The State Property Fund (SPF) of Ukraine on November 7 this year will again put up for online auction with conditions the state block of shares of JSC “Institute of Titanium” (Zaporozhye) in the amount of 100% of the authorized capital. According to information in the system prozorro.sale, the announcement of the three-round English auction is dated October 29.

The starting price of the mentioned block of shares has been reduced from UAH 97.651 mln (excluding VAT) to UAH 48 mln 825.5 thousand (excluding VAT).

At the same time, the auction scheduled for October 30 was not held.

As it was reported, the Federal State Property Management Committee has previously conducted the sale of the company at auctions, which did not take place.

The main activity of the Institute of Titanium, according to its charter, is research and experimental development in the field of natural and technical sciences.

The authorized capital of the company is UAH 75.311 mln.

Agrotrade has completed sowing winter wheat for the 2025 harvest in the fields of Poltava, Chernihiv, Kharkiv and Sumy regions, covering a total of 14.6 thousand hectares, the company’s press service reports.

According to the report, the work went according to plan and all areas have sprouts. In the fields where winter crops were sown early, the plants are already highly developed. And where the crops were sown in the optimal periods, they are in the early stages of development.

“To reduce the cost of growing technology, we have changed our approach to choosing a predecessor crop. Previously, we sowed large areas of winter wheat where we grew winter rape. Under these conditions, it requires herbicide and insecticide protection, which costs about $42-47 per hectare. This year, we reduced such crops and planted soybeans and sunflower on the main area. This way we reduced the cost of autumn wheat protection,” said Oleksandr Ovsyanyk, Director of Agrotrade’s Agricultural Department.

The agricultural holding also implemented all measures related to technological control of sowing. The Online Agricultural Operations Management Center monitored the quality parameters of field work: sowing depth, seeding rate and fertilizer application, speed of machinery, and compliance with field contours to achieve high quality sowing and avoid resource overruns.

We remind you that winter wheat ranks first in terms of area among all crops grown by the group.

As reported, on August 13, Agrotrade started the sowing campaign of winter crops for the 2025 harvest, allocating 27.9 thou hectares for the crops. The area under winter rapeseed increased by 1.3 thou hectares compared to last year to 12.5 thou hectares.

The Agrotrade Group is a vertically integrated holding company with a full agro-industrial cycle (production, processing, storage and trade of agricultural products). It cultivates over 70 thousand hectares of land in Chernihiv, Sumy, Poltava and Kharkiv regions. Its main crops are sunflower, corn, winter wheat, soybeans and rapeseed. It has its own network of elevators with a simultaneous storage capacity of 570 thousand tons.

The group also produces hybrid seeds of corn and sunflower, barley, and winter wheat. In 2014, a seed plant with a capacity of 20 thousand tons of seeds per year was built on the basis of Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand Agroseeds on the market.

Vsevolod Kozhemiako is the founder and CEO of Agrotrade.

The state-owned enterprise Forests of Ukraine has shipped the first batch of round timber under a contract with the Ministry of Defense, the company’s press service reported on its telegram channel.

According to the report, 11,021 thousand cubic meters of pine have already been shipped from the branches of Polissia, Stolychne, Slobozhanskyi, Northern and Central forest offices to the frontline regions for the construction of engineering and military facilities. The final destinations will be Kharkiv, Donetsk, Zaporizhzhia and Kherson regions.

It is explained that the timber is intended for five military units of the Engineer Troops engaged in the construction of fortifications of the first line of defense – dugouts, fireworks, trenches. The delivery price includes the cost of removal from the intermediate warehouse, loading into railcars and delivery by rail. To reduce costs, the railcars are lined with boards to increase their capacity.

As reported, in September 2024, the State Enterprise “Forests of Ukraine” signed an agreement with the Ministry of Defense for the supply of almost 65 thousand cubic meters of round timber. In total, this year, 10 contracts have been concluded with military units for the supply of 97 thousand cubic meters of wood, most of which have been completed by 95%.

“This year, we have supplied 185.2 thousand cubic meters of wood worth UAH 335.5 million, which is almost twice as much as last year. We close all applications by 100%, because we understand the importance and significance of wood for the construction of fortifications,” summarized the Forests of Ukraine.

As reported, Ukraine launched a forestry reform in 2016. As part of it, the sale of raw wood at electronic auctions has already been introduced. Since 2021, an interactive map of wood processing facilities has been operating in a test mode in a number of regions.

The industry has implemented the Forest in a Smartphone project, which contains a list of logging tickets for timber harvesting and allows you to check the legality of logging on the agency’s online map.

On June 1, 2023, Ukraine launched a pilot for the electronic issuance of logging tickets and certificates of origin of timber. In addition, the State Enterprise “Forests of Ukraine” has launched a pilot project for the procurement of timber harvesting services through the electronic platform Prozorro.

Insured losses from natural disasters for 9 months of 2024 exceeded the average and amounted to USD 102 billion, which is higher than last year’s USD 88 billion and the average of USD 79 billion.

This is reported in the report of the global brokerage group Aon “Global Catastrophe Review for the third quarter – October 2024” published on its website.

It is noted that the consequences of Hurricane Milton and other events expected by the end of the year may lead to annual insured losses exceeding USD 125 billion recorded in 2023.

According to the report, since the beginning of 2024, at least 280 major natural disasters have occurred around the world, resulting in economic losses of at least USD 258 billion, which is approximately 27% lower than the figure for the nine-month period of 2023 of USD 351 billion, and below the average of USD 277 billion.

