The number of cars subject to luxury tax decreased threefold over the year

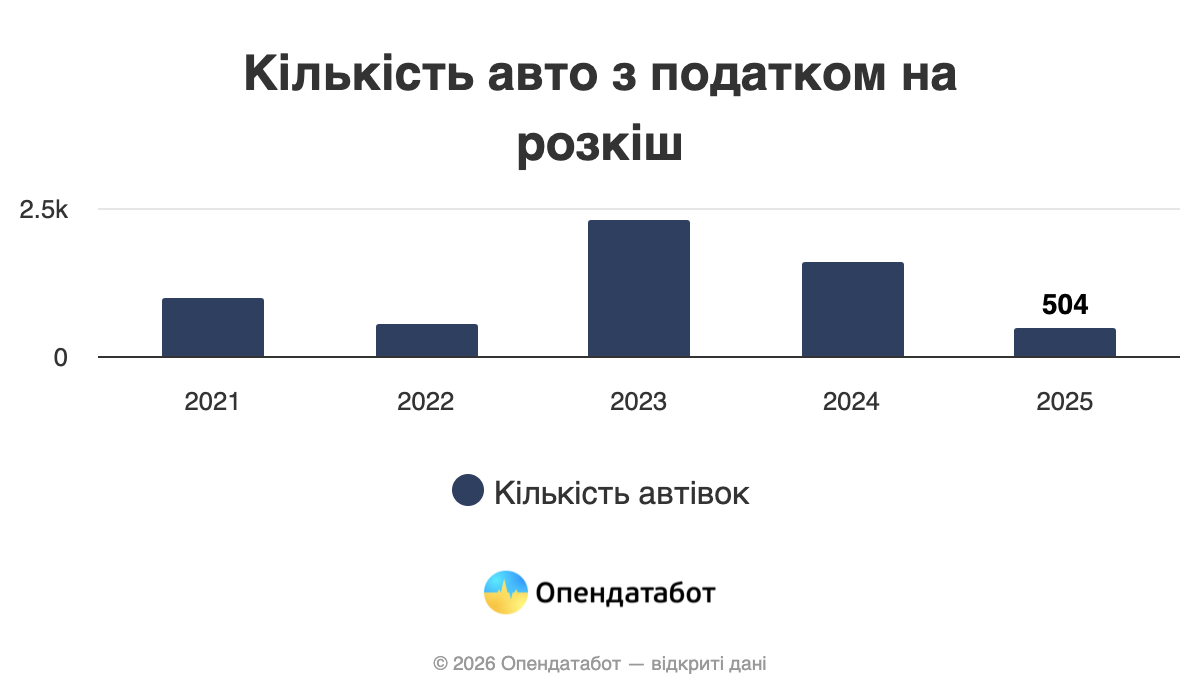

According to the Ministry of Internal Affairs, 504 vehicles subject to luxury tax were imported into the country last year.

This is the lowest figure in the last five years. Porsche and Mercedes-Benz account for 89% of luxury vehicles, and every second such car is a Porsche Taycan. In total, electric cars account for 65% of all cars subject to luxury tax.

504 cars subject to the “luxury tax” were imported into Ukraine in 2025. This is 3.2 times less than in 2024. Overall, this is the lowest figure in the last five years.

Every second car on the “luxury” list is a Porsche Taycan: 232 cars. Overall, Porsche became the leader in the luxury segment with additional taxation: cars of this brand account for 64% of the total volume. Mercedes-Benz took another quarter of the market with 126 cars. The rest of the premium brands together account for 11% of the market: Audi, Rolls-Royce, Aston Martin, Lamborghini, Maserati, etc.

It is worth noting that, in contrast to overall imports, electric cars dominate the premium segment: 65% of imported luxury cars. Another 18% are hybrids that can run on electricity as well as gasoline or diesel. Pure gasoline cars, the leaders in overall imports, are at the bottom of the list with 17%. Diesel accounts for a symbolic 0.4%.

