China’s housing market is heading for a new crisis that could be the country’s worst yet, The Wall Street Journal writes.

The bankruptcy of a major real estate developer, China Evergrande Group, two years ago triggered a wave of developer defaults, and the industry’s problems have had a negative impact on the Chinese economy as a whole.

Now, China’s largest private developer, Country Garden Holdings, is in a difficult position. Unlike Evergrande, whose problems were caused by excessive wastefulness, Country Garden’s difficulties are related to the withdrawal of investors and buyers from the real estate market.

The situation with Country Garden could pose much more serious problems for the Chinese economy than Evergrande’s default in 2021, the WSJ notes. Much of Country Garden’s operations are concentrated in industrial zones that have been the engine of growth for the Chinese economy in the best of times. Now, these regions are experiencing financial difficulties and facing an outflow of residents, making it likely to be difficult for them to cope with the collapse of a major developer.

Economists expect that the problems in the residential real estate market will have a negative impact on consumer confidence, which will prolong the decline in activity in the sector. Real estate and related industries account for about a quarter of China’s GDP.

“The whole industry is in trouble,” said Kenneth Rogoff, a Harvard University economics professor. Small and medium-sized cities are experiencing particularly serious problems.

Construction volumes have been exceeding demand for several years, leading to a huge oversupply of housing, and the market needs to be adjusted, Rogoff said.

“How do you prevent the Chinese population from panicking when they see that a significant part of their wealth could collapse? It’s not easy,” the expert says.

As of June 30, Country Garden was involved in more than 3 thousand projects involving millions of homes. The company’s total liabilities, including sold but not delivered homes, debts to suppliers and banks, as well as bonds, are estimated at $186 billion, with the bulk of them due within a year.

The developer recorded a record loss of about $7 billion in the first half of the year, writing down the value of a number of assets.

Last month, Country Garden missed interest payments worth $22.5 million on two issues of dollar-denominated bonds, but managed to find the funds to make them during a 30-day grace period, avoiding default. Chinese lenders have granted the company a grace period for repayment of some of the RMB bonds.

Country Garden’s new home sales in August were down 70% compared to the same month a year earlier. If sales do not recover, the developer faces default, analysts say.

TAS Agro Group has made the first shipment of 1,500 tons of rapeseed oil to consumers in China, the agricultural holding’s press service reported on Facebook.

It is specified that TAS Agro has been processing rapeseed, sunflower and soybeans on a tolling basis at its partners’ plants for the second year in a row. As explained in the agricultural holding, in conditions of low profitability, increasing the added value of products through the development of processing is perhaps the only way to achieve a positive result.

“The realities of wartime force farmers to change, be flexible, and look for new strategic solutions. TAS Agro made the right decision to start processing rapeseed, as it is more profitable to sell oil than raw materials. Last season was the first experience of processing for our agricultural holding, and the financial results are positive,” said Anton Zhemerdeev, Deputy CEO for Commercial Affairs.

According to him, the agroholding has added new specialists to its team and is now focused on extending logistics to end consumers and opening new markets to generate additional margins.

TAS Group was founded in 1998. Its business interests include the financial sector (banking and insurance segments) and pharmacy, as well as industry, real estate, and venture capital projects.

Before the war, the TAS Agro group of companies cultivated 83 thousand hectares in Vinnytsia, Kyiv, Kirovohrad, Chernihiv, Mykolaiv, Sumy, Kherson, and Dnipro regions, was engaged in dairy farming (up to 5.5 thousand cattle), and owned six elevators with a one-time storage capacity of 250 thousand tons.

The founder of TAS is Sergey Tigipko.

China has increased its imports of semiconductor component manufacturing equipment to a record level ahead of the entry into force of export restrictions by Japan and the Netherlands, the Financial Times reports.

According to the General Administration of Customs of the People’s Republic of China, the volume of imports of equipment for the production of chips in June and July amounted to about $ 5 billion, which is 70% higher than the figure for the same period last year ($ 2.9 billion).

China purchased the bulk of the equipment from the Netherlands and Japan. These two countries announced in January of this year that they would join the U.S. export restrictions on China’s semiconductor equipment.

In Japan, these restrictions will come into effect on July 23, and in the Netherlands – on September 1. Once they come into effect, buyers of equipment will have to obtain special licenses from the governments of these countries.

As the FT notes, the increased imports of chip-making equipment shows that China wants to avoid any disruption to its plans to expand semiconductor production.

“This is one of China’s responses to export restrictions imposed by the Netherlands and Japan,” notes Lucy Chen, vice president at Taiwanese analyst firm Isaiah Research. – Beijing is stockpiling equipment in advance to negate potential supply chain problems.”

China’s imports of Dutch chip-making equipment doubled in June and July compared with May due to increased shipments by ASML Holding NV, FT industry sources said.

ASML chief executive Peter Wennink said on an investor conference call last month that there was strong demand for equipment designed to produce non-advanced chips from Chinese buyers.

Imports from Japan also rose. In addition, there has been an increase in shipments to China of chip-making equipment from Singapore and Taiwan, the FT notes.

CHINA, IMPORT, PRODUCTION, ЧИП

The world’s central banks, according to preliminary data, sold 27.4 tons of gold from international reserves in May 2023, the World Gold Council (WGC) estimated.

By comparison, sales totaled 69.4 tons in April, according to revised figures.

The largest state seller of gold in May was Turkey (62.8 tons). There were also reduced reserves in Uzbekistan (10.9 tons), Kazakhstan (2.4 tons) and Germany (1.8 tons).

They bought gold in reserves in Poland (19.9 tons), China (15.9 tons), Singapore (3.9 tons), Russia (3.1 tons), Iraq (2.3 tons), India (1.9 tons), the Czech Republic (1.8 tons) and Kyrgyzstan (1.5 tons).

China increased oil production by 2.7 percent in May compared with the same month last year, to 18.1 million tons, according to the State Statistics Administration of the country.

Refining output soared 15.4 percent last month to 62 million tons, the second-highest total ever recorded. This was due, among other things, to the completion of scheduled maintenance work at a number of refineries.

Natural gas production in China in May increased by 7.2% and reached 19 billion cubic meters, since the beginning of this year – by 5.3% to 97.3 billion cubic meters.

Oil imports last month totaled 51.44 million tons, up 12.2 percent from the same month a year earlier, customs said. Gas imports rose 17.3% to 10.64 million tons, the highest since January 2022.

CHINA, GAS, OIL, PRODUCTION

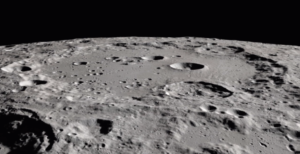

The China Manned Spaceflight Program Administration (CMSA) on Monday announced plans to send astronauts (Chinese taikonauts) to the surface of the moon before 2030.

“According to the plan for a project to explore the moon by taikonauts, Chinese taikonauts will land on the moon for the first time before 2030, with two taikonauts driving a lunar rover to conduct scientific research,” the administration said in a statement on its website.

China has previously announced plans to land taikonauts on the moon and build a lunar research base there in the 2030s. The South Pole was suggested as a preliminary landing site because of the abundance of sunlight in the area and the presence of ice reserves from which water could be extracted.

China’s main rival in the “moon race” is the United States. In April, Bill Nelson, head of the U.S. National Aeronautics and Space Administration (NASA) said that the U.S. space agency expects to send astronauts to the moon in late 2025 or 2026 under the Artemis national lunar program.