Aon notes that between the first and third quarters, insured losses from major risks were relatively low, and no event demonstrated the potential to significantly impact the broader reinsurance market.

In fact, USD 59 billion, or 58% of insured losses for the period, were caused by severe convective storms (SCS), and USD 21 billion, or 21%, by tropical cyclones.

According to Aon, in the third quarter, losses were caused by three costly hurricanes, SCC events in the United States and Canada, and floods in Central Europe.

In addition, Canada is experiencing its largest year of insurance losses on record, with most of the impact coming from four events that occurred within a single month in the third quarter, and expected payouts will exceed $5.9 billion.

According to Aon, in other parts of the world, Typhoon Yagi, the deadliest event of the year and the most expensive event on record in Vietnam, was the third most damaging event in the period under review.

According to Aon, by the end of the third quarter of 2024, natural disasters had killed about 13 thousand people, the lowest number since 1986.

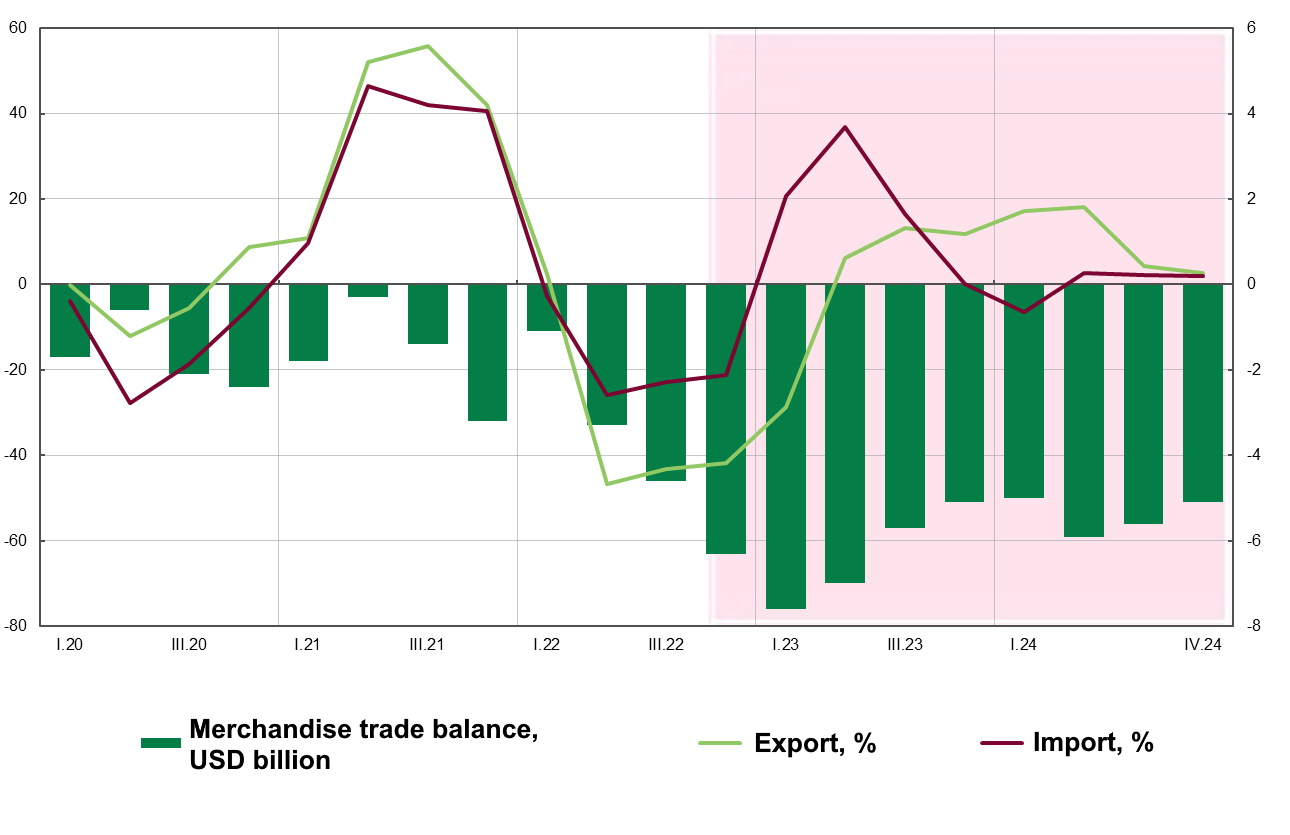

2022-2024 goods trade balance forecast (USD billion)

Open4Business.com.ua

During the Week of International Cooperation Initiatives, which took place on October 17-25 in Tashkent, Anthony Bringazen, Vice President for Central Asia of the Saudi company ACWA Power, said that the company is implementing large-scale projects in Uzbekistan worth about $15 billion.

This fund has been allocated for 15 projects. Most of the projects are related to wind energy. In particular, 87% of the investment will be directed to green energy projects, and the rest to the production of green hydrogen. All 15 projects are planned to be commissioned by 2030.

Anthony Bringaisen noted that after Saudi Arabia, Uzbekistan accounts for the largest volume of the company’s investments.

It is noted that the $1.1 billion TPP project in the Syr Darya will provide electricity to more than 3 million households and hundreds of industrial enterprises. The first phase of the green hydrogen project will produce 3 thousand tons of hydrogen. Next, the focus will be on mineral fertilizer processing and the construction of a 52 megawatt wind farm.