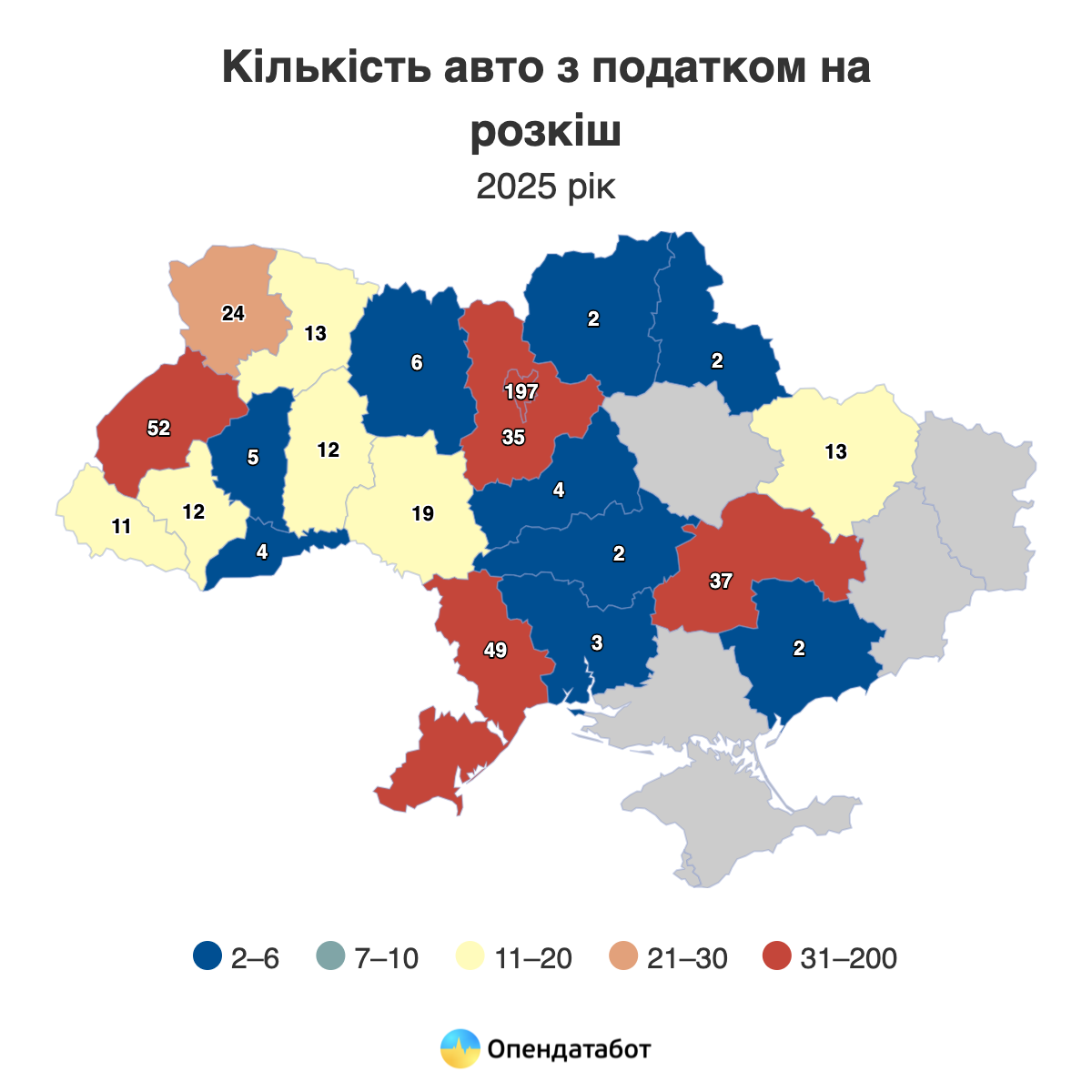

Almost half of all luxury cars are registered in Kyiv and the surrounding region: 236 cars. Another 52 cars are in Lviv region, 49 in Odesa region, and 37 in Dnipropetrovsk region.

Most of the cars in the luxury segment are registered to individuals — 82% or 413 cars. Only 18% of such cars are registered to businesses.

