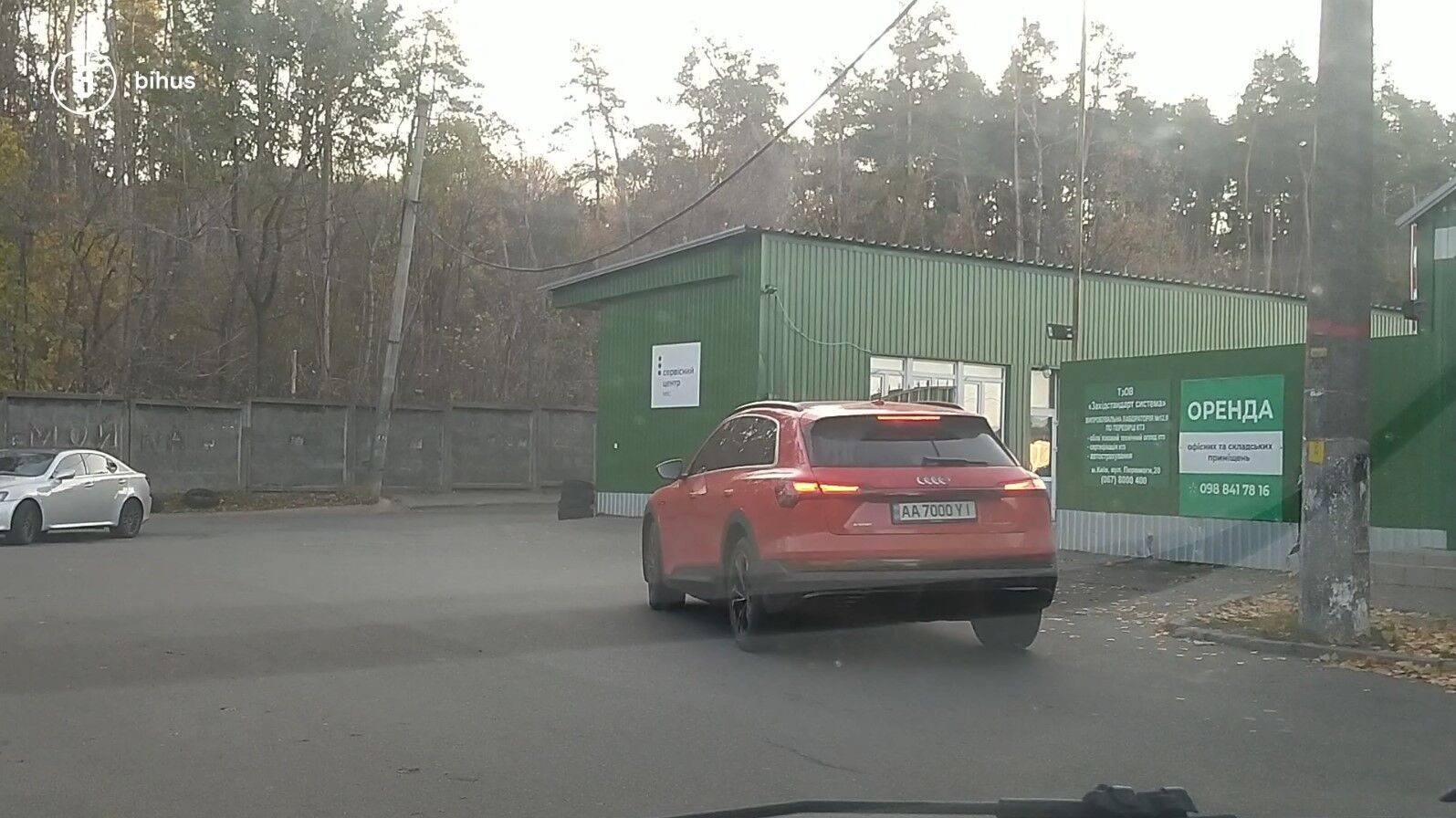

TSC administrator Volodymyr Naumenko uses an Audi E-Tron (over $40,000) at work, but this car is registered to his 22-year-old son. Naumenko’s wife has an apartment in a new building and a new Highlander, his eldest son has a separate apartment in another new residential complex, a dacha on the Kyiv Sea, a large amount of land in Muzychi near Kyiv, and a Toyota Camry, and his younger son also has an apartment in the same residential complex and the aforementioned E-Tron.

The Lexus NX 300 in the service parking lot behind the SC (pictured) is registered to the mother-in-law of the administrator Anatolii Klymenko. His declaration shows that the apartment in the new building was given to him by his retired father, and it allegedly cost only UAH 50 thousand.Also, a new Lexus NX 450H+ (from $60 thousand) is registered for the retired father.

Administrator Natalia Los drives two different Teslas – a Tesla Model 3 and a Tesla Model Y, although she officially has only a “not very fresh” Dodge Challenger.

Administrator Serhiy Panchenko does not have a wife in any of his declarations. However, his Toyota Land Cruiser Prado is registered in her name, and “the woman has been posting family photos with Panchenko on social media for many years.” Panchenko’s mother owns a private house in Mizhrichchia near Kyiv, and his father owns another Toyota Land Cruiser Prado.

PJSC “Ukrhydroenergo” on December 4 announced its intention to conclude with IC “European Insurance Alliance” the contract of compulsory insurance of motor liability of owners of land vehicles.

