At a meeting on November 5, shareholders of Ukrainian Fire Insurance Company (UPSC, Kyiv) plan to decide to allocate UAH 4.8 million of retained earnings for 2023 to dividends, according to the company’s information disclosure system.

The amount of dividends per share is UAH 0.3.

As reported, the insurer’s shareholders at a meeting on May 7, 2024, decided to allocate UAH 25.6 million of retained earnings for 2022 for dividends. The amount of dividends per share was UAH 1.6.

“UPSK” PrJSC was registered in 1993. The company specializes in motor, financial, travel, property, cargo and luggage insurance.

The insurer is a member of the Motor (Transport) Insurance Bureau of Ukraine and holds 36 insurance licenses: 20 for voluntary insurance and 16 for compulsory insurance.

According to the National Securities and Stock Market Commission, as of the second quarter of 2024, the owner of 99.999% of the insurer’s shares is Oleksandr Mikhailov.

The authorized capital of the insurer is UAH 100 million.

Ukrainian companies increased imports of zinc and zinc products by 28.1% to $43.550 million in January-September this year ($5.308 million in September).

Zinc exports for the first nine months of this year amounted to $277 thousand (in September – $77 thousand), while in January-September 2023 it was $88 thousand.

In 2023, Ukraine increased imports of zinc and zinc products by 18.8% to $45.966 million. In 2023, the company exported $130 thousand worth of zinc compared to $1.331 million in 2022.

Pure zinc metal is used to restore precious metals, protect steel from corrosion and for other purposes.

In January-September 2024, Naftogaz Group paid more than UAH 61 billion to the state budget of Ukraine and UAH 5 billion to local budgets, the company’s website reports.

In September, the company paid UAH 5.8 billion to the state budget, including UAH 0.6 billion to local budgets.

As reported, in 2023, Naftogaz Group companies paid UAH 90.2 billion in taxes, UAH 83.4 billion of which went to the state budget and UAH 6.8 billion to local budgets.

In January-September this year, Ukrainian enterprises reduced imports of lead and lead products by 14.1% to $749 thousand (in September – $135 thousand).

Exports of lead and lead products in 2023 increased by 23.5% to $14.778 million.

Lead is currently mainly used in the production of lead-acid batteries for the automotive industry. In addition, lead is used to make bullets and some alloys.

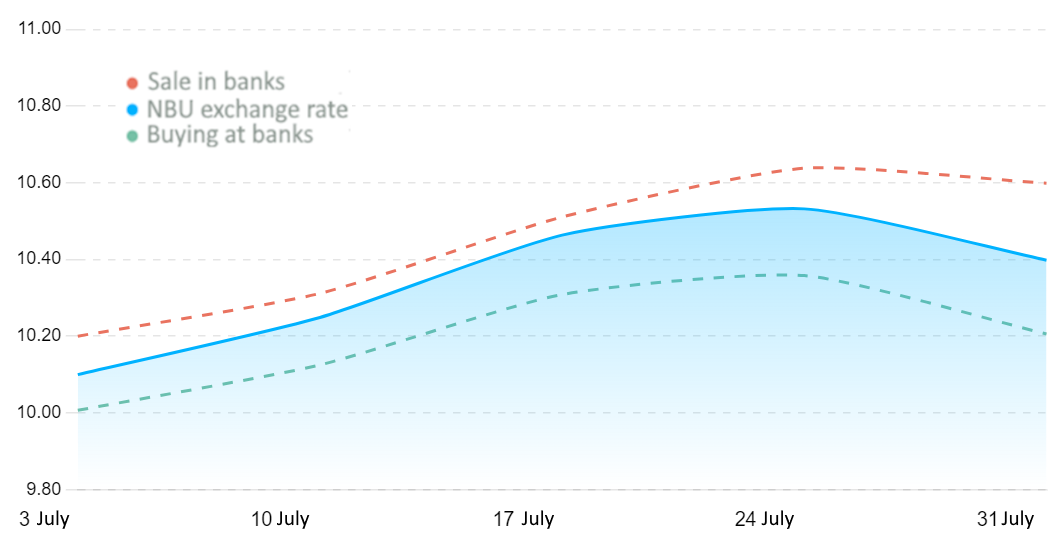

Quotes of interbank currency market of Ukraine (uah for 1 pln, in 01.07.2024-30.07.2024)

Open4Business.com.ua

In January-September this year, Ukraine increased imports of aluminum ores and concentrate (bauxite) in physical terms by 99.8% compared to the same period last year, up to 19.528 thousand tons. According to statistics released by the State Customs Service on Tuesday, bauxite imports in monetary terms increased 2.2 times to $2.435 million during the period.

The imports came mainly from Turkey (77.38% of supplies in monetary terms), China (19.42%) and Spain (3.20%).

Ukraine did not re-export bauxite in the same period of this year as in January-September 2013.

As reported, in 2022, Ukraine reduced imports of aluminum ore and concentrate (bauxite) in physical terms by 81.5% compared to the previous year – to 945.396 thousand tons. Imports of bauxite in monetary terms decreased by 79.6% to $48.166 million. Imports were mainly from Guinea (58.90% of supplies in monetary terms), Brazil (27.19%) and Ghana (7.48%). In 2023, Ukraine imported 19,830 thousand tons of bauxite worth $2.360 million.

Bauxite is an aluminum ore used as a raw material to produce alumina, which is used to make aluminum. They are also used as fluxes in ferrous metallurgy.

Mykolaiv Alumina Plant (MAP) imports bauxite to Ukraine.