The ultra-premium segment deserves special attention. Last year, 21 Rolls-Royces were imported into Ukraine. Fifteen of them are the electric Spectre model, which costs about $600,000. The registry also includes seven Aston Martins and two Lamborghinis.

It should be noted that the “luxury tax” applies to cars costing more than UAH 3.2 million and less than 5 years old. The tax amount for one such car is UAH 25,000 per year.

https://opendatabot.ua/analytics/luxury-car-fee-2025

CAR, IMPORT, luxury, Porsche Taycan, TAX

The national postal operator Ukrposhta has completed its second auction on Prozorro.Prozori, selling 716 decommissioned vehicles for UAH 9 million, and is preparing to sell another 250 cars, according to the company’s CEO, Ihor Smelyansky.

“In exchange for this ‘loss’, Ukrposhta received UAH 9 million. It also received thousands of square meters of free space and millions of hryvnias, which it will now save on storage, accounting, and maintenance of these cars,” Smelyansky wrote on Telegram on Monday.

According to him, 716 units of obsolete equipment were sold, ranging from a 1979 GAZ-52 from Poltava to a Volvo FH12 truck. The average mileage of each vehicle put up for auction was about 470,000 km, and the physical wear and tear of the fleet reached 96%.

In addition, it is noted that some of the vehicles were purchased by organizations and will be used for spare parts for the needs of the army and volunteer initiatives.

In the fourth quarter of 2025, Ukrposhta received a net profit of UAH 257.9 million, which exceeded the figure for the same period in 2024 by 69.2% due to additional income from the sale of the company’s property, which amounted to UAH 168 million.

The national postal operator increased its revenue in the fourth quarter by UAH 10.7 million compared to the same period in 2024, to UAH 3 billion 601.6 million.

Overall, car imports grew by 17%

According to the Ministry of Internal Affairs, almost half a million cars were imported into Ukraine from abroad in 2025. This is 17% more than in 2024, but still a third less than before the start of the full-scale war. The average age of imported cars is 9 years. One in five imported vehicles was registered in Kyiv. And one in four cars that crossed the border was electric, which is even more than the number of imported diesel cars. Volkswagen retains its leading position, and the Tesla Model Y will remain the most popular car model.

444,860 vehicles were imported into Ukraine last year. This is 17% more than in 2024, but still a third less than in 2021.

Ukraine remains a market for used cars: more than 70% of imports last year were used cars. The average age of imported vehicles remained unchanged over the year at 9 years. By comparison, in 2021, the average age of newly imported cars was 11 years.

Against this backdrop, there were also some real automotive rarities: from a 1967 Honda Monkey moped to a classic 1971 Chevrolet Corvette. Even the electric segment has its “veterans”: the oldest electric car, the Peugeot iOn, is already 15 years old.

On the eve of the return of taxes on the import of electric cars, such cars were in high demand — every fourth car that crossed the border last year. Electric cars even surpassed diesel cars in popularity: 109,309 electric cars versus 94,014 diesel cars. However, gasoline cars still lead the way with 195,059 vehicles.

It is worth noting that of the 504 luxury cars subject to the luxury tax, half were also electric. Volkswagen was the most sought-after car brand, while the Tesla Model Y was the most popular imported car of the year.

However, it is worth noting that Volkswagen leads in 20 regions. The exceptions were the Odesa region, where BMW unexpectedly took the lead, Chernihiv and Donetsk regions, where Renault took the lead, and the Kherson region, where the Spark motorcycle brand became the leader.

If we look exclusively at electric cars, the picture is even clearer — Tesla became the No. 1 brand in 22 regions of the country, yielding only to Volkswagen in the Zakarpattia region and to the Chinese BYD in the Sumy region.

Almost one in five imported vehicles was registered in the capital: 80,425 cars. Lviv region ranks second with 51,730 cars. The top five also includes Kyiv region (28,179), Dnipropetrovsk region (26,311), and Rivne region (23,608).

https://opendatabot.ua/analytics/import-cars-2025

In 2025, Ukrainians purchased 274,300 used passenger cars imported from abroad, which is 24% more than in 2024, according to Ukravtoprom’s Telegram channel.