According to the information on the web portal Prozorro, the price offer of IC “European Insurance Alliance” amounted to UAH 773.3 million at the expected cost of the purchase of services of UAH 790.27 thousand. IC Krajina participated in the tender with the offer of UAH 774,4 th.

EUROPEAN INSURANCE ALLIANCE, MOTOR INSURANCE, UKRHYDROENERGO

On December 2, the State Air Traffic Services Enterprise of Ukraine (Ukraerorukh) announced its intention to enter into a voluntary medical insurance contract with InterExpress Insurance Company (Kyiv) for its employees traveling abroad.

According to information on the Prozorro portal, the company’s price offer amounted to UAH 87.9 thousand at an expected cost of UAH 199.999 thousand.

The tender was also attended by insurance companies EXPO Insurance with a bid of UAH 88 thousand, European Travel Insurance – UAH 152.2 thousand, Ultra Alliance – UAH 181.5 thousand, and Insurance Guarantees of Ukraine – UAH 188.2 thousand.

“Ukraerorukh was founded in 1992. It provides a full range of air navigation services: air traffic services, organization of air traffic flows, organization and management of airspace, radio communications, navigation and surveillance, provision of meteorological and aeronautical information for all types of flights.

German investment company Connect GmbH & Co. geschlossene Invest KG (Connect) will provide Astarta, Ukraine’s largest sugar producer, with a €5 million loan for seven years to modernize its sugar factories, the company’s website reports.

“The agreement is financed by the ImpactConnect program, which includes any Connect financing and financing programs established by the German government. The purpose of this financing is to maintain, develop and modernize Astarta’s sugar factories,” the statement said.

The agricultural holding added that the financing will be provided to one of Astarta’s subsidiaries, but did not specify its name.

“Astarta is a vertically integrated agro-industrial holding operating in eight regions of Ukraine. It comprises six sugar factories, agricultural enterprises with a land bank of 220,000 hectares and dairy farms with 22,000 cattle, an oil extraction plant in Globyno (Poltava region), seven elevators and a biogas complex.

In 2023, the agricultural holding reduced its net profit by 5.0% to EUR 61.9 million, and its EBITDA decreased by 6.1% to EUR 145.77 million, while revenue increased by 21.3% to EUR 618.93 million.

Metinvest Group’s KAMETSTAL, a steelmaking plant at Dnipro Metallurgical Plant (DMK, Kamenskoye, Dnipro Oblast), replaced outdated electrical equipment in the company’s coke oven shop to stabilize the operation of coke oven battery No. 5 and improve energy efficiency.

According to the company, distribution substation No. 55 was modernized in the coke shop as part of this year’s investment program, which made it possible to demonstrate higher reliability of power supply to coke oven battery No. 5.

It is also specified that the main objective of the investment project is to completely replace the outdated contact equipment with modern automatic German-made equipment. As part of the modernization, new circuit breakers with current and thermal protection were installed, as well as new electromagnetic starters instead of contactors. In total, four sections of the substation have been upgraded, and the old equipment at RP-55 has already been decommissioned.

The new equipment with a high level of automation allows online monitoring of the circuit breakers. The sections are equipped with on-off visualization elements, which allows the electrician on duty to check the operation of each circuit breaker faster and more accurately.

Alexander Shulzhenko, an electrician at Kametstal’s coke shop, stated that the three months of operation of the new equipment have made it possible to improve the reliability of the battery’s power supply and avoid downtime of the main equipment related to the reliability of power supply.

“Also, thanks to the metering system introduced as part of the modernization, which allows us to track electricity consumption online on a computer, we can now analyze the electricity consumption of each consumer throughout the day. This analysis has improved the accuracy of electricity consumption planning, and we plan to develop energy-efficient measures to reduce electricity consumption based on the analytical findings,” said Shulzhenko.

“Kametstal was established on the basis of Dnipro Coke Plant and Central Iron and Steel Works of Dnipro Metallurgical Plant.

According to the 2020 report of Metinvest Group’s parent company, Metinvest B.V. (Netherlands) owned 100% of the shares in DCCP.

Ukrzaliznytsia JSC (UZ) has doubled the free internet limits in Intercity and Intercity+ trains to 2GB, the company’s press service reports.

“Ukrzaliznytsia has doubled the internet limits on Intercity and Intercity+ trains. From now on, users on trains can access 2 GB of traffic at a speed of 10 Mbps for free. So don’t waste a single minute while traveling – communicate with your family, friends, colleagues, and partners while continuing to travel on schedule,” she said in a telegram on Wednesday.

It is specified that since the launch of Wi-Fi in Intercity, 750 thousand passengers have used it – in fact, every second passenger on high-speed trains. The total traffic on board exceeded 2.3 petabytes.

The most active Wi-Fi users travel on routes #741/742 and #777/778 Kyiv-Lviv, where an average of 66% of passengers on each flight connect to the Internet, UZ said in a statement.

The company reminded that the Internet is already available in 16 Intercity trains: ten Hyundai, two Skoda, two Tarpans, and the same number of trains with MPLT cars.

Earlier, Ukrzaliznytsia launched free Wi-Fi in ten Intercity and Intercity+ trains. Travelers have the opportunity to use 1 GB of traffic at a speed of 10 Mbps by logging in to the onboard portal portal.uz.com.ua.

It was also reported that Oleksandr Pertsovsky, Chairman of the Board of JSC Ukrzaliznytsia, promised to equip long-distance night trains with Wi-Fi starting in 2025.