‘Over 77% of all passenger cars that joined the domestic car fleet last year were used cars imported from abroad,’ the report states.

The average age of imported used cars was 8.4 years (nine years in 2024).

Petrol cars accounted for the largest share in this segment of the car market – 43%, compared to 47% in 2024. Next are electric cars – 31% (18%); diesel cars – 18% (25%); hybrids – 5% (5%) and cars with LPG systems – 3% (5%).

The Volkswagen Golf tops the list of the ten most popular models with 12,812 units, followed by two TESLA electric car models – Model Y (10,683 units) and Model 3 – 9,348 units.

The list of the most popular models also includes the Renault Megane – 8,379 units; Skoda Octavia – 7,754 units; Nissan Leaf – 7,559 units; VW Tiguan – 7,439 units; AUDI Q5 – 6,933 units; Nissan Rogue – 6,310 units; and KIA Niro – 5,799 units.

As reported, in 2024, more than 222,100 used passenger cars imported from abroad were added to the Ukrainian car fleet, which is 4% more than in 2023 and exceeded 75% of the passenger car market.

As in the previous year, the most popular model was the Volkswagen Golf, with 12,164 registrations. The top three also included the Renault Megane with 9,608 registrations and the Skoda Octavia with 8,083 registrations.

The TESLA Model 3 ranked 9th last year with 4,639 used imported cars registered, while the Model Y did not make it into the top ten.

As reported, the increase in demand for used cars from abroad (as well as new ones) is primarily due to the introduction of VAT on their import from 1 January 2026.

At the same time, market experts emphasise that a significant portion of these cars were purchased ‘in advance’.

The share of electric vehicles in the new passenger car market in Ukraine in 2025 increased to 28.3% from 14.5% a year ago, while cars with traditional engines (gasoline and diesel) accounted for only half of the market compared to more than 65% in 2024, Ukravtoprom reported on its Telegram channel.

“Models with gasoline engines remained the most popular, but their market share decreased from 40% to 32.3% compared to 2024,” the association said.

In particular, the diesel car segment decreased from 25.6% to 17.4%, while the share of hybrids increased from 19.5% to 21.8%.

Cars equipped with gas cylinder equipment (LPG) again accounted for less than 1% of the new passenger car market.

According to Ukravtoprom, the Hyundai Tucson took the lead in the gasoline car segment, the Volkswagen ID.Unyx in electric cars, the Toyota RAV-4 in hybrids, the Renault Duster in diesel cars, and the Hyundai Tucson in cars with LPG equipment.

According to Ukravtoprom, in 2025, the market for new passenger cars in Ukraine grew by 17% to 81,300 units, including a 2.2-fold increase in December to 12,400 units.

These figures are due to the sharp growth in sales of electric vehicles in the last months of 2025, given the cancellation of VAT exemptions during their customs clearance from the beginning of 2026. In December, according to AUTO-Consulting, the share of electric vehicles exceeded 50% of sales.

According to market experts, after the announcement of the abolition of VAT exemptions, prices for electric vehicles began to rise, and by the beginning of 2026, prices for both used and new electric vehicles had effectively offset the 20% VAT.

Ukrzaliznytsia has equipped 100 of its own railcars as temporary mobile heating, communication, and leisure centers in response to power outages across the country, the company said in a statement on Tuesday.

“Ukrzaliznytsia, with the help of its partners—All Hands&Hearts, World Central Kitchen, Hachiko Foundation, and White Stork—has equipped 100 of its railcars as temporary mobile heating, communication, and leisure centers,” the company said in a statement on its Telegram channel.

It is noted that the railcars have a full heating system. In addition, they are equipped with chargers from generators and portable power sources, microwaves, refrigerators, and Starlink kits for uninterrupted communication.

Ukrzaliznytsia added that each of the 100 carriages can be used at the request of local authorities as a free mobile hub with a constant autonomous power supply.

Separately, the company noted that the cars have a children’s compartment equipped with play sets, as well as a compartment for a comfortable stay